Marin Katusa Talks Gold Deposits After A Disappointing NAR Report

News

|

Posted 25/07/2017

|

8374

Marin Katusa of Katusa Research has been fairly actively talking about gold on Twitter of late. Today we explore some of his observations after first looking at the latest National Association of Realtors report.

Marin Katusa Talks Gold Deposits After A Disappointing NAR Report

Overnight price action in gold was fairly steady after hitting a four-week high earlier on Monday. This stabilisation of price was on the back of the latest National Association of Realtors (NAR) report which was a disappointment. The report indicated that consumers in the US bought 1.8% fewer pre-existing homes in June, equating to 5.52 million units. A decline was expected by economists but only in the order of 1% to 5.58 million units.

The next release of significance will come from the FOMC meeting which begins on Tuesday morning and ends early Wednesday afternoon US time. A statement will be released but the “Fed-watching” community expects no changes in US monetary policy. The tone of language used in the statement will be, as usual, finely dissected by economists and their brethren as we’ve identified previously, so as we wait for the outcomes of that release, let’s today turn our attention to Marin Katusa.

Receiving accolades from names such as Doug Casey and Rick Rule, Marin built an impressive fortune from investment research, especially in the gold and oil stock space.

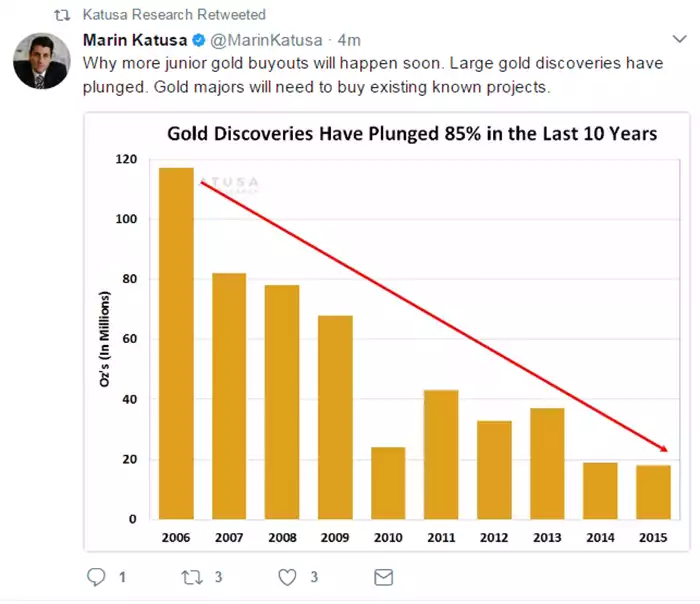

Captured 4 minutes after it was tweeted this morning comes this comment from Marin. We often focus our attention on the increase in physical demand driven largely by China and India but if any chart speaks to the fall in gold supply, it’s this one.

Marin’s suggestion that the consumption of known deposits held by junior minors will be a means of compensating for organic discoveries is supported by the information we covered two weeks ago on senior silver producers such as the Coeur D’alene who are doing the same thing. As a 16 million ounce silver producer, Coeur is adding a lot of gold production because of the difficulty inherent in routinely keeping all revenues in silver when operating at that level. This gold production will to an extent come from deposits being targeted for acquisition by the major gold miners in order to maintain their own production.

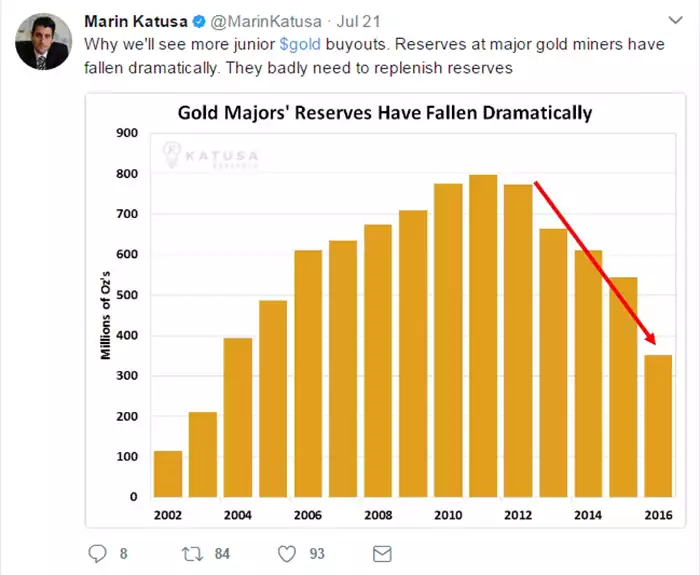

Marin’s July 21st tweet pictured above illustrates that the reduction in gold discoveries has had a radical impact on gold reserves held by the major producers. It can be clearly seen that ounces in reserve peaked at just under 800 million in 2011 and by last year those reserves had more than halved. Maris suggests that this dynamic will see continued buyouts of junior gold companies but with such an aggressive trend, this is a stalling tactic at best. Without sustainable gold deposit discovery, supply will ultimately falter and in the current high physical demand environment, this is supportive of much higher physical prices going into the future.