Bitcoin is Dead… Again.

News

|

Posted 21/11/2018

|

7739

Whilst Wall Street was a sea of red again last night (and gold up!), losses such as 2.2% in the Dow and 1.8% in the S&P500 pale next to another brutal night on crypto markets. Bitcoin is down another 10.7% over the last 24 hours (now at US$4420, a 1 year low) taking the losses over the last week to 30%. That is extraordinary and whilst most commentators are blaming the hostile forking of Bitcoin Cash (BCH) and the usual detractors claiming Bitcoin is dead, we came across the following article from Medium.com that puts all of this into perspective.

“As the price of digital assets make new lows for the year, shocking many (myself included) a lot of people are asking why they have fallen so much. To answer that question, I’d like to pose another question: why did they go up so much in the first place?

There are, of course, plenty of long term investment thesis that can be applied to cryptocoins, having to do with the benefits of decentralization, sovereignty of money, new ways of building online communities, cheaper payment rails, distrust of the banking system, ZIRP, QE and so on.

But none of that explains why Bitcoin tripled late last year or is down 30% in the last week. The reasons listed above will play out over the course of years and decades, not days. A better explanation for the seemingly unstoppable unidirectional moves is the fact that price remains the primary input and primary output of any shorter-term investment thesis, creating a feedback loop.

Traditional assets like stocks and real estate have long established valuation metrics that inform investing. These metrics, which tend to be tethered to information outside of the financial system?—?think company earnings or property location?—?help longer-term investors anchor their decision making during volatile price fluctuations. Although the absolute levels of things like P/E ratios that are considered desirable fluctuate over time, their very existence and tendency to revert to historical means provide a useful rudder.

Crypto assets have no such framework. Some people attempt to apply existing valuation metrics, like ones borrowed from physical commodities, but those are not a clean fit (unlike oil drilling or gold mining, new Bitcoin production has nothing to do with the price, thanks to the periodic difficulty adjustment).

What remains are technical indicators, but there too we have a newness problem. Most digital assets haven’t been around long enough to have significant price history. Even Bitcoin, which has been around for almost a decade, has gone through enough changes to make its earlier price data questionable. It’s not clear that price data from the days when you practically needed to know how to code to get your hands on some is all that relevant today.

That leaves us with a single valuation metric: price, as both the input and output of most people’s decision function.

So why did Bitcoin go to $20k last year? Because it broke above $10k. Why has it fallen below $5k this week? Because it broke below $6k last week. I understand that this isn’t helpful for anyone trying to make a tough decision today, but it does help explain some of the volatility. I’m sure digital assets will eventually have their own sophisticated valuation metrics, but those are going to take a long time to come about, so the volatility is here to stay.

I suggest turning off the quote screen and sticking to your guns. Bitcoin at $4500 means the same thing today as Bitcoin at $20,000 did last year: not much.

This is a brand new asset class that’s still trying to find its footing. Until it does, we’d all be better off spending our time learning, teaching and building the underlying infrastructure. Progress in the industry is not nearly as bad as an 80% decline would indicate today, just as it was never as good as a 300% rally did last year. Progress remains steady, but slow.”

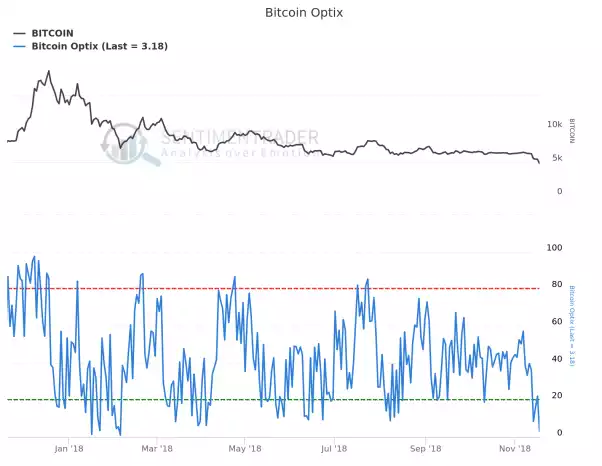

Investing in a brand new asset class requires fortitude. As the above article says, when you don’t have that historic value ‘floor’ it is easy to panic and that is what’s happening right now. We shared back in late June the low sentiment for Bitcoin. At that time it was coming off “Extreme Pessimism” (the green line below) presenting some hope it was potentially bottoming. It wasn’t. The chart below shows sentiment has now reached lows not seen since the big rout in February. Panic is back.

Whilst that article talks of the steady, slow progress there are no end of examples of alt coins that were nothing more than white papers when BTC was hitting $20,000 less than a year ago, which are now real businesses producing real products, services and industry partnerships utilising blockchain technology. If you missed our article at the beginning of the month talking to the comparison with the internet adoption it’s a must read. Perspective is everything.

In terms of trade, this last week saw news that would ordinarily drive the price up but amongst such sentiment it was lost. The crypto world is preoccupied by the pending announcement by the US’s SEC as to whether it will approve the crypto ETF’s before it. Last week Amun announced it gained approval for its crypto ETF to start trading on Europe’s 4th largest exchange, the SIX Swiss Exchange which has a market cap of $1.6 trillion.

“The Amun ETP will give institutional investors that are restricted to investing only in securities or do not want to set up custody for digital assets exposure to cryptocurrencies. It will also provide access for retail investors that currently have no access to crypto exchanges due to local regulatory impediments.”

The fund tracks the same ‘big 5’ that Ainslie Wealth trades and presents a huge boost to crypto currencies as it overcomes the common hurdle posed by institutional investors as described above.

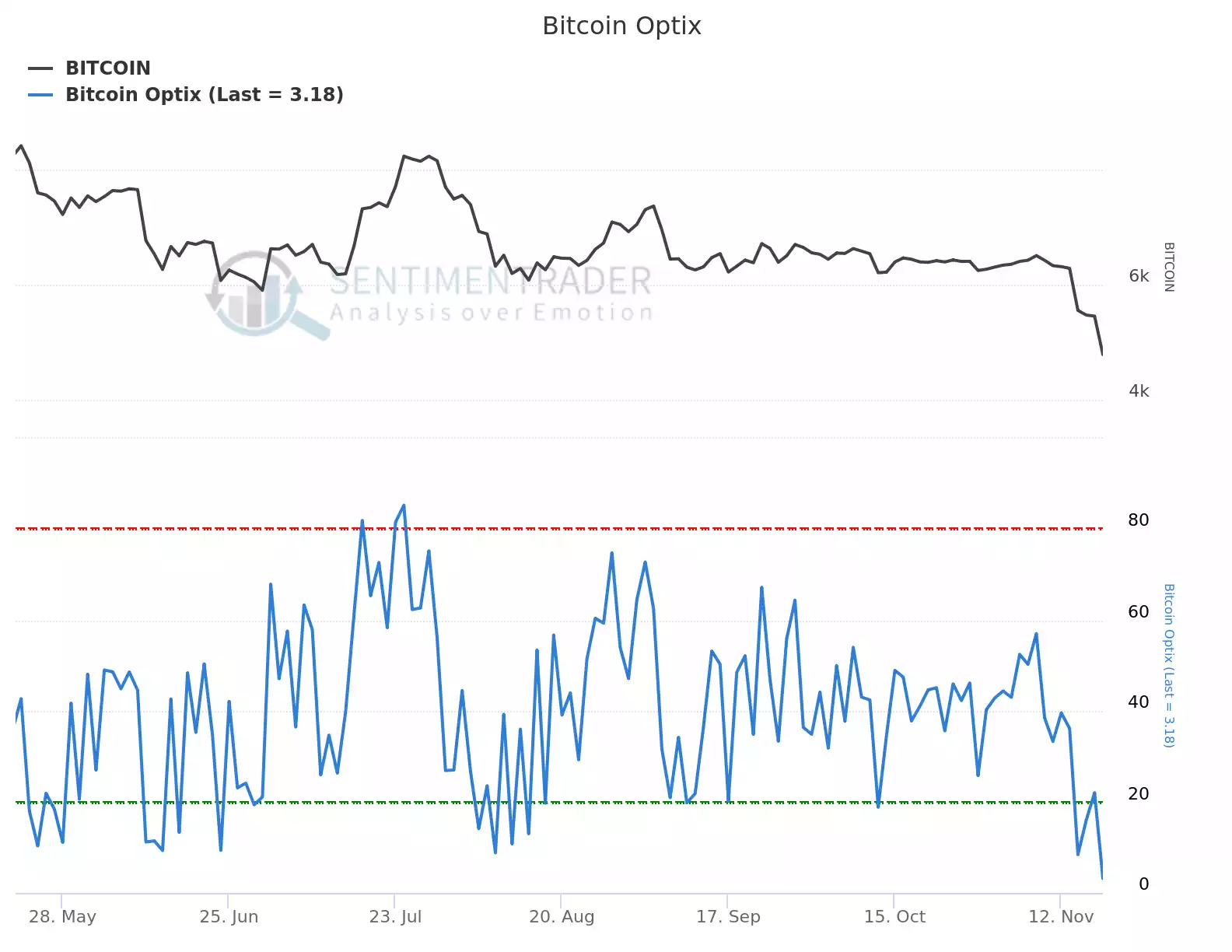

The zoomed out sentiment chart above makes it a little hard to see the rallies that inevitably follow bottoms in sentiment. Below shows this more clearly.

The problem is, whilst the resulting rallies are clear and sizeable in percentage terms, each has been short lived this year at it essentially tracks sideways. The question now is, is this the worst it’s getting and potentially the bottom before a more pronounced, prolonged rally; or is there more pain ahead?