NFP Awesome v REPO reality

News

|

Posted 09/12/2019

|

14653

Friday night saw a huge 266,000 NFP employment print for the US, surpassing all expectations, particularly after the ADP employment print just a couple of days before was the worst since March 2010. However the sharemarket embraced the better number and surged to new all time highs whilst gold and silver got hit along with bonds. Everything is most certainly awesome….

However, and in the context of the importance of a healthy and functioning banking system, what doesn’t seem to be getting much airplay anymore is the ongoing involvement of the US Fed in the Repo market, preventing a complete liquidity seizure. We’ve explained Repo here before and the fact that in effect, the Feds involvement via OMO is essentially QE by any other name here.

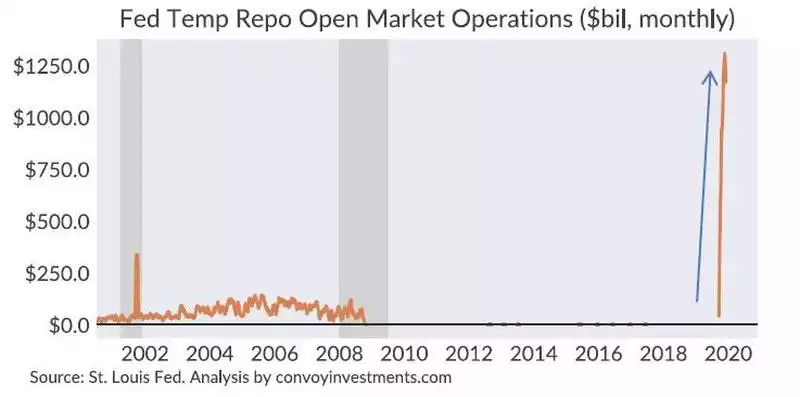

Howard Wang of Convoy Investments on Friday reminded us of the sheer scale of what the Fed are currently drawn into to maintain the Repo market functionality. The following chart illustrates that sheer scale of the current operation with $1.2 trillion purchased per month. The market panic during the 911 Attack saw $300b by comparison and next highest.

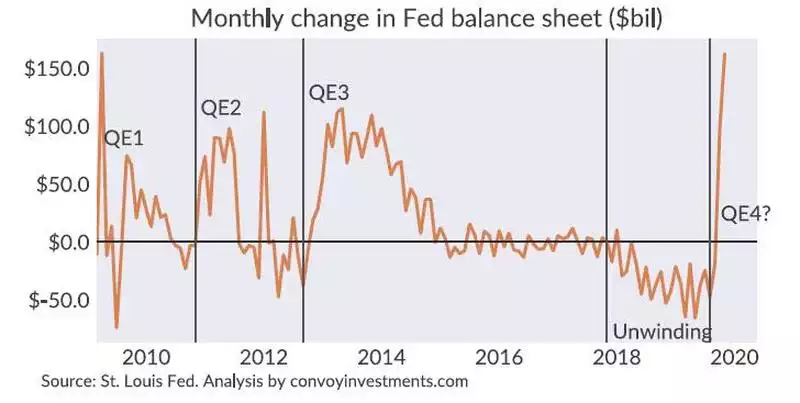

Why nothing since the GFC? Because the Fed pumped $4.5 trillion into banks via QE1, 2 and 3 meaning banks were flush and didn’t need Repo support. Only once the Fed tried unwinding via QT did the cracks reappear. Subsequently the current expansion of the Fed’s balance sheet is only matched in scale to that initial emergency opening of the bailout floodgates during the GFC.

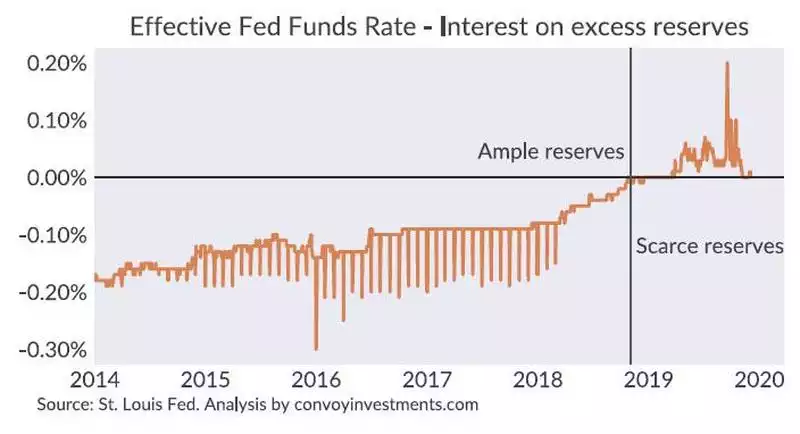

Back in May this year we explained the Interest on Excess Reserves (IOER) tool of the Fed and Wang has that as the thing to watch going forward for cues as to what happens next. Per the chart below you can see (from the vertical line of December 2018) the banks went from ample reserves (courtesy of QE) to scarce after QT. We then had that massive spike in the IOER on that Repo market shock per the link above.

With the reserves balance now precariously around zero the Fed has a choice of maintaining this ‘just in time’ Repo open market operations approach or return to a more comfortable ‘cushion’ courtesy of more traditional QE. He believes it will be the latter.

“Unless banking regulations change dramatically, my guess is that QE4 is coming. The Fed would rather have a cushion of ample reserves against unexpected repo market blow ups than react retroactively with $trillions/month of open market operation purchases.”

Irrespective, both are money printing to keep a highly stressed financial market from cratering and remind us that the ‘everything’s awesome’ narrative of Friday night is in complete disconnect to reality. Remember too that every new USD created out of thin air is in complete contrast to the real money of gold which has protected people from such reckless currency debasement for thousands of years.