Platinum – Once in a lifetime opportunity?

News

|

Posted 21/09/2018

|

9711

Yesterday we gave you the fundamentals behind platinum and today we get into its incredible current pricing setup.

Like gold and silver, the platinum price has a couple of masters.

There are the fundamentals of supply and demand and we showed how tightly strung that was yesterday. In that dynamic you have the current moribund investment demand because, well, everything’s awesome and people have everything on black (financial investments), just as we are seeing in gold and silver. That of course will reverse and potentially reverse quite suddenly. Conversely you have automotive sales growing every year for the last 8 years, driven in part by China’s ever growing middle class urbanites combined with China and India in particular tackling their pollution issues. All that needs catalytic converters and they need platinum. We illustrated how little above ground reserves there are and how slow and expensive this metal is to mine. Increased demand with no increase in supply leaves only one other variable. Price.

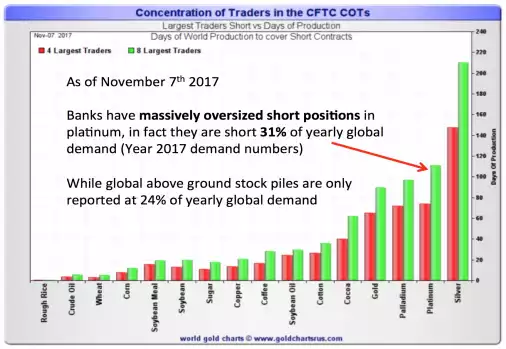

However as we know with gold and silver, in the relatively short term, price is not necessarily driven by reality. The COMEX futures exchange distorts that with the big end of town placing massive bets well in excess of the metal underlying them. We have shared extensively of late (here and here) the historic setup playing out right now in both gold and silver futures. Via the weekly Commitment of Traders reports from COMEX we can see that the Commercial’s (bullion banks and commercial hedgers) are net long and the Managed Money (speculative hedge funds) are short. That setup almost without exception precedes a rally. The scale of the current setup has many salivating at a massive short squeeze rally.

Platinum is in the same situation but with a very transparent twist…

Baird&Co’s Asia Regional Director, David Mitchell explains:

“Much like platinum ores in the Earth's crust, the production of platinum metal is highly concentrated, with the four largest refiners accounting for 67 percent of total platinum production. The world's largest platinum producer, Anglo American Platinum, accounted for nearly 40 per cent of all primary refined platinum and roughly 30 per cent of total global production.

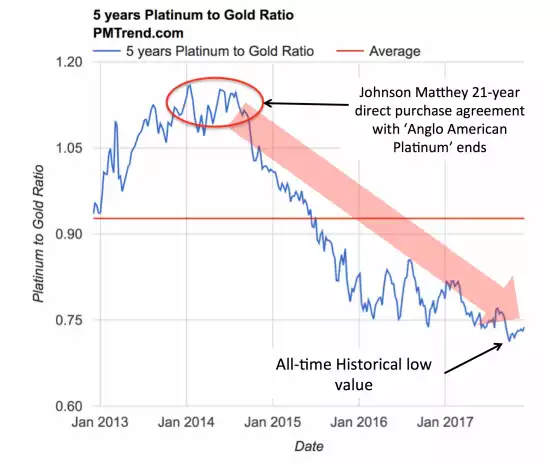

Hence Anglo American Platinum has a particularly large effect on global prices in the supply and its conduct in how the metal is sold. Anglo American Platinum, in late year 2013 terminated 1 a longstanding platinum supply contract with Johnson Matthey, which had included a small discount, but JM was obligated with substantial marketing arrangements.

It has been widely reported that ever since the contract ended Anglo American Platinum has struggled to implement a new and successful strategy of selling directly to end-users at productive prices, sources say.

The idea was to make more money by cutting out the middleman, going direct to traders and carmakers and seizing profit opportunities by financing or lending metal and arbitraging different locations and grades. In effect all they have done is go direct to the banks who in turn realizing a huge profit-making opportunity have sold platinum futures short – as they know the supply of the metal is settled with them at the paper futures price in the market, hence their shorts are covered.

[note the same graph of this released last week is very similar]

“Having another look at the platinum/gold ratio in the time period when Anglo started selling its platinum directly through the banks

“The reality is that platinum is in the grip of a price manipulation for the pure benefit of a few select banks via mismanaged producer selling.

Virtually all price manipulations in history have been of the upside variety which caused prices to be higher than they should have been. Buying an asset priced artificially high is a reliable prescription for eventual financial loss. But because the manipulation of platinum at this time is of the rare downside variety, the price is artificially low, thereby guaranteeing eventual profits for those taking advantage of the opportunity.”

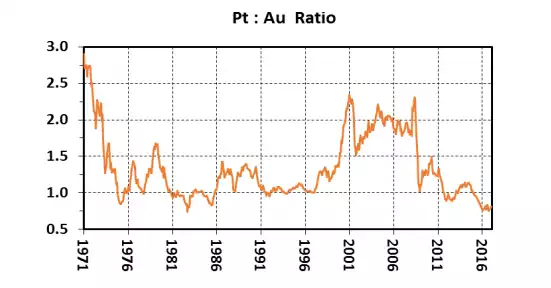

Now let’s look at the ratio of platinum to gold that David touches on above a bit closer. Again, regular readers will know we are currently at a near all-time high in the Gold Silver Ratio (GSR) at 84.2 as we write. We have shared many times the remarkable correlation with ensuing price rallies in both metals (but particular for silver of course) off such highs.

The Platinum Gold Ratio (PGR) is also right now at an all-time historic low. For a few months in 1982 it came close to the current 69.

Zooming in a little closer you can see just how far it is below its mean.

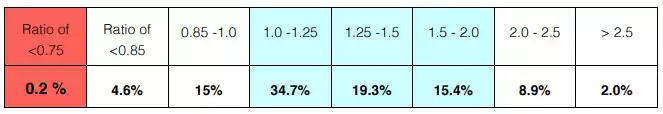

Unless you are a big believer in ‘this time is different’, that deviation from the mean is very important. Platinum could double in price without gold moving a cent, and it will simply revert to its 30 year mean. The first of the 2 graphs above is from a study by Earth Sciences into 46 years of data. They compiled the table below that shows the PGR spent 70% of its time between 1 and 2 and just 0.2% of its time below 0.75. Again, we remind you it is 0.69 right now.

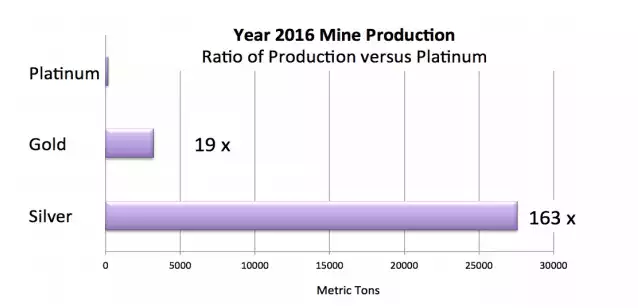

If maths and ‘reversion of the mean’ theory isn’t your thing then consider the price against how much of the two is mined. The chart below shows that the metal priced at $1200/oz is extracted at 19 times the rate of the metal priced at $840/oz. Something seem wrong to you there?

The facts presented above certainly paint a very compelling story for any contrarian investor. That they are presented in isolation of the backdrop of cracks appearing in this record breaking financial markets and debt expansion period makes it all the more so.