What is IOER and Why Watch It

News

|

Posted 01/05/2019

|

22108

Yesterday we discussed the prospect of the US Fed lowering interest rates as it holds it meets today and tomorrow. As a reminder, the US Fed is supposedly independent and supposedly unaffected by what’s happening on sharemarkets. Their capitulation in December to end the sharemarket rout brought such independence sharply in to question. It of course also doesn’t stop Trump from continually tyring to influence them as demonstrated again last night with this tweet:

That last point highlights the debt trap the US finds itself in. You only have a couple a few options when you have $22 trillion of debt to somehow get rid of (at a time you are adding around $1 trillion a year too..) – 1. Pay it off with unprecedented growth fuelled surpluses (remembering the US hasn’t had a real surplus since 1969); 2. Default (not an option when you are the world’s reserve currency); or 3. Inflate it away by devaluing its real value through currency devaluation via orchestrated inflation. The latter is their agenda but inflation stays stubbornly low… for now.

A couple of readers yesterday asked about our reference to the liquidity issue and the IOER. As is his gift, Lance Roberts explains it nicely recently:

“When the Fed embarked on QE, they wanted to ensure that the money created to buy Treasuries and mortgages was being held by the banks as excess reserves and not being used to form loans. They also knew that controlling the Fed Funds rate would become problematic given the sharp increase in potential banking reserves. To help them keep the money on the sidelines and better control the Fed Funds rate, the Fed decided to pay banks interest on excess reserves (IOER). The IOER rate was set above the Fed Funds rate (the rate banks lend reserves to other banks on an overnight basis). The thought being that banks would rather collect a higher interest rate and take no risk than lend out money to other banks at a lower interest rate. On the flip side, if Fed Funds rose the IOER rate, the banks would lend their reserves which should, in theory, provide a cap for Fed Funds.

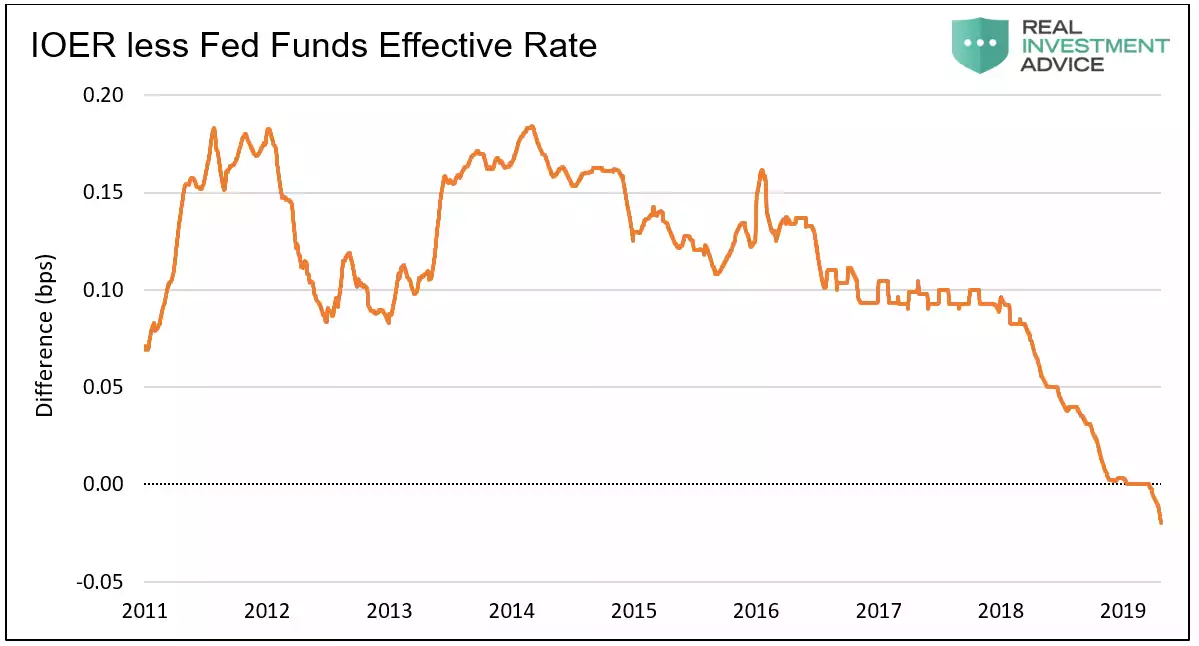

The IOER premium over Fed Funds served its purpose in keeping excess reserves constant and in capping the Fed Funds rate from 2011 to 2017. However, as shown below, its effectiveness started eroding with the advent of QT in October of 2017

We believe the liquidity drain associated with QT [Quantitative Tightening – unwinding their QE acquired assets] created a shortage of dollars among foreign banks. Given this liquidity shortfall, foreign banks are likely being forced to pay higher interest rates for overnight funding. The Fed Funds rate is now higher than the IOER rate. That was not supposed to happen. Domestic banks either do not have the liquidity to lend or are being precautionary. Regardless of the reasons, a dollar shortage can become a dollar crisis if not addressed.

It is quite possible this situation will cause the Fed to stop QT before the scheduled September 30th end date. More importantly, it also raises the specter that QE, which injects liquidity into the banking system, is not as far off as we think. Watch the IOER/Fed Funds rate differential and the dollar for clues of further liquidity problems.”

One possible explanation for the recent drop is a huge coordinated draw down of cash from taxes due payable from April and so this may be transitory and whilst the effective Fed Funds rate is currently 2.44% it is still below the Fed rate range of 2.25-2.5%. It would therefore not be surprising to see the Fed hold firm tomorrow. There is a chance however that they may well lower the IOER in an effort to bring down that effective Fed Funds rate. They were clever in December as they hiked their Fed Funds target by 25bp but the IOER quietly by only 20bp. As Barron’s explains, the risk is the market over reacts to a IOER cut and the bubble gets inflated even more on central bank hopes not fundamentals.

“The Federal Open Market Committee could announce a five basis point (0.05%) reduction in its IOER—the interest rate on excess reserves—while leaving its key policy rate, the federal funds target range, unchanged. Since last June, the FOMC has set the IOER under the top of the fed funds target. When the FOMC last raised its funds rate target by 25 basis points in December, to its current range of 2.25%-2.50%, it increased the IOER by only 20 basis points, to 2.40%.

In recent weeks, the fed-funds rate has moved above the IOER, to an effective rate of 2.44%. That doesn’t sound like a big deal, but the Fed doesn’t want to lose control of the funds rate and let it creep above the top of the target range. By lowering the IOER, the funds rate should gravitate back toward the middle of the target range.

If it all sounds like inside baseball, it is. But at 2 p.m. E.T. on Wednesday, headlines may flash news of a Fed rate cut and send uninformed traders (or maybe algorithms) into a tizzy over what actually is a matter of money market mechanics. JPMorgan economists put a one-in-three odds on a technical IOER cut while their counterparts at BMO think one could come at the June 18-19 confab.”

The precarious nature of the “everything bubble” financial markets the Fed and other central banks have placed us all in is both fascinating (if you own gold) and scary (if you don’t) at the same time.