Most Bullish Setup for Silver Since 2003

News

|

Posted 05/03/2018

|

11261

Like it or loath it, the paper trades in silver via futures contracts on COMEX is a fact of life and if ‘played’ unemotionally can yield great returns.

Followers of Mike Maloney may already have watched his latest video titled “$700+ Silver? Here's How It Could Happen”. If not, you can watch it by clicking here.

Mike talks to two coinciding market events for silver, the low net short commercial / low net long speculator positions on COMEX and the sky high gold silver ratio. We discussed the latter recently here and if you missed it, it is a MUST READ.

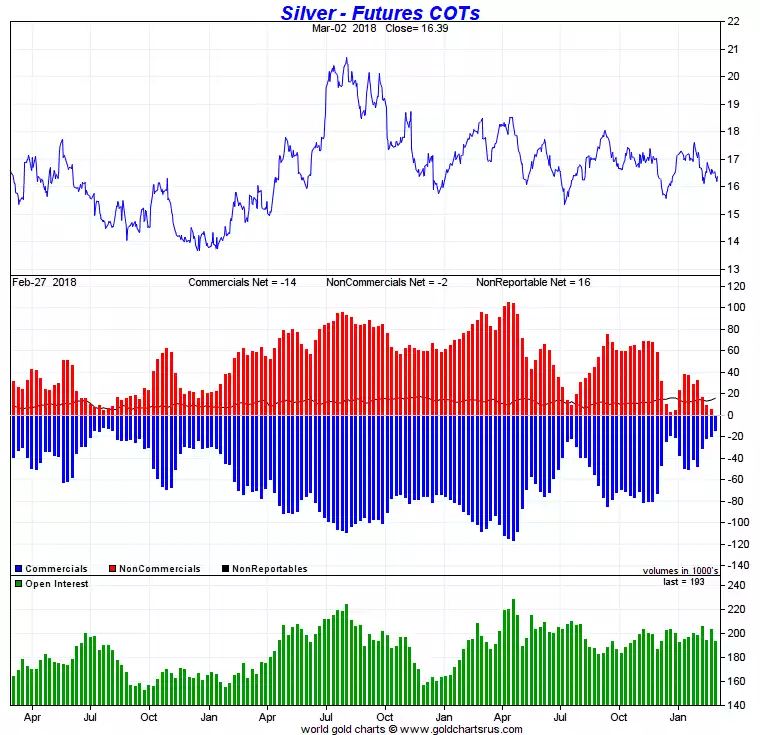

In terms of the COMEX position, since Mike’s video that just got a whole lot more exciting. Below is a graph generated from last week’s COMEX Commitment of Traders Report:

Some graphs are self explanatory and you can see above the correlation between price (top blue line) and the same low net short Commercials (blue bars) and low net long Speculators/Managed Money (red bars). Every time marks a bottom from which the silver price increases. What makes this time ‘different’ (and different to when Mike made the video), indeed only the first time since 2003 from which silver commenced its massive run from around AU$7 up to it’s peak of AU$40, is the speculators are net short, not long. That dear reader wreaks of speculative capitulation and the big Commercials are repositioned to profit from the turn. You don’t need to like them or what they appear to do with futures trades through manipulation, but you’d be foolish to bet against them. Sure there will come a time when a market event may see them lose out when there is a panicked rush for safe havens, but until then they have a pretty good track record / control.

That this set up coincides with the near record high GSR makes it all the more tantalising. In 2003 the GSR was at similar levels to now and finished at around 30:1 at the peak in 2011.

One must head the usual ‘history is not an accurate predictor of future events’ but as Mark Twain famously said, ‘it often rhymes’….