Crypto Sentiment – Contrarian’s Delight

News

|

Posted 28/06/2018

|

8186

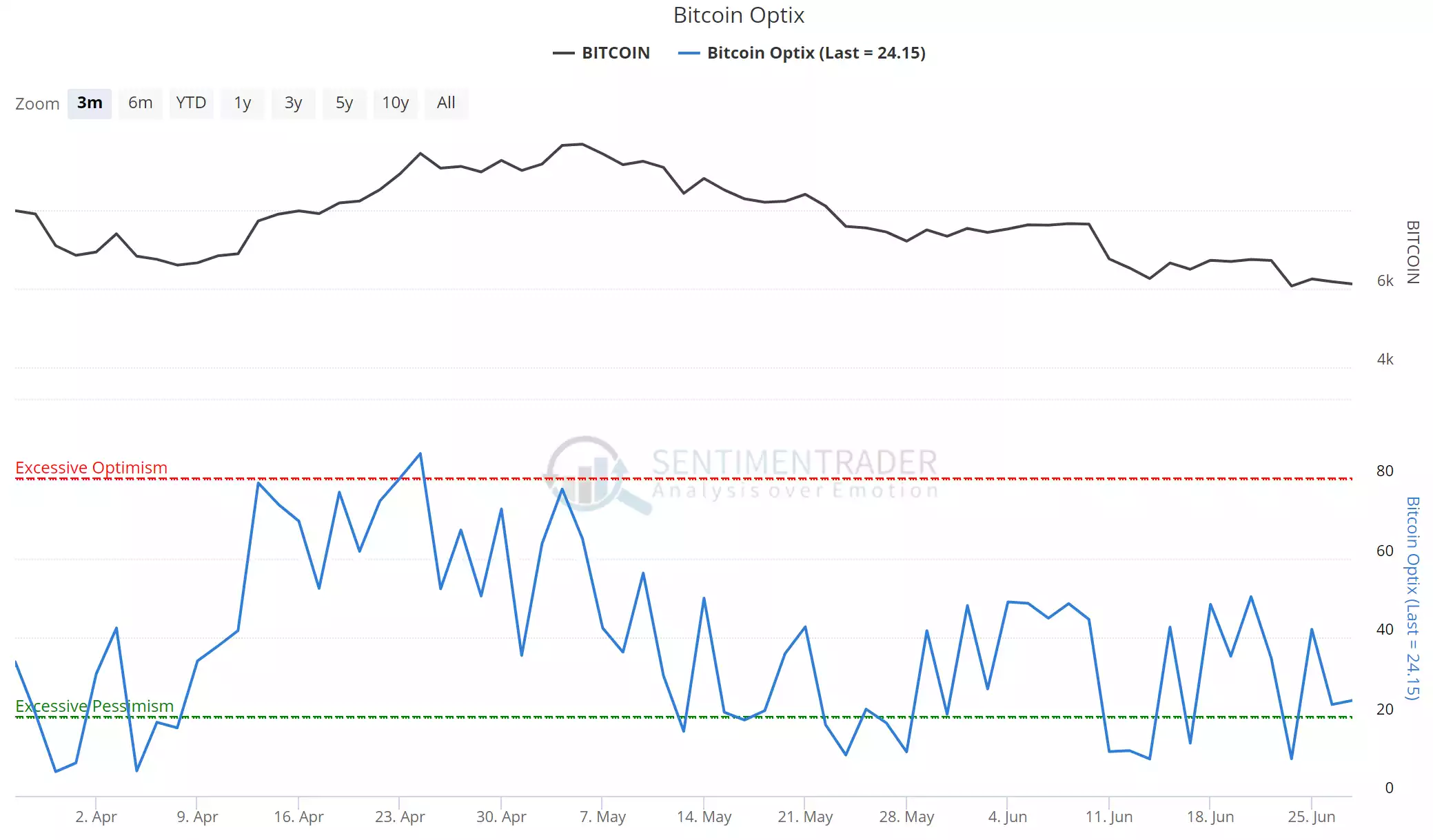

Bitcoin has been generally tracking sideways after the falls last week, albeit with a momentary dip below US$6000 on Monday to an 8 month low of US$5835. The big question for many is where is the bottom of this correction? It is often instructive to look at sentiment as a lead indicator. The following chart is from SentimenTrader.com. Their Optimism Index measures market sentiment from a number of different data sources. It generally follows the momentum of the market, but is useful to indicate turning points at extremes as a contrarian indicator. Recent extreme pessimism is unsustainable and may indicate that the downside move we have seen in the Bitcoin market, and crypto markets generally, has been exhausted as sentiment has been drifting into the extreme range several times over the past week.

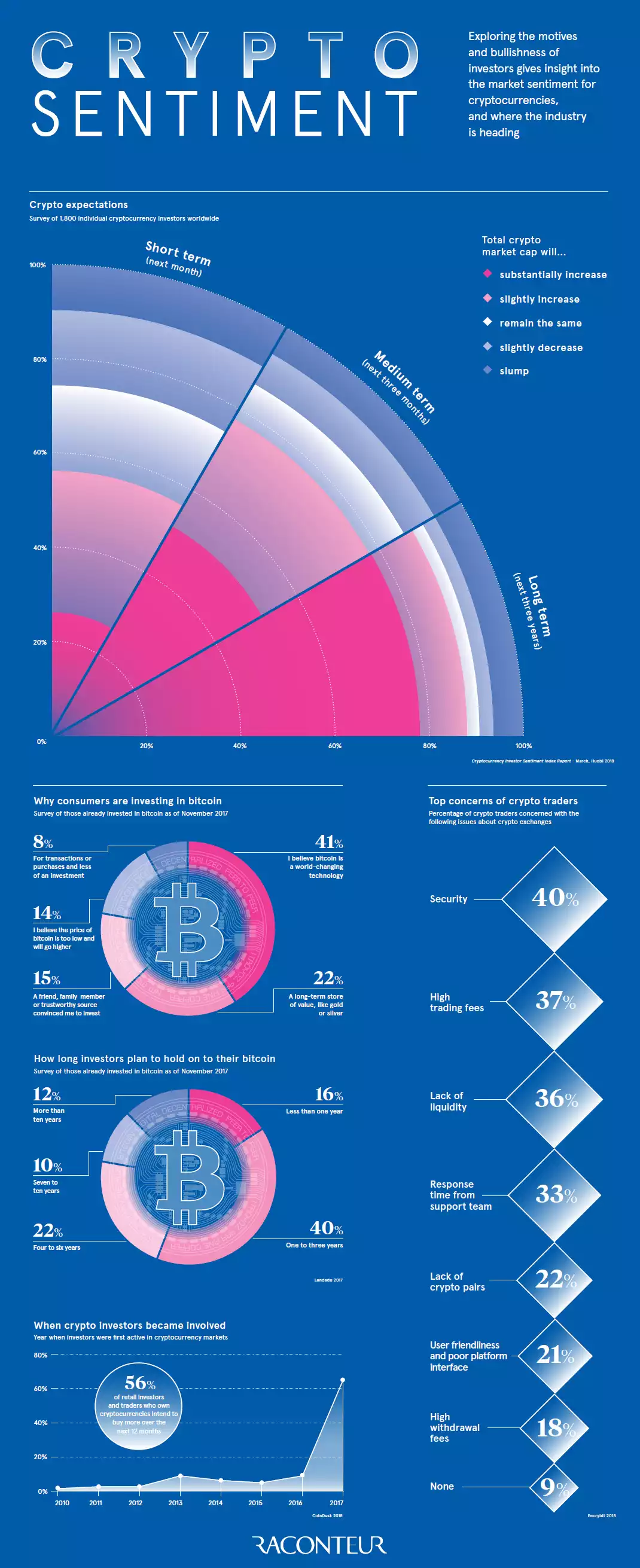

VisualCapitalist.com recently shared an insightful info graphic on a survey of 1,800 crypto investors around the world. Whilst 79% of them expected to see the crypto market up more than 30% over the next 3 years it is the insights into their reasons for buying, timing in and expected timing out that debunk a lot of the ‘flash in a pan’ commentary around the crypto market.

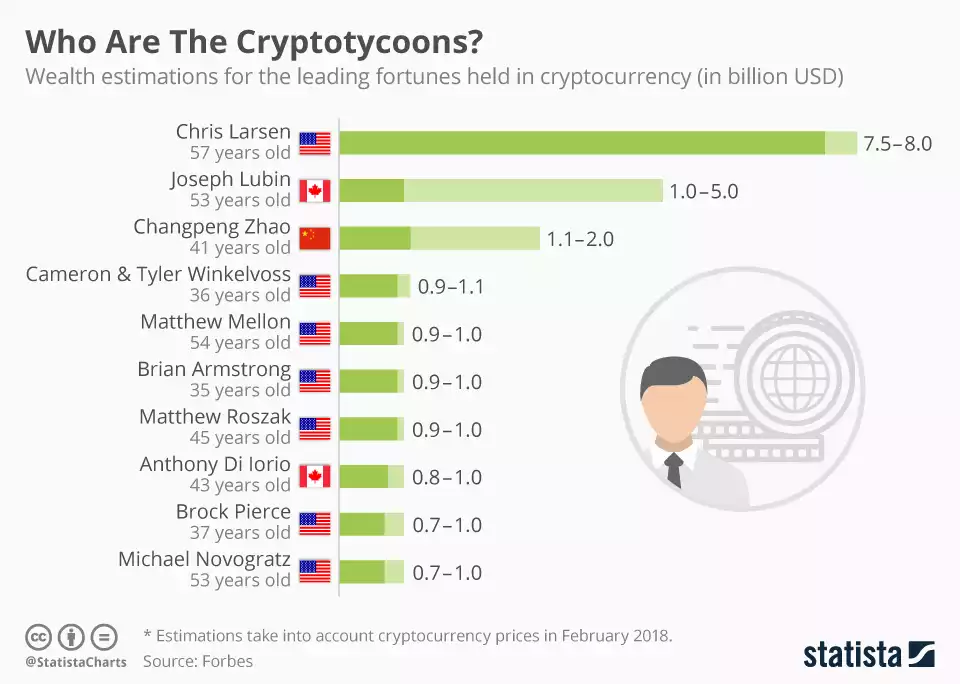

We were reminded this week too of the ‘big money’ in crypto with the following list of the world’s biggest holders, or “Cryptotycoons” (in $US billions):

This is all of course a contrarian’s delight. Such contrarians are avid believers in the Rothschild mantra of ‘the time to buy is when there is blood in the streets’.