Worst US Economy Since 1930’s – Raise Rates?

News

|

Posted 06/06/2017

|

6036

We are now one week from the US Fed meeting where they are widely tipped to raise rates. To do so into economic weakness almost always ends in a recession. Yesterday we shed some light on the less than awesome real employment situation and today we highlight again the reality of economic growth in the world’s biggest economy, the US.

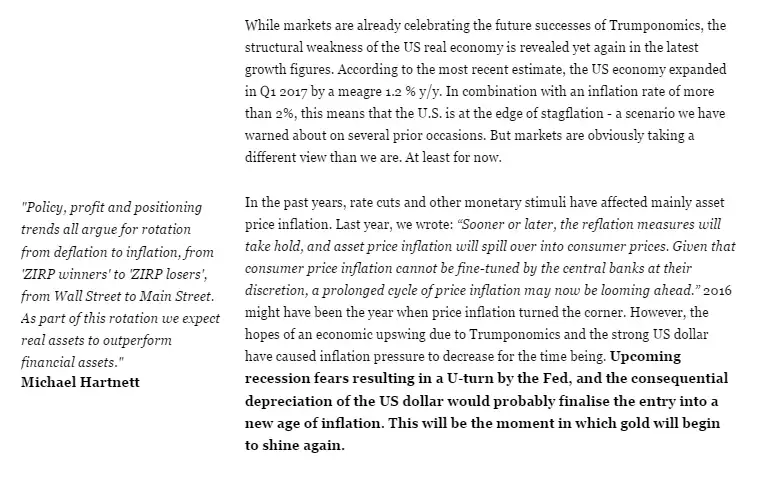

Yesterday we saw the pre-eminent ‘hard data’ (real numbers not surveys) of the Durable Goods New Orders falling 0.5% (its worst since Feb ’16) and Factory Orders falling 0.2%. In the ‘soft data’ of the Services PMI and ISM surveys one was up and one down but collectively only indicating a moderate pace of economic growth. This is not new per the following:

This latest set of data saw more downgrades last night on the estimated Q2 GDP. Yet again hope is yielding to reality. So what exactly is the reality of GDP growth over the last decade? Over to John Rubino:

“….the average rate of growth for the U.S. economy over the past 10 years is exactly equal to the average rate that the U.S. economy grew during the 1930s.

The hard fact is that the past decade’s $10 trillion in deficit spending has produced the worst economic growth as measured by Gross Domestic Product in our nation’s history. You read that right, in the past decade our nation’s economy grew slower than even during the Great Depression [1.33%]. This stagnant, new normal, low-growth economy is leaving millions of working age people behind who have given up even trying to participate, and has led to a malaise where many doubt that the American dream is attainable.”

Now does that sound like an environment in which to raise rates? Keep in mind too, that more than ever before, this weak growth has come despite record debt accumulation. Raise rates and the cost of servicing that debt rises…

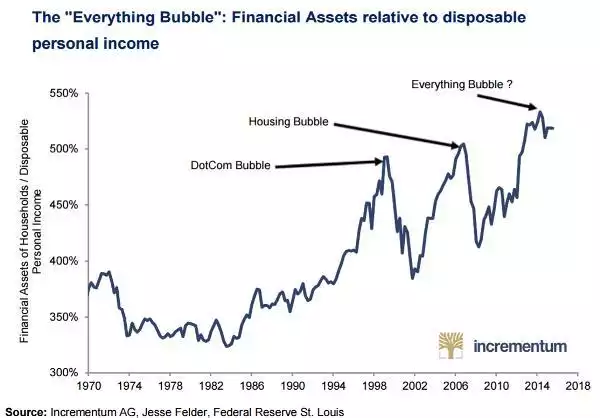

On Sunday we emailed a link to the annual ‘bible of gold’, Incrementum’s “In Gold We Trust” report for 2017. If you missed it, it is a must read and the link is here. If you aren’t on our Daily Email list (daily spot price / AUD / GSR updates and a link to the latest news) you can subscribe on our homepage or shoot us an email to [email protected] requesting us to add you.

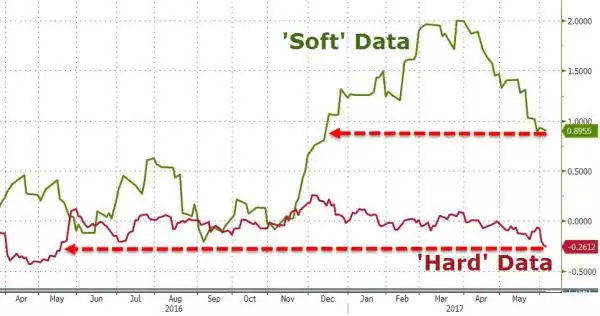

That report highlighted the unprecedented amount of currency that has been printed and injected into financial markets in the last decade. Don’t think for a minute that because the US has stopped QE this has abated. In the first quarter of this year alone, nearly $1trillion of new money has been created. As they point out that could have bought every single person in the world a 1/10th oz gold coin!

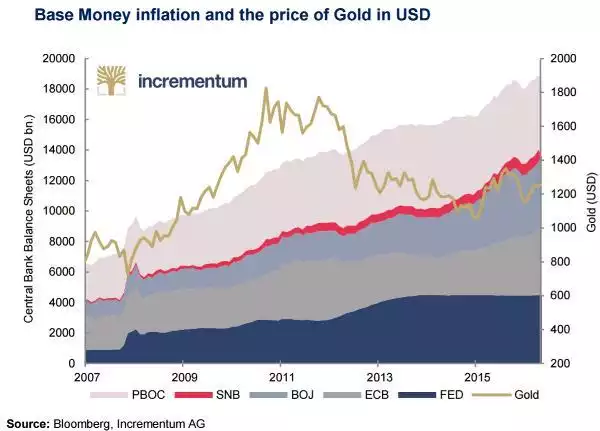

The result? That aforementioned weak REAL economic growth but AWESOME financial asset bubbles:

Incrementum sum it up nicely: