Why are gold and silver surging?

News

|

Posted 23/07/2020

|

10915

After another very strong night in the northern hemisphere last night gold, at US$1872 is just $30 off its all time high of US$1900 whilst silver smashed through $23 to a 7 year high but still less than half its US$48 high in 2011 and the GSR sits at 81. In Aussie terms gold is back above $2600 and now $120 off the $2745 all-time high in March this year and silver at $32.40 is more than $10 off its 2011 high.

So why all of a sudden are things ramping up again? The list is extensive and it is as much as about the sum of the parts as any one because individually nothing is particularly new. However rarely do we have an environment where nearly all financial experts are almost unanimously bullish gold.

Currency debasement

Just yesterday Deutsche Bank’s Jim Reid concluded "Gold is definitely a fiat money hedge" after stating "fiat money will be a passing fad in the long-term history of money". Reid pointed out that from 1860 to the end of the gold standard in 1971 the real price of gold fell 75% against inflation. Since we left the gold standard and embraced fiat currency to now, gold has risen 700%, double its 1860 real level.

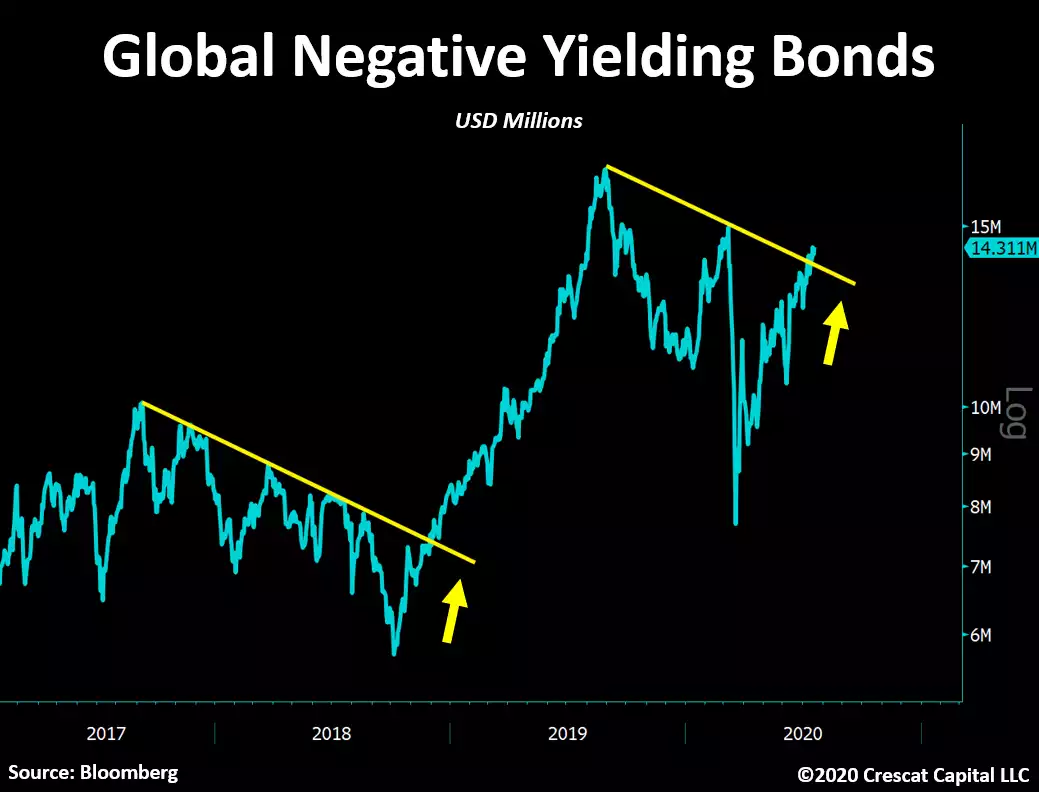

What is happening now is an unprecedented, and dare we say terminal death throw, debasement of fiat currencies around the world through central bank monetary stimulus and government deficit spending. Today we see headlines in Australia stating a child born today will not see the current COVID-19 deficit spending repaid before they are 30 years old. And THAT is before the inevitable extensions of various support packages as this gets worse not better. Whilst we spoke yesterday of the RBA doggedly resisting more stimulus we are seeing elsewhere in the world a new surge in negative yielding government bonds:

This chart alone is very bullish for gold as the price has very closely tracked this chart. It also highlights the level of debasement when we have over $14 trillion of negative yielding bonds in the world at the same time as fiat currency being created at an unprecedented pace.

In real terms (deducting inflation) US 5 year Treasuries are already negative, now yielding -1.15%, a 7 year low and as we’ve shared before the trend is most definitely lower. Many economists are predicting we will see negative unadjusted yields in the not too distant future. That sees big money querying why they’d take on the risk of money in the bank when there is no return for that risk. As Treasuries become zero bound, that same money is becoming more wary of Treasuries and the capital growth potential to offset that lack of yield, leaving gold and silver as the sole safe haven trade with strong capital growth potential and the added benefit of no counterparty risk.

As we discussed yesterday as well, we now have the EU in a coordinated and massive stimulus package, half of which is not even pretending to be debt, instead an outright ‘grant’ to the struggling economies of the union. That is outright pure, ‘eyes rolled back’ money printing.

This all collectively sees downward pressure on the USD too which is now at its lowest level since the March mania, and again bullish for gold and silver. In summary ex Bloomberg:

“The combination of low-to-negative government bond yields plus a weakening U.S. dollar, and most importantly, massive central bank accommodation, supports financial demand,” said Stephane Monier, chief investment officer at Geneva-based Banque Lombard Odier & Cie SA. “This relationship between gold and real yields has held for the last decade and recent central bank interventions have reinforced the case for holding gold as a portfolio diversification tool.”

China

Last night’s precious metals rally was certainly further fuelled by the escalating tensions between the world’s 2 biggest economic super powers. The closure of the Chinese embassy in Houston is just the latest incident in tensions ranging from technology, Hong Kong politics, to trade. Whilst initially spooked, Wall Street shrugged it off with new vaccine hopes (again…) and shares rallied again but there were plenty heading for cover in precious metals and Treasuries. Michael Every, head of Asia financial markets research at Rabobank in Hong Kong summed up this complacency well last night in Bloomberg:

“This is only the latest escalation in a series that will end up in a crash for relations, for Hong Kong and for the yuan unless something changes. The markets will worry for all of five minutes and then resume rallying -- right up until they realize the China-U.S. dynamic blows everything up eventually. I’m massively bearish in the long term. So enjoy the ride and don’t believe in it for a moment.”

The China issues go well beyond the US tensions too. We passed on Crescat’s excellent summary of the woes before China right now earlier this month here. Aside from the political tensions we also have the fact that China too is seeing the effects of the global recession whilst carrying the biggest debt burden in the world. Bloomberg explains in the article “As China’s Economy Slows, Why the World Should Care”:

“China’s $14 trillion economy, second in size only to the U.S., accounts for almost a third of global growth each year. That makes it a vital driver of job creation and improved living standards everywhere. The advanced age of the U.S. expansion -- more than a decade -- and worries about Europe make China’s pace of continued growth that much more important. If China’s current slowdown were to suddenly accelerate, the ripple effects could squelch the global recovery. A slowdown is structural -- something that’s expected to happen over time. But a plunge defies expectations and is therefore far more disruptive.”

Last week China surprised analysts with a better than expected GDP print for the second quarter April to June of 3.2%. Those that even believe the numbers China puts out also qualified this was likely pent up demand of outstanding orders held up by the lockdowns and so universally doubt China’s claim of a bigger bounce back toward 6% from here. This of course followed the negative 6.8% print for the first quarter. However even 6%, if achieved is not as amazing as it seems. Why? Bloomberg go on:

“In one respect, nothing, since it’s more than twice the global rate. But China’s economy is loaded up on debt and its ability to service repayments depends on rapid growth to generate the profits and tax revenues needed. Slower growth challenges China’s ability to stem the buildup of its government, corporate and household debt -- which according to Bloomberg Economics is on track to add up to more than 300% of gross domestic product by 2022. The bigger that debt pile becomes, the bigger the impact on global growth should it all go sour. Plus, growth could even slip below 6% without more aggressive stimulus -- something officials in Beijing have been leery of trying for fear of sparking a financial blow-up.”

Falling China demand will be a huge weight on our AUD adding to any USD gains in gold because of the impacts on the global economy.

Finally, and as explained in part yesterday, there has been a lot of money on the sidelines waiting to see clear signals that silver’s bear run since 2011 was over (we wrote to this here). That money appears to be convinced and is pouring in now. As the GSR drops toward its mean around 45-50 we could expect to see this continue strongly though not without the peaks and troughs along the way that this much smaller and volatile market routinely dishes up. Bull markets are not un-coincidentally named after a bucking beast…. Enjoy.