Past Peak Gold

News

|

Posted 24/07/2014

|

6509

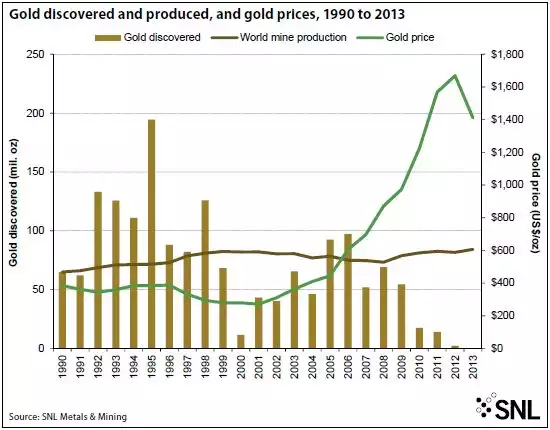

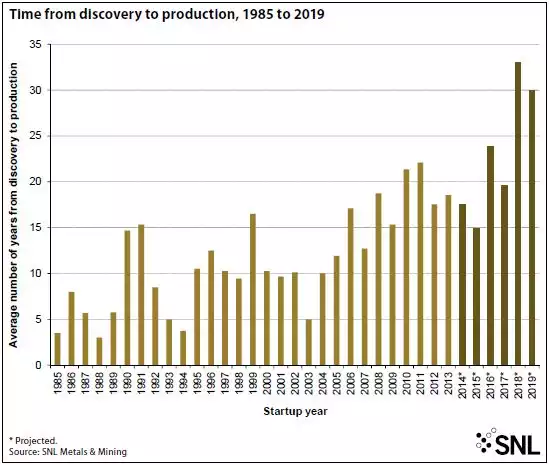

One of the most respected analysts of gold production, SNL Metals & Mining have just released a report that confirms what we’ve reported previously from other credible sources in that gold discoveries are diminishing, but critically they also report on how time to production too is increasing. That means fewer new gold discoveries are also taking longer to get to production. Combining this with our previous articles on diminishing yields and increasing costs (or tonnes of ore & costs to produce a gram of gold) and it is a dire forecast for gold supply in an already constrained market.

The 2 graphs below need little explanation and paint a very clear picture of us having passed peak gold supply. SNL point out too that one needs to keep in mind conversion and recovery not captured in these graphs. They estimate a 75% rate for converting resources to economic reserves (noting this is likely underestimated with worsening political, environmental and economic hurdles) and a 90% recovery rate during ore processing. So for the last 15 years that translates to new discoveries replacing only half of the gold produced during the same period. Got yours yet?