“Extremely Rare” Silver - Market Tightens

News

|

Posted 20/09/2019

|

11466

The tightness of the silver market during this period of high demand is highlighting both the relatively small nature of the silver market and the price implications for that. We discussed this briefly in an interview with Nuggets News recently (released last night – you can watch it here) but other recent news further highlights this dynamic.

In that interview we touched on the disconnect between the ‘paper’ price and ‘physical’ price when we had the first big sharemarket correction in 2015 when China did the shock Yuan devaluation. There was an enormous rush to physical gold and silver and dealers and refiners alike around the world were literally cleaned out of stock of silver in particular. Refiners and hence dealers had to raise prices to get the metal to satiate demand and yet the ‘spot price’ did not reflect this due to the influence of COMEX futures trading. In other words, the spot price, highly influenced by synthetic paper trades, did not reflect what you had to pay to get the physical metal.

On an “unrelated note” (cough cough…) this week you will have seen that JP Morgan were criminally indicted for manipulation of the metals markets. The prosecutors described JP Morgan’s precious metals desk as a ‘criminal enterprise operating inside the bank’ and the individuals indicted as partaking in a ‘conspiracy to conduct the affairs of an enterprise involved in interstate or foreign commerce through a pattern of racketeering activity.’ From Lawrence Williams in London:

“According to a Bloomberg report, the JPMorgan investigation grew out of a multibank U.S. crackdown on manipulation of commodities markets using techniques including spoofing. The Justice Department had already brought criminal charges against 16 people, including traders who worked for Deutsche Bank and UBS. Seven pleaded guilty, one was convicted at trial and another was acquitted. The latest indictments may thus be only the ‘tip of the iceberg’ in terms of large scale manipulations of all kinds of markets.”

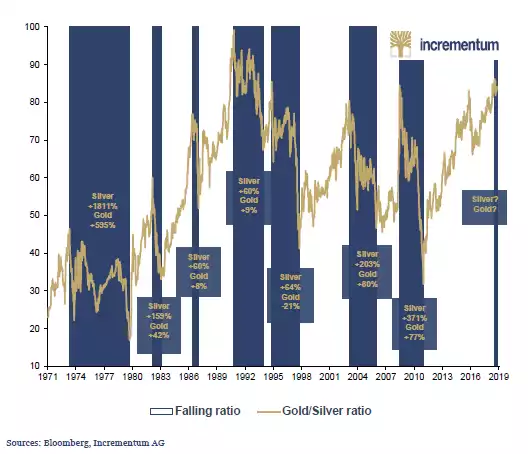

In this latest market rally, that has seen silver more predictably rise 20%, we may have a more organic market at play. Indeed, per the playbook, silver lagged behind gold’s initial rally as it historically does before taking off as the gold silver ratio reverts. That has seen the GSR fall from 94 to its current 84, still at historically nose bleed heights but the start of the reversion nonetheless.

This anomaly of an 84:1 ratio of the gold price to silver price was brought into sharper focus by the CEO of mining giant First Majestic Silver this week in an interview with Kitco News. Keith Neumeyer talked to the absurdity of the current price stating above ground silver reserves are dwindling in unison with production rates dwindling. From Kitco:

“We’re mining eight to one, so for every one ounce of gold that’s being mined worldwide, we’re only mining eight ounces of silver. Silver is extremely rare and people don’t get it,” Neumeyer told Kitco News on the sidelines of the Denver Gold Forum. “People think silver is in abundance, but it’s not.”

8:1 versus 84:1… And remember half of silver is used in industry with little recovered from that.

On record as predicting triple digit prices for silver soon, he also addresses the argument that industrial demand will reduce should that happen. He says electric cars only have 3 -5 kilograms of silver in them so silver going from $20 to $100 is not going to have a material effect on the price of a car and a mobile phone likewise has around $5 of silver in it, and so the same argument.

He also responds to the question of that dwindling mine production simply turning when the price goes high enough. Neumeyer points out that yes that higher price can bring mines on line but there is ordinarily a 5 to 10 year period to actually do so and therefore it simply isn’t nimble enough to have any immediate impact on the silver price from a supply versus demand perspective.

Highlighting the fragility of the silver mine production rates, we’ve also learned this week that one of the biggest silver mines in the world, Mexico’s Peñasquito (Newmont-Goldcorp) mine is yet again shut down due industrial strikes and protests.

Silver is often described as the most undervalued asset in the world. Synthetic markets can only counter natural supply and demand rules of economics for so long. The contrast between 2015 and 2019 may be indicating that time is approaching.

And as a reminder: