Platinum “Too Cheap to Ignore”

News

|

Posted 07/11/2018

|

9935

One of the world leaders in precious metals investment, Sprott Asset Management has recently penned 2 special reports titled The Platinum Opportunity outlining their very bullish view on the ‘white gold’ metal.

If you missed our own two part articles on platinum back in September we consider them a must read for value investors. They are here and here.

Sprott go further into the reasons for Palladium’s strong price rally over the last couple of years whilst Platinum has nearly halved since its peak in 2011. They now think it is “too cheap to ignore” and whilst they called the Palladium rally they now think it is done and it is Platinum’s turn.

First they set the scene by comparing price movements since the turn of the century. You can see in the chart below the fall of platinum against the gains in palladium and gold over the last few years. In 2015 platinum broke from its historic 1+ platinum to gold ratio and now sits at 0.72 having come off a record low 0.66 when the chart below was produced just late last month.

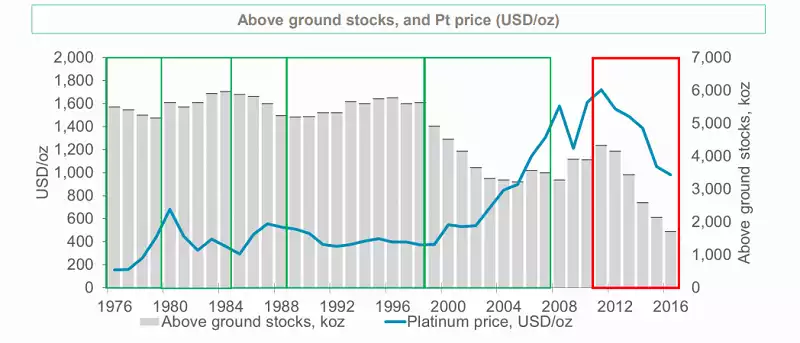

In our previous articles we talked of the concentration of supply from troubled South Africa and Zimbabwe (80%) and Russia (now facing sanctions). Recently the World Platinum Investment Council released an official position on the oft debated stockpile situation. As you can see below it is very severely depleted.

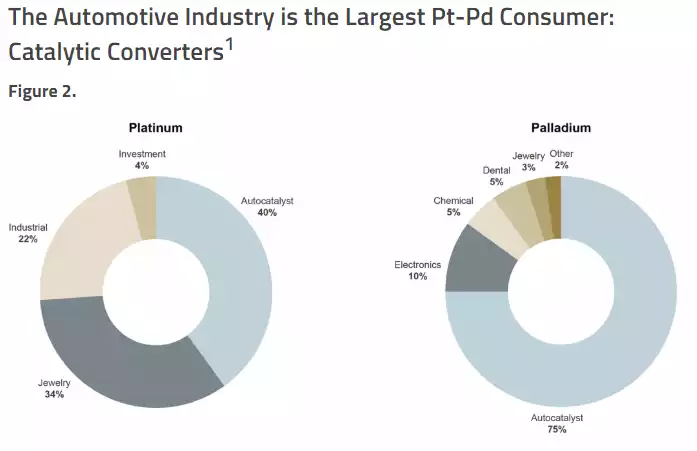

So why is that price acting counter-intuitively to the supply side of the equation? Sprott put a lot of it down to the VW ‘Dieselgate’ scandal and a move toward the cheaper palladium option for automotive catalytic converters. As you can see below this sector accounts for the lion’s share of demand for both metals:

The two metals are often largely interchangeable and so more and more manufacturers moved to the cheaper palladium as you can see above. Additionally, platinum is the preferred metal for diesel engines and ‘dieselgate’ put a dent in demand. However with the passing of time we’ve seen both palladium surpass the price of platinum and ‘dieselgate’ become a distant memory. There is evidence already of a move back to platinum by manufacturers. Just since our September articles platinum is up 6% and the Pt:Au ratio up to 0.72 from 0.69.

As we discussed last time too, platinum has growing uses where palladium doesn’t, being high performance glass, jewellery (where Indian demand is currently surging), petrochemical, fertilizer manufacturing and fuel cells. That latter one is particularly exciting as only platinum is used to catalyse the electricity-producing conversion of hydrogen and oxygen into water in hydrogen-based fuel cells, increasingly used in electrical vehicles.

So with growing use and demand let’s revisit the supply side of the equation, and reminding you that 71% of supply comes from South Africa. From Sprott:

“As the price of platinum has faltered over the better part of the decade, and wages have increased, platinum miners have had to make some tough financial decisions. Investments needed to sustain output have declined, as have investments to increase output. Simply put, platinum miners are unprepared for an increase in demand. Equity investors in South Africa’s platinum sector have taken it on the chin. Previously high-flying platinum mining companies such as Lonmin, which accounts for almost 17% of South Africa’s platinum output have seen their share prices decline by 99% over the past five years. It is easy to understand why investors have been turned away from this space.”

We have just received our 2019 Platinum Kangaroo coins from Perth Mint. You can check them out here.