October “Crazy” Looming

News

|

Posted 23/09/2019

|

10479

Gold surged Friday night on the back of not just more concerns around the on-again-off-again US China trade war but also yet another Fed rescue to the repo market (which we explained here).

Markets are getting decidedly nervous. The US Fed hasn’t had to intervene in the repo market since the GFC and yet last week they had to come to the rescue every day from Tuesday to Friday such is the liquidity squeeze being experienced. And remember this is supposedly in an environment where the banks do indeed have available cash.

One tweet over the weekend summed it up perfectly:

“You are a bank. You can deposit your cash overnight with:

- the Fed for a 1.8% return

- another bank for up to 10% return

You pick the Fed, why? You don't think the other bank will repay you tomorrow.”

That level of nervousness and distrust speaks volumes, particularly when we are talking of the financial institutions who’ve “got this”.

To top it off the Fed announced on Friday that it will step in with further emergency interventions. From CNBC:

“The New York Federal Reserve Bank said Friday it will inject billions into the US financial plumbing on a daily basis for the next three weeks in an effort to prevent a spike in short-term interest rates.

The Fed will offer up to $75 billion a day in repurchase agreements — exchanging secure assets for cash for very short periods — through October 10, it said in a statement.

In addition, it will offer three 14-day “repo” operations of at least $30 billion each.”

But don’t mention QE…. Apparently this is different. However, whatever name you want to give this, it is the injection of new money into a strung out system to keep it going. These repo injections are called Open Market Operations (OMO – to keep your markets bright and sparkly…). Part of the disappointment with last week’s Fed meeting was the expectations of POMO (Permanent OMO) otherwise known as QE if we are being frank. So maybe, just as the US dollar was being ‘temporarily’ broken from the gold standard in 1973, and QE1 was a one off, followed by QE2, Operation Twist and QE3 then maybe, just maybe this 3 week OMO may become a little more POMO than they think…

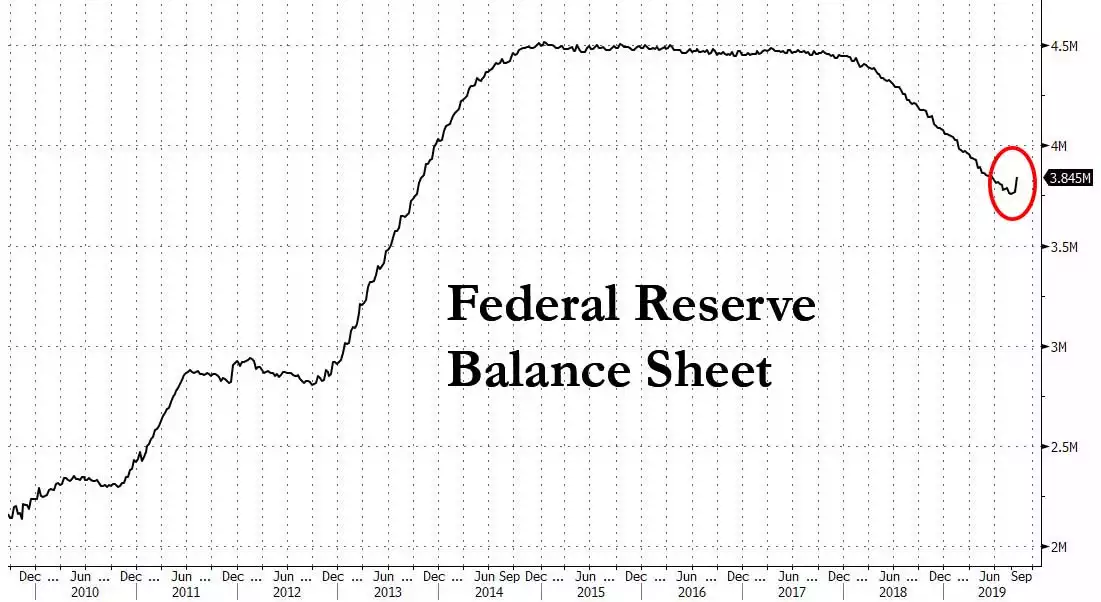

The chart below shows the US Fed’s balance sheet where they have tried to unwind (QT) all that QE amassed debt (sorry, I mean “assets”). The market, deprived of it’s ‘juice’ turned bad, QT was prematurely halted, rates dropped, and even that not being enough… back to expansion we go:

Both Goldman Sachs and Bank of America have since come out predicting POMO in the next couple of months. That is not the sign of a health market.

And the timing? We are now just one week from October and as most people know, October is the financial crash bogey month. From CNBC:

“For investors taking a breather from the chaos in August, buckle up as the market is about to go crazy again, Goldman Sachs warned.

Wall Street is now inches away from reclaiming its record highs, but a rockier ride could be around the corner as stock volatility has been 25% higher in October on average since 1928, according to Goldman. Big price swings have been seen in each major stock benchmark and sector in October over the past 30 years, with technology and health care being the most volatile groups, Goldman said.”