This Hasn’t Happened Since 1976

News

|

Posted 04/11/2019

|

13722

Friday night saw a better than expected NFP employment report out of the US (128K new jobs against a dismal 85K expected) and some more hints toward an easing bias from some Fed officials saw everything surge except the USD.

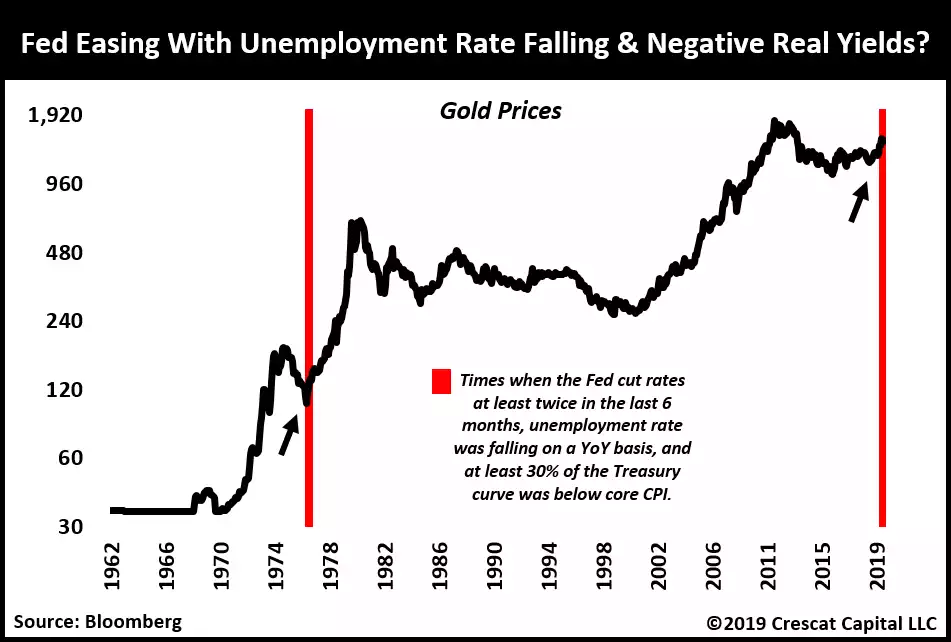

Whilst traditionally uncorrelated there could be good reason for both shares and gold rising together. The contradiction in the market at the moment that sees the US Fed easing monetary policy and yield curves inverted against a scene of near record unemployment and a strong sharemarket is not without precedent. As you can see below, this happened in the mid 70’s, before one of the strongest bull markets in gold’s history. From 1976 to 1980 gold rose 520% - over 5 fold in 4 years. By the way, in a classic GSR reversion, silver rose 800% in the same period after, you guessed it, lagging gold for a while and then sling shotting past…

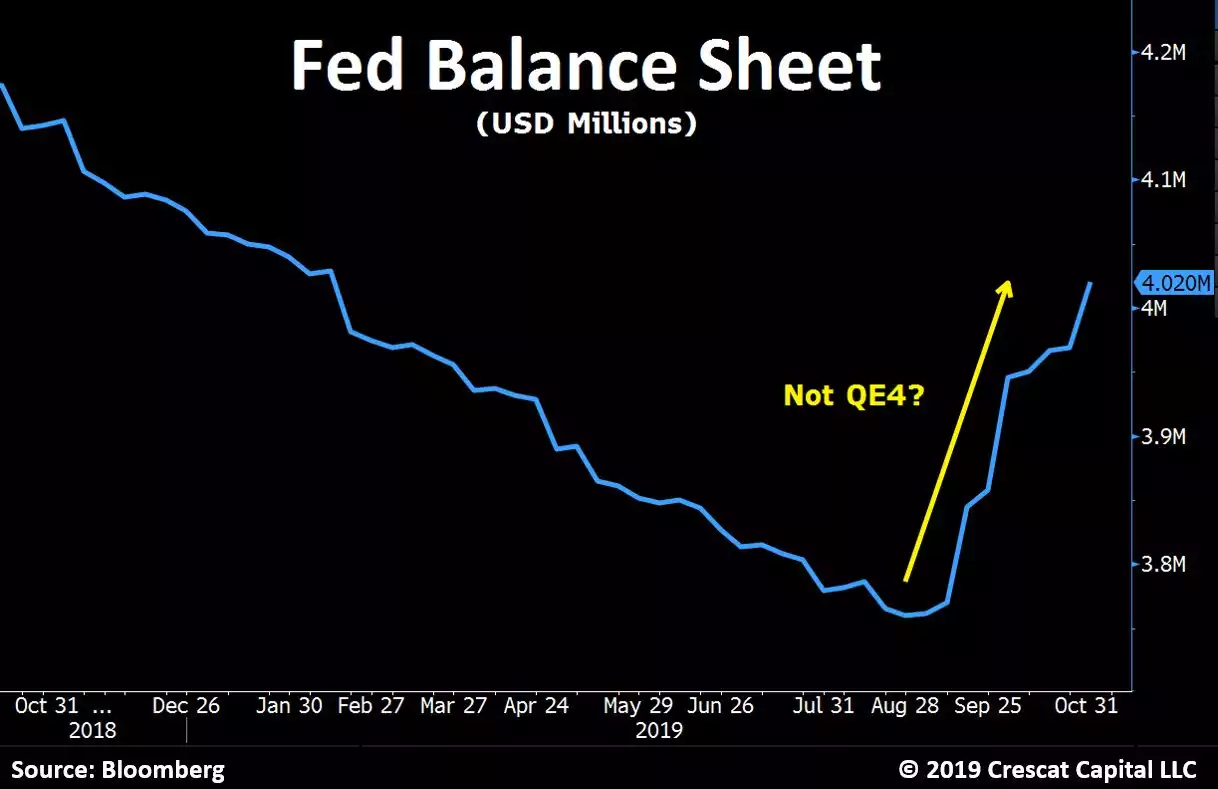

The thing is, not only are the Fed cutting rates now, they are fully deploying ‘notQE’ liquidity injections at the same time (printing money). Whilst steadfastly not calling it QE, the Fed have added $258 billion in just 2 months through the faltering Repo market. That is the same amount they reduced their balance sheet by since the beginning of the year through QT! Moreover, the Fed is now promising $60 billion per month right through to the middle of next year.

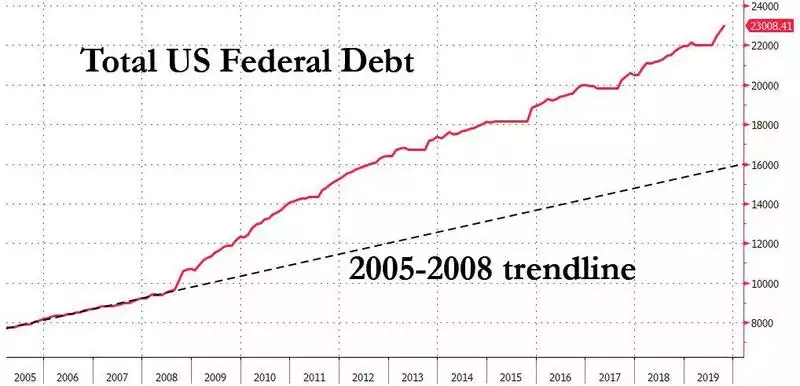

The backdrop to all of this is burgeoning government debt and weak economic growth. US public debt just breached the $23 trillion mark just months after hitting $22 trillion and continuing the steep trend set since the GFC, a debt born crisis….

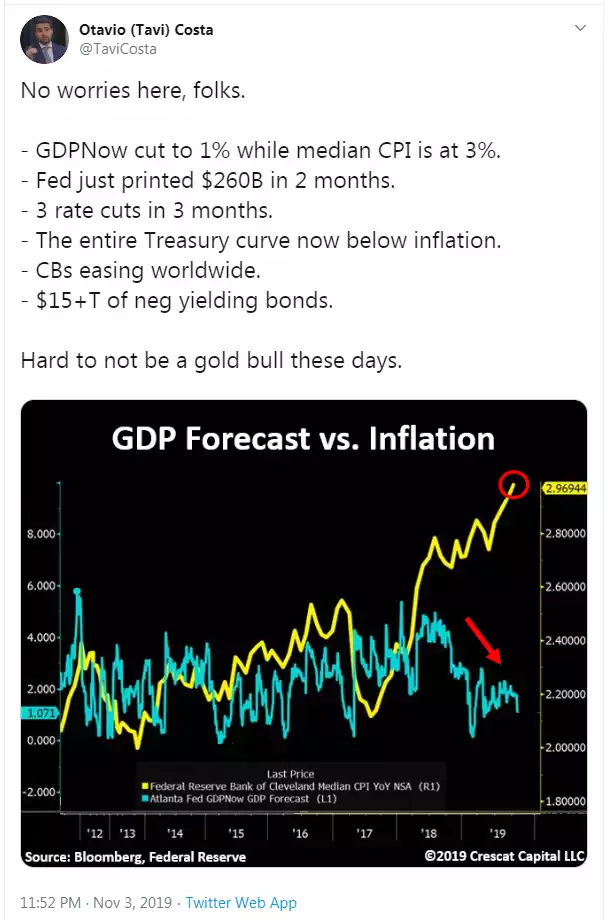

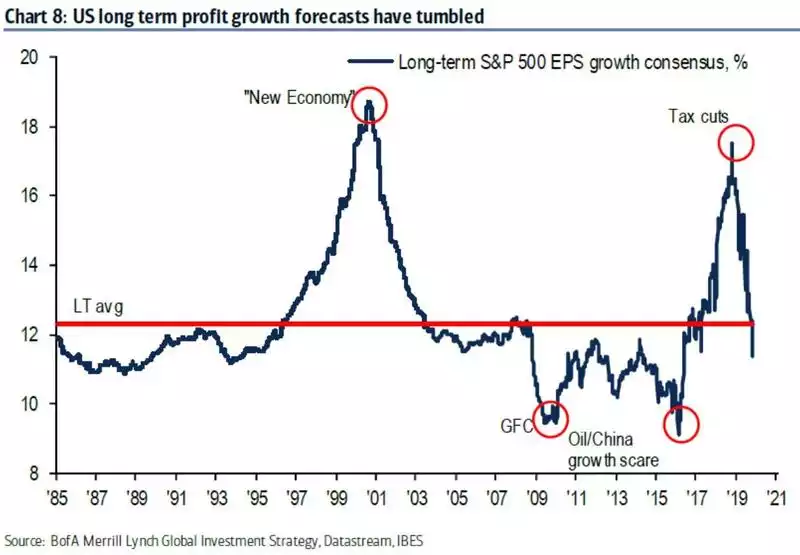

The Atlanta Fed GDP forecast is now only 1% and long term earnings projections are plunging.

Crescat’s Otavio Costa sums it up…