PIMCO says Buy Gold Now

News

|

Posted 20/08/2018

|

10171

PIMCO is one of the world’s largest bond managers and investment services companies with over $2.2 trillion of assets under management. They made the headlines in Australia back in March when they cut their exposure to Australian bank debt, real estate and retailers bonds off the back of concerns around our ‘lofty valuations’.

PIMCO says Buy Gold Now

Late last week they issued their mid year investor update warning of inflation, market dispersion and recession risks at this stage in the cycle.

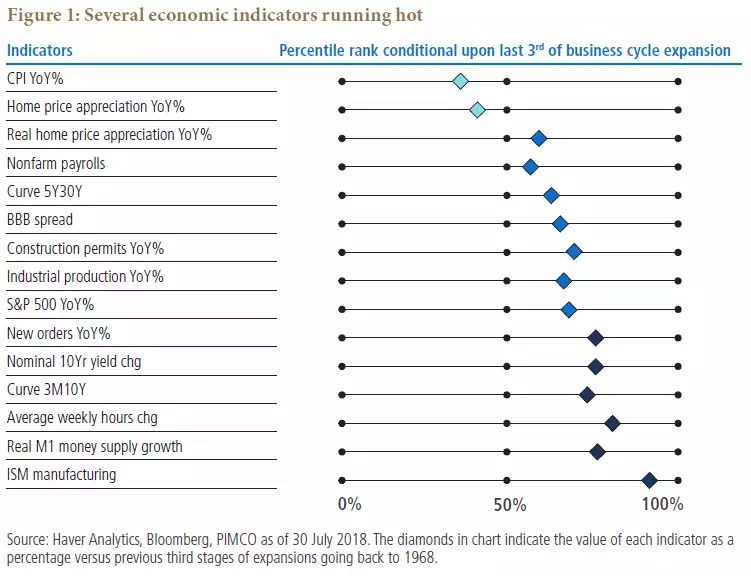

“There are ample signs of change in the wind for investors. The Federal Reserve is raising short-term interest rates, and U.S. inflation is at target for the first time since 2012. The global trade order that has existed for decades is being disrupted. Several economic indicators are running hot (see Figure 1) even as the current U.S. expansion has begun its tenth year. Volatility is higher as some investors price a dire outcome while others are more sanguine, creating relative value opportunities.”

As we discussed last week the market is currently very bullish and not concerned about inflation, hence shares are high and commodities low. To wit:

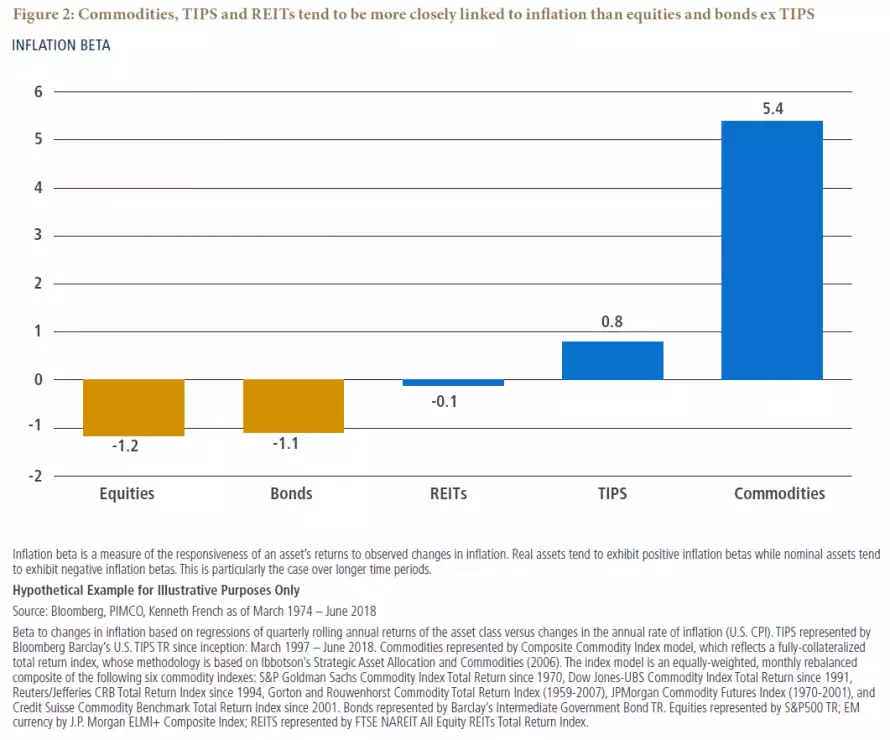

“We believe investors should understand the inflation sensitivity, or “inflation beta,” of their portfolios. Traditional stocks and bonds tend to respond negatively to inflation surprises (see Figure 2), while real assets not surprisingly tend to respond positively; investors should verify and be comfortable with the inflation betas of their portfolios”

They go on to outline key investment areas to look at now before this plays out including shorter-maturity bonds, gold, and large cap equities. On gold they say:

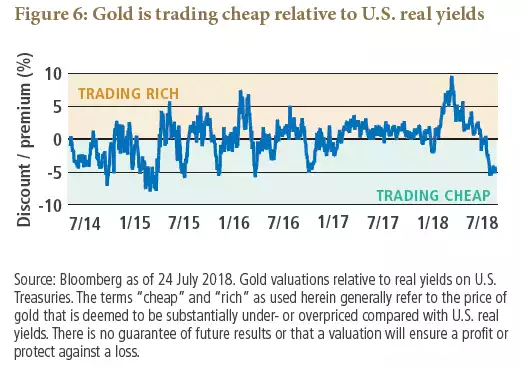

“Gold is a real asset that not only serves as a store of value but also a medium of exchange, and that tends to outperform in risk-off episodes. As such, one would expect gold to outperform during the recent period of rising inflation expectations along with rising recession risk. Yet counterintuitively it has been underperforming relative to its historical average (see Figure 6).”

In conclusion they say:

“Lofty valuations, an aging expansion and changing rules for global trade are leading to a tricky investment environment. While recession indicators are not flashing a red warning signal that a downturn is imminent, which would imply a retreat to a defensive position, they are flashing a yellow “caution” signal. This coupled with expectations for higher volatility suggest a regime of careful portfolio construction and opportunistic investments.”

History shows markets don’t usually give you a ‘warning’ when the red signal happens, it is often apparent only in expensive hindsight. Right now PIMCO have us on orange and one asset you want before red is currently ‘on sale’ as their Figure 6 so clearly show. The adage, ‘better a year too early than a day too late’ is always one to remember.

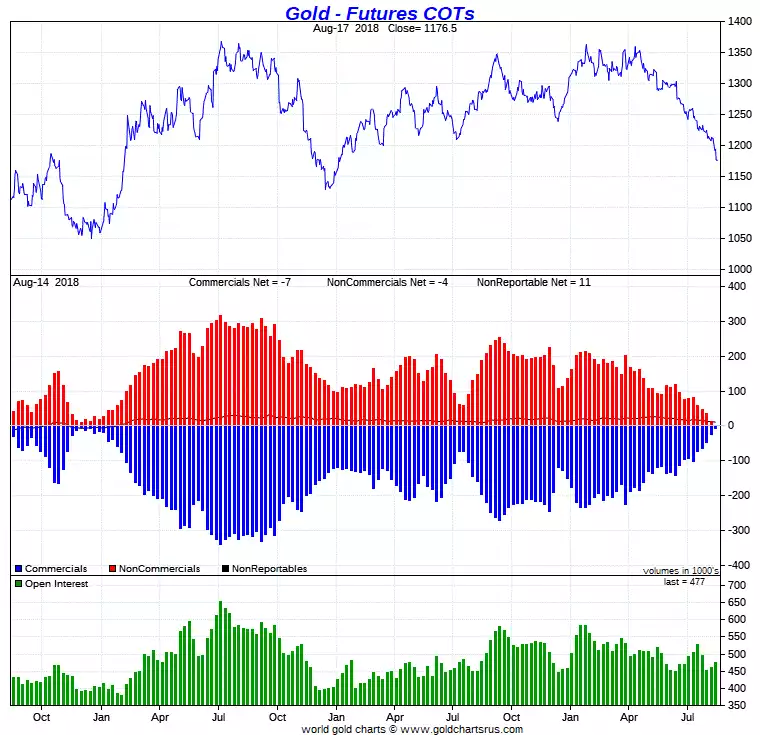

Further to our previous 2 Monday news articles the setup on COMEX this last week (and remember that data doesn’t include the big dump last Wednesday) just got even more bullish in that regard per below. Again, please just check for yourself the correlation with price rises after each such occurrence.