A Critical Message From the ‘Seas’…

News

|

Posted 11/11/2015

|

6376

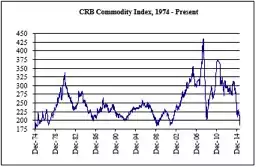

There a couple of ‘barometers’ of the health of the world’s demand for ‘stuff’. The production and consumption of stuff is the key fundamental of any economy. Australia is feeling the pinch now as China doesn’t need our commodities anymore. China is feeling the pinch as it can no longer keep producing infrastructure (needing our commodities) at the pace it has done since the GFC. It did that through quadrupling it’s debt from $7 trillion to a simply staggering $28 trillion over just six years after the GFC. It’s not just China but a worldwide slump in commodities as illustrated clearly below (as at this week) – yes we are nearing an all time low and it’s heading down quickly.

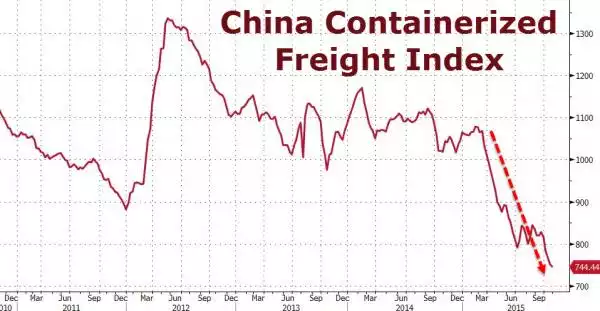

China is also feeling the pinch as the world wants less of the stuff it makes. We saw more terrible data over the weekend showing the continued slump in both imports and exports for China and the chart below again paints a clear picture. More broadly, the international Baltic Dry Index (the so called bellweather of global consumption) has dropped to 631, the lowest level for this time of year (the usually strong pre Xmas month) in history and getting very close to an all-time historical low.

The US is trying to paint the picture that this is just ‘the rest of the world’s’ problem but data shows that a full third of all containers leaving their 2 biggest ports are empty. This will only worsen as the USD gains strength, eroding their already weak competitiveness, as the Fed talks up an imminent rate rise. Let’s be clear, this is a global economic downturn and the US is firmly part of that. Whilst the IMF and OECD etc keep revising down growth projections around the world, sometimes you need to hear from where the rubber hits the road. The CEO of the world's largest cargo shipping company, Maersk, just had this to say:

"The world's economy is growing at a slower pace than the International Monetary Fund and other large forecasters are predicting. We believe global growth is slowing down. Trade is currently significantly weaker than it normally would be under the growth forecasts we see. We're a little bit more pessimistic than most forecasters."

And this is in a world where most developed countries are at zero or even negative interest rates or reducing them towards that (ala Australia) and, critically, before any supposed US rate rise…. What happens if they do?