Behind the 2015 Chinese Gold Record

News

|

Posted 15/01/2016

|

6558

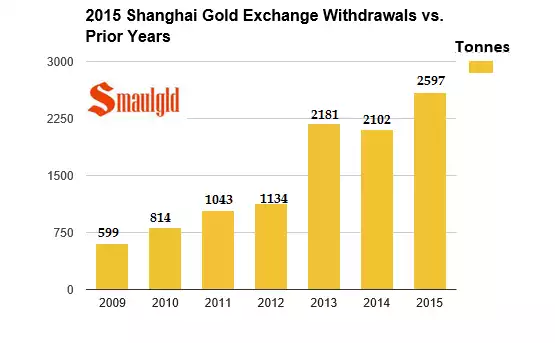

China’s financial market woes have hogged the headlines this year but you probably didn’t see anything in the mainstream press about their final figure on gold consumption for 2015. As we mentioned in today’s Weekly Wrap Podcast, that figure came in at an incredible 2,597 tonne.

A big number indeed, but let’s give it some context…

For a start, per the first chart below, it is 19% higher than the previous record set in 2013.

Secondly that figure accounts for around 80% of global production. When you add that India surpassed 1000t in 2015 you have 2 countries alone consuming more than is mined.

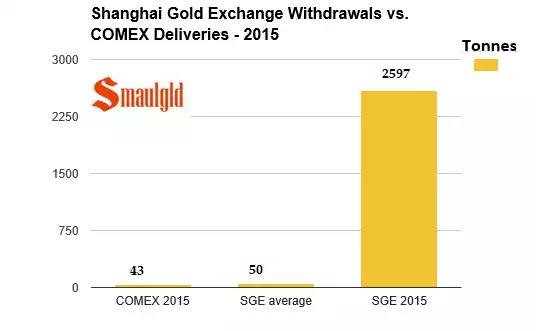

In a market where the spot price is largely dictated by futures trades on COMEX, where 100’s millions of oz’s are ‘traded’ through paper contracts – short and long, you very quickly get further context when you compare what happens with physical gold actually changing hands. That Chinese consumption of real physical gold of 2,597 tonne annually equates to an average weekly number of 49.9 tonne. The TOTAL gold deliveries in COMEX for 2015 were 43.5 tonne. That’s right, the Chinese consumed more physical gold in one week than the total for the whole year on COMEX, yet it is largely COMEX that sets the price….(for now).

Finally, China is the world’s largest producer of gold at around 450 tonne per year. That leaves 2,150 tonne of gold consumed in China coming from imports. Simple logic dictates that a large portion of that is coming from ‘western’ vaults as prices declined last year because ‘everything is awesome’ and you don’t need gold… This year is already clearly demonstrating that everything is most certainly not awesome and the problem is that gold has gone to a couple of countries and cultures that historically hold gold for the long term. The speculative ‘weak’ hands of the west have delivered gold on the proverbial silver platter to the ‘strong’ hands of the east. Watch this space….