Bitcoin Turns 10 years old

News

|

Posted 01/11/2018

|

8064

Yesterday was Bitcoin’s 10th Birthday and it was as notable for the conflicting views being penned as it was the milestone itself. In effect some articles read as a eulogy and others as a 10th birthday for a child yet to make their mark on the world.

10 years ago yesterday Satoshi Nakamoto published a paper titled “Bitcoin: A Peer to Peer Electronic Cash System”. Born out of the wreckage and disenfranchisement with banks during the GFC it was a decentralised peer to peer monetary system cutting the banks or any centralised body out altogether.

It was the first real mainstream use of blockchain or decentralised ledger technology (DLT). From it spawned endless (around 2000 at last count) applications of the technology but it would be fair to say none of them have really grabbed mainstream by the horns. An incredibly clever technology, but no one has fully unlocked its potential….yet.

Again we are reminded of another clever technology you may be familiar with… the internet. We wrote a piece back in mid August titled “Crytpo’s Dead – Just like Amazon”. If you missed it, it is a must read.

Some of the crud being written, in particular by one of the most popular Australian online news outlets, was embarrassing to read. Apparently the basis for the post mortem piece on bitcoin is that its price is lower than a year ago. Yep, it’s all over folks, time to move on. No mention of, say, the Aussie sharemarket taking almost the full 10 year life of bitcoin to regain its losses from the GFC or 5000 year old silver also being down on its price 1 year ago. Few would think it’s the end for either. Let’s take 3 of the graphs from that article for context. Amazon, like Bitcoin, is a use of a new technology, in its case the internet.

First let’s look at the mania in Amazon’s shareprice over the dotcom bubble…

And then, like we saw in January this year, it crashed, and crashed badly.

That author may well have said it’s all over for this crazy idea of cutting out the bricks and mortar stores and people buying online. But then this happened:

Look really hard and you can see that ‘huge’ top during the dotcom bubble on the left hand side.

It’s potentially a very similar story for Bitcoin and for any number of other legitimate crypto currencies and tokens. Don’t get us wrong, of that 2000 coins, many are absolute rubbish trying to ride a wave. That was also the case during the dotcom mania and the cream rose to the top after the big clean out. Why? Because the technology was clever and clever people figured out how to use it. That is the case with blockchain as well. It may not be Bitcoin and better platforms then Ethereum may take ascendancy but they also have a massive lead in a crowded market and network effect always matters. One of the coins still massively up on 12 months ago is XRP (Ripple) as it continues to make ground in unleashing a real world use. But it is just one.

Bitcoin has gone from nothing to a market cap of US$110b, 54% of the entire crypto market cap. $4.2b of it was traded just in the last 24 hours.

Here are some interesting observations from DataTrekResearch:

- Bitcoin is worth more than much older entities like Goldman Sachs ($83 billion, founded in 1869) or Morgan Stanley ($78 billion, founded in 1935).

- Its market cap is still just 9% of all the $100 bills in circulation ($1,252 billion) or 17% of all 100 – 500 euro notes outstanding.

- There are 29.7 million bitcoin wallets in existence, a tiny fraction of the estimated 2.5 billion smartphone users in the world. That’s the most important statistic to understand both the opportunity and problem with crypto currencies just now. Mobile payments are the future – that’s easy enough to see –and bitcoin is mobile-ready.

Returning to how we started… It is ultimately up to the individual to decide if this is a eulogy moment or a 10th birthday for plucky kid named Amazon.

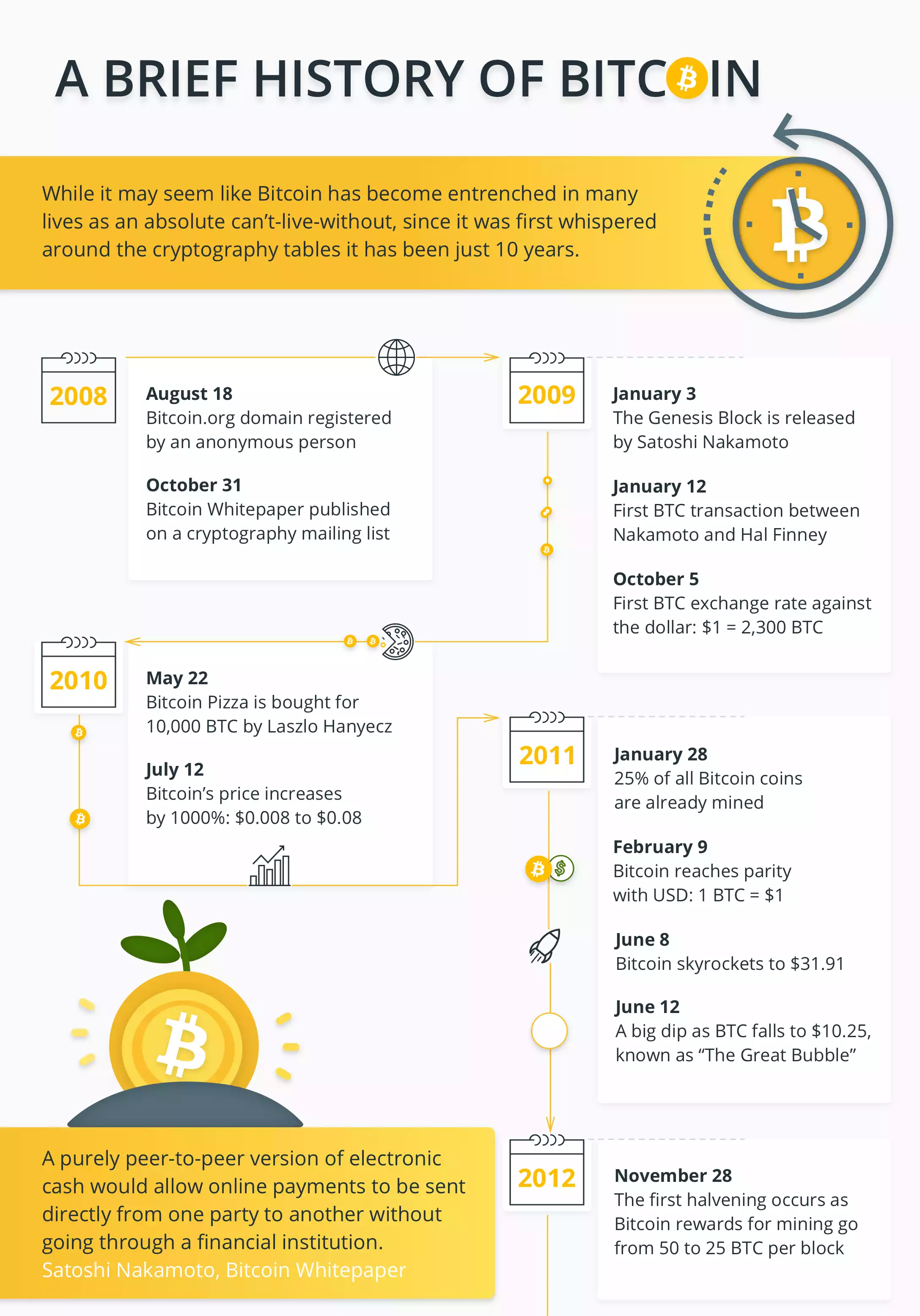

Let us leave you with this brief history of Bitcoin courtesy of cointelegragh.com.