Historic Run Ends Tomorrow – Where to from here?

News

|

Posted 21/08/2018

|

7228

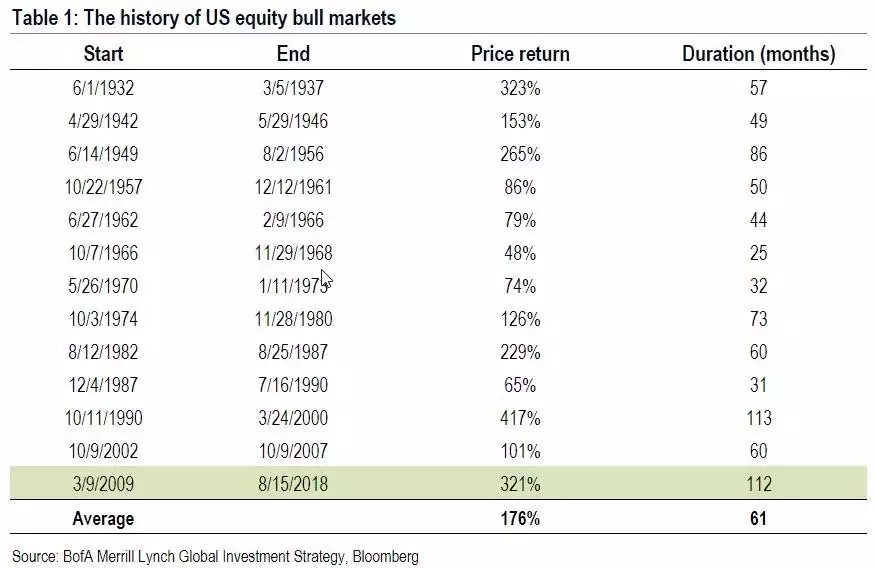

Tomorrow is an auspicious day according to most economists. Tomorrow the S&P500’s bull market run turns 3,453 days old making it the longest bull market streak in history. From Retuters:

“The bull was born in the ashes of the financial crisis and carried along through much of its rise by $3.5 trillion of asset purchases by the U.S. Federal Reserve. The debate now is over when, not if, its run will come to an end.

“Bull markets are like incandescent light bulbs. They tend to glow brightest just before they go out,” said Sam Stovall, chief investment strategist at research firm CFRA.”

Bank of America Merrill Lynch had this to say on the topic of why this will be the longest bull market in history:

“central banks immediately adopted extreme & unprecedented monetary policies (705 rate cuts, $12.4tn QE, lowest global rates in 5000 years) successfully preventing debt default & deflation, reflating Wall St…catalysing one of the greatest credit & equity bull markets in history”

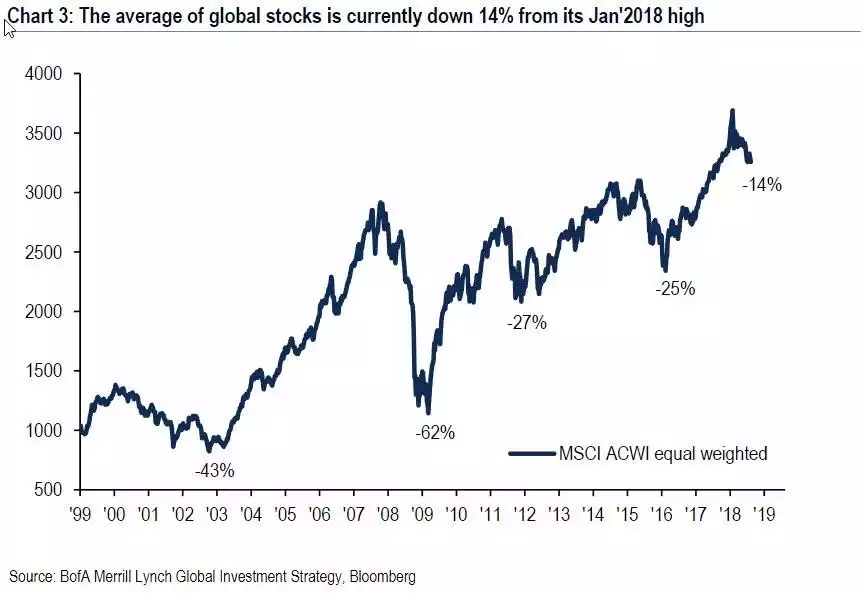

However, whilst the S&P500 is the world’s biggest sharemarket index, it certainly isn’t the only one and 2018 has been notable for the growing disconnect of it (as a proxy for the US economy) and the rest of the world. As all that stimulus is winding back, other markets are not fairing so well. Per BofAML:

“the end of the excess liquidity regime in 2018 has been the main factor behind the grizzly bond, commodity & equity market returns this year" (with the very conspicuous exception of the US dollar, the NASDAQ & the S&P500)”

As you can see from the chart below, the MSCI World Index is down 14% since hitting highs in January (and the S&P500 only last week surpassed its January highs):

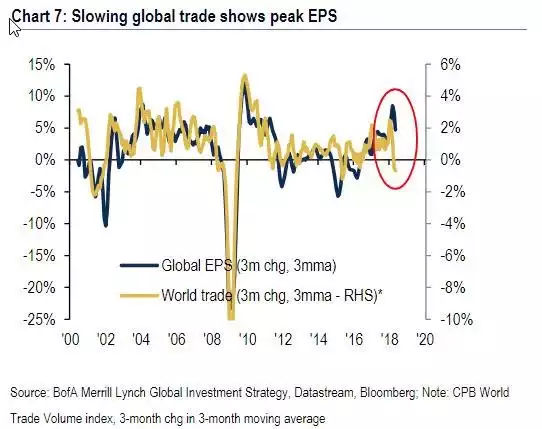

The chart below clearly shows this retreat from January highs has real roots with both earnings and trade on the decline:

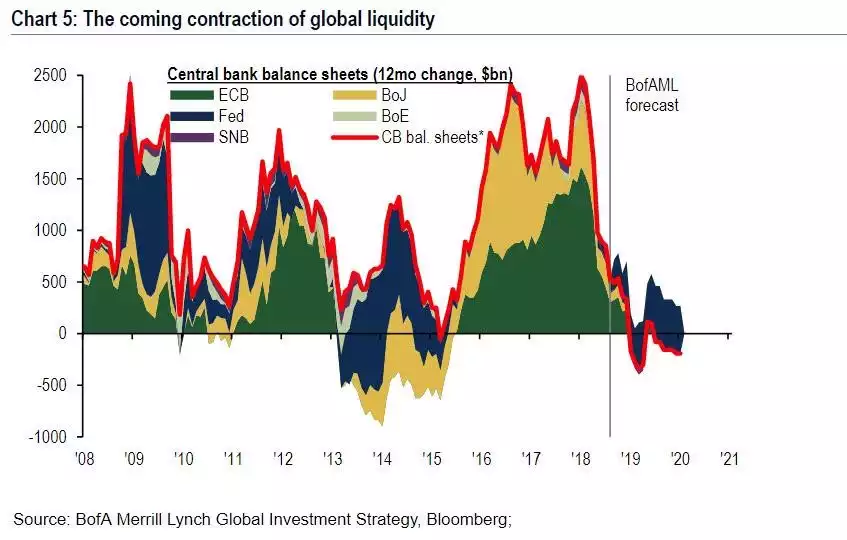

Going back to that earlier quote on all the central bank stimulus fuelling the bull market, we are reminded by BoFAML of what’s not only in play now, but how much further they see this QT or unwinding going:

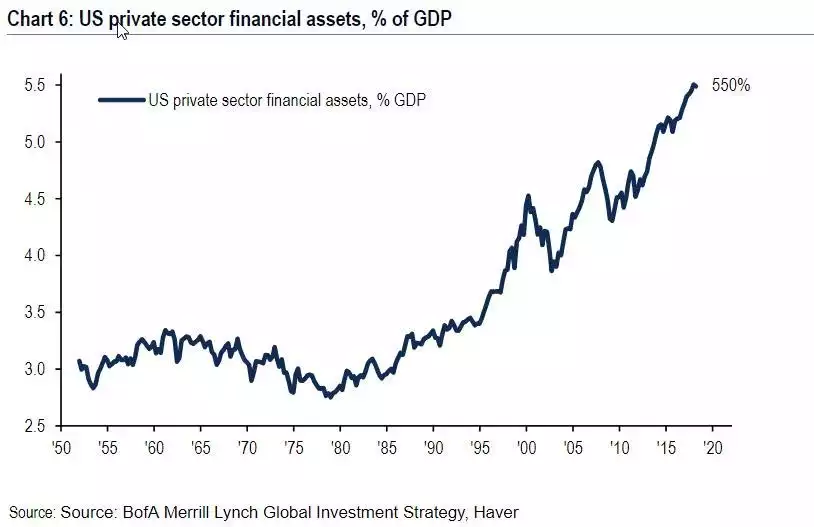

In the absence of outright Quantitative Easing, markets have still binged on cheap debt. Virtually everything in the US is riding on debt or ‘leverage’. From BofAML

“Share buybacks with borrowed money is leverage, private equity are leveraged equity portfolios, tax cuts financed with Treasuries is leverage, pension fund liabilities in excess of assets is leverage”

So where does this end?

"ultimately, the Fed will work out that a levered financial market and economy can't cope with higher rates and they will stop"

“Until the Fed blinks (likely December at the earliest) and until KOSPI [Korean sharemarket] & copper indicate that Chinese policy makers have eased big to stimulate Asian growth, we believe the double-whammy of Peak Profits & Peak Policy stimulus will overwhelm Bearish Positioning; we retain defensive, bearish recommendations.”

Meanwhile…

Yesterday we presented PIMCO’s call on buying gold because of rising inflation. The Fed may indeed ‘blink’ and lower, or at the very least hold, rates amid growing inflation because Wall Street deflation presents a bigger recession risk than ‘Main Street’ inflation. Should that happen the inflation Genie will then truly be out of the bag and we could well see the confluence of high inflation and financial market turmoil. That presents very strong tailwinds for the gold price.