The Other Side of ‘Peak Gold’…

News

|

Posted 08/02/2016

|

6227

As previously reported, China continues to be the world’s biggest consumer of gold and is also the world’s biggest producer as well.

For the first time in many years, China’s gold production fell in 2015, according to the China Gold Association. Whilst only down 0.4% to 450.05 tonnes, it aligns with our previous reports on 2015 being the year of ‘peak gold’ and must be looked at in the context of the 10 year average growth in production in China being around 11%. That is a big drop.

China is still well ahead of any other gold producing nation. They produce 1.6 times more than second placed Australia. Russia is just behind Australia and the US is 4th and over half that produced by China.

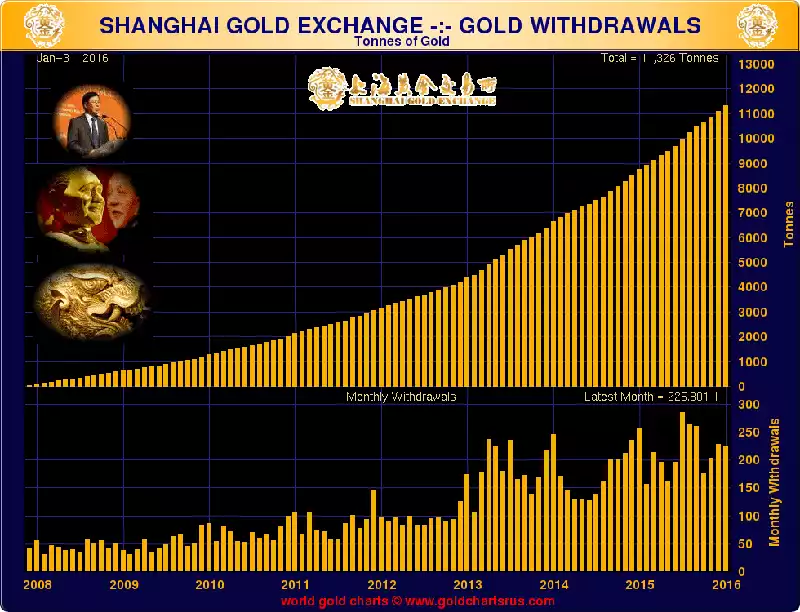

As weekly podcast listeners know, Shanghai Gold Exchange has for some time been reporting weekly withdrawals (which align most closely with total Chinese consumption). After a world record setting 2597 t last year, they stopped reporting this year. They have just surprised everyone by releasing the monthly consumption figure for January. That number was 225 tonne. If that were annualised it would be 2700 tonne.

So it appears the world’s biggest consumer is not letting up on demand but its domestic production is starting to fall. That means more imports and even more demand on the rest of the world when just last year they already consumed 80% of total gold produced.