Silver Explodes, Gold Surges, AUD Puts “For Sale” Sign Up

News

|

Posted 22/07/2020

|

16066

You may at first be a little confused this morning. The news is spruiking gold shooting higher last night and of course silver like a rocket, up $23.70 (1.3%) to $1843 and $1.43 (7.2%!) to $21.32 respectively. However in AUD gold is this morning down $9 or 0.35% and silver up $1.55 or 5.5% respectively. You can say thanks to the EU and our RBA respectively that you get to buy at comparatively suppressed prices before the inevitable fall.

Last night the EU reached an historic agreement with the announcement of a $860b (EUR750b) stimulus package that not only sees EUR360b of low interest loans but also EUR390b of outright grants, particularly for the harder hit southern nations such as Italy. The protracted negotiations saw the so called ‘frugal four’ (Netherlands, Austria, Denmark and Sweden) capitulate after the grants were reduced from EUR500b. That agreement saw the Euro surge forcing the USD index markedly lower and gold up and silver up even more after its already huge moves yesterday. That fall in the USD conversely had a buoyant effect on the AUD.

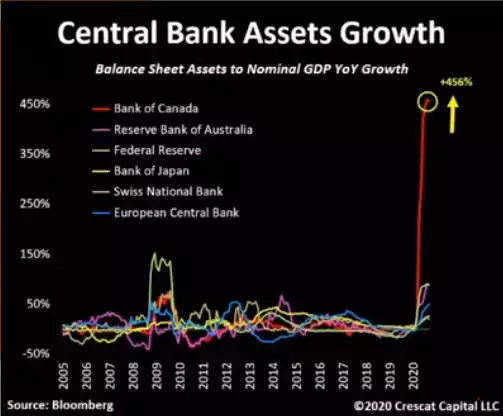

Additionally we heard from the RBA chief Phil Lowe essentially rule out the extraordinary central bank stimulus measures being deployed or openly contemplated by other central banks around the world. All currencies are only relative to others and that put more upwards pressure on the AUD which went from 70c yesterday to 71.3c at the time of writing and hence wiping off the gains off that USD gold spot price last night.

The criticisms of Lowe are starting to mount as this sees Australia at a distinct disadvantage globally and one can only wonder how this ends well on the global stage. For now, Aussies get to buy into this bull market at a discount with the prospect of the eventual capitulation of the AUD a tantalising boost. For most of this year the AUD price growth has outpaced the USD price but on this latest rally and higher AUD gold is now up 21.4% in USD terms compared to 19.9% in AUD, and with the belated silver rally, silver is now up 19.5% in USD terms and 17.8% in AUD. Bloomberg yesterday wrote to the renewed rally:

“Precious metals are soaring to multi-year highs on the back of persistent concerns over the coronavirus and the outlook for further economic stimulus worldwide.

Gold futures surged to an almost nine-year peak and silver touched the highest since 2014 after Hong Kong reported additional cases of the virus and new infections in the Australian state of Victoria surged, fueling demand for haven assets. European Union leaders agreed on an unprecedented stimulus package to pull their economies out of a virus-induced recession. Silver, used in manufactured products ranging from solar panels to electronics, is getting an added boost from supply concerns and bets on a rebound in industrial demand.

The two metals are the top performers in the Bloomberg Commodity Index this year as investors clamor for insurance against further economic fallout from the virus. Low interest rates amid easy monetary policies have also bolstered the appeal of the non-interest-bearing assets. The jump in demand has sent holdings in exchange-traded funds backed by the metals to all-time highs.

“For gold it’s the same old story: Real rates continue to grind lower and we are reaching levels close to the global financial crisis,” Daniel Ghali, TD Securities commodities strategist, said by telephone. “We’ve seen that silver has been increasingly trading as an industrial metal. We think the marginal unit of demand for silver is coming from the industrial metal side.”

Gold futures for August delivery rose 1.5% to settle at $1,843.90 an ounce at 1:30 p.m. on the Comex in New York, the highest closing price for a most-active contract since September 2011. Gold futures are less than $100 away from the all-time high of $1,923.70 set that year.

Silver for September delivery jumped 6.8% to settle at $21.557, the highest since March 2014. Other precious metals also advanced on Tuesday, with palladium futures gaining 3.7% on the New York Mercantile Exchange and platinum climbing 7.1%, the most since April.

Even after recent gains, there’s a long list of banks and traders predicting silver will keep rising as investors continue to pile in. Citigroup Inc. said in a report this week that it sees prices rising to $25 in the next six to 12 months, with the potential for $30 based on the bank’s bull case.

“Silver is now leading the charge,” said Stephen Innes, chief market strategist at AxiCorp Ltd. The metal is following the same trajectory as during the global financial crisis, he said. Back then, prices dropped during the worst of the crisis before rallying to fresh records near $50 by 2011.”

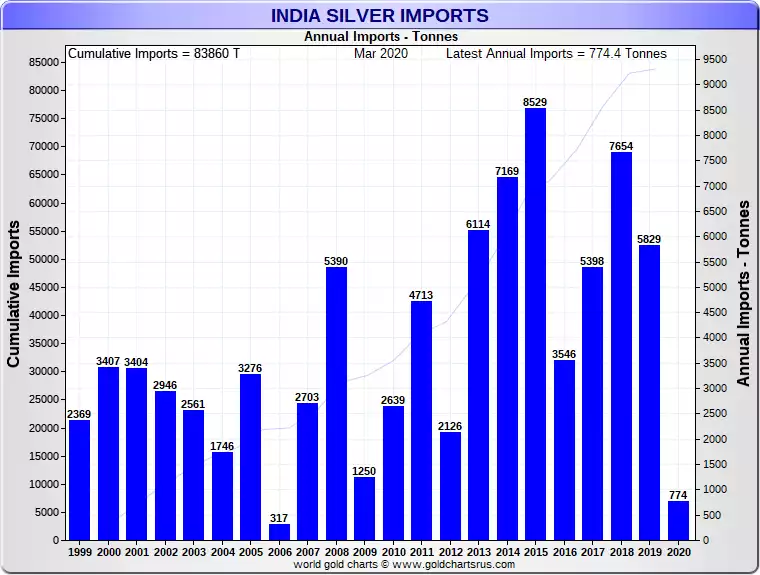

There are a number of influences converging for silver at the moment. As we reported Monday, ETF demand is surging and since that news the Sprott ETF announced it was purchasing $1.5b of physical silver (nearly 9% of annual global production!) to satiate demand. There are also growing calls of silver demand in India about to explode. Indian silver demand has been lagging in 2020 as you can see from the chart below. On average over the last decade India consumed 172.7 million ounces of silver per year. In 2020 that has been less than 25 million oz in part due to lockdowns affecting the wedding season.

When you start to see headlines in India’s Business Standard like “Silver is emerging as the new gold as price rallies 4.8% in a day” you know it’s about to turn. From that article:

“Anuj Gupta, AVP, Angel Broking, said: “Industrial demand increased globally. ETFs, too, are supporting silver. The holding of the biggest silver ETF – BlackRock’s iShares Silver Trust, has surged by $2.45 billion to $9.72 billion this year. In India, a good monsoon is also one of the reasons for the increase in the price of silver. Demand for silver jewellery from rural areas has also supported the metal. We expect silver to test Rs 60,000 levels soon. Festival demand is also supportive.””

To illustrate the explosiveness of this rally, you will note the gold and silver prices at the start of writing this article. Now at the completion of writing, silver is up to USD22.27 or AUD31.26, 4.4% in an hour…

It is worth remembering too the usual dynamics of a falling Gold Silver Ratio. Right now it is 84:1 when it was 94 just 2 days ago. Whilst of course that is incredibly bullish for silver as it potentially heads toward (and of course beyond as mean reverting works) that century long mean of around 45, that is normally in lockstep with gold rising as well. In other words, a falling GSR is historically a bullish signal for gold as well despite that seeming counterintuitive. Check out the chart below.

If you missed our broader commentary on silver last week it is here. Think you’ve missed the boat? Silver last peaked at $50….