Gold to Test $1360, Silver “Once in a lifetime” Setup

News

|

Posted 26/03/2018

|

7833

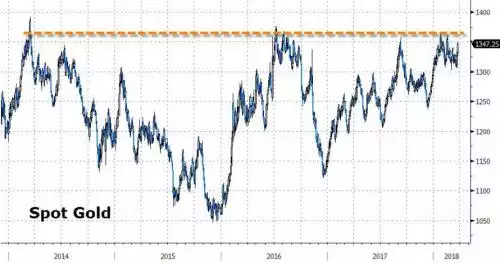

Amid the trade war outfall carnage that saw the S&P 500 sink 5.9% last week (its biggest drop in more than two years and the Dow Jones down 11% from its January highs), gold and silver again surged on Friday, with gold spot hitting US$1350. That is getting tantalisingly close to the ‘magic’ resistance line of US$1360 that it hasn’t been able to sustainably break in years.

It’s not just the volatility of markets from the trade wars, central bank tightening, and credit market stress tanking markets lifting gold, but additionally last week seeing the US Senate passing a spending bill of another $1.3 trillion prompting Senator John Kennedy to summarise:

"It sucks…..No thought whatsoever to adding over a trillion dollars in debt."

That’s not an isolated view, pressuring faith in the USD and supporting gold.

Throw in growing geopolitical tensions with Russia, on top of that already with China, and it’s a perfect environment for gold to break that resistance line.

On top of the set up for gold, and further to our article “Most Bullish Setup for Silver Since 2003” , that setup just got more bullish on COMEX with the Speculators net short by the largest degree ever. Have a look what happened after the previous instance in 2003…

To make this more amazing the Commercials (bullion banks) reduced their net short position by a staggering 15,564 contracts. That is 77.8 million troy ounces of paper silver! It certainly looks like classic capitulation of the speculative ‘Managed Money’ and the Commercials moving in for the kill.