Real Gold, COMEX Gold & THAT Crash…

News

|

Posted 12/11/2015

|

4812

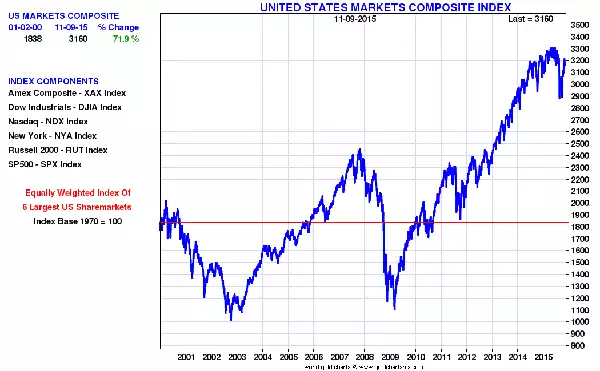

A simple pictorial journey of logic today… The first graph below shows a composite illustration of all major US share indices…

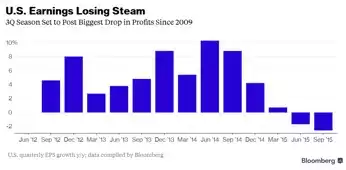

Keeping in mind buying shares is buying a share in the future earnings of a company, the next graph shows the new trend in said US earnings…

The first graph represents a huge increase in investment funds moving into the US shares bull market. The second could be writing on the wall (together with the global slowdown reported yesterday) and of course just one month out from the supposed rate rise of December, itself a possible trigger for the overdue correction. Whilst we’ve had all those funds moving into US equities, the opposite has been the case for gold by the same western investors (who needs gold when everything is awesome?). Now consider the telling story of east v west in gold…

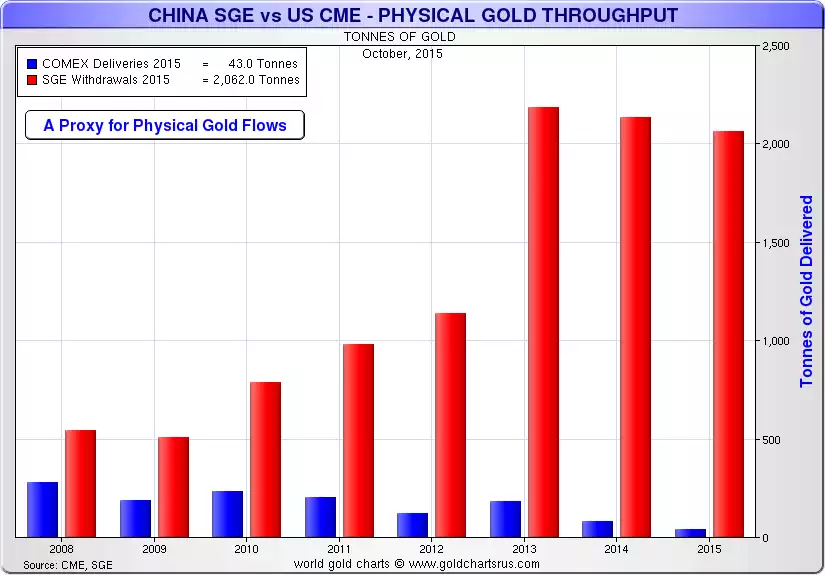

Now to be clear this is not a direct comparison, but it is instructive nonetheless. COMEX contracts deliver physical gold rarely as they are largely paper trades between short sellers and long buyers, closed out each month. That is of course until something happens (let’s say, a big market crash) and one or two big buyers demand their metal – now please. We reported recently the current record set up in this respect and it’s a must read in this context. It would take just a $200m contract to demand delivery of real gold and there’s not enough registered to do so (PS. December is traditionally the biggest month of deliveries in each year….)

The perverse thing is the COMEX trades, those most removed from physical reality, largely dictate the spot price. For now….

Meanwhile the canny Chinese have been taking delivery of physical gold, not so coincidentally as COMEX has seen outflows. The former are long term holders of the real stuff, the latter simply speculative traders. Note too, that 2,062t to China is just year to date. Predictions are for around 2,600t by year end. An all-time record.

So if China have consumed most of the gold and even a fraction of the c$300t of total financial assets try to move into the c$1.5t gold market on a sizeable correction – what do you think might happen?