Central Banks Ramp Up Gold Buying

News

|

Posted 07/07/2021

|

5816

One of the key underpinnings of gold’s intrinsic value and safe haven proposition is that it is a mainstay of most central bank’s reserves. The irony is not lost but it is also telling that those ‘institutions’ that are debasing fiat currency at a record pace have also been net buyers of real money, gold, every year since the GFC after which the money printers really started up.

News broke yesterday of Russia announcing it was coming back into the ring with its finance ministry announcing it was buying $4b of gold this month. Russia set a record in 2018 buying 275 tonne of gold in one year and continued strongly in 2019 however then went quiet during 2020, most likely to keep funds free for COVID as many countries did. Indeed in Q3 of 2020, central banks became net sellers of gold as cash was needed during COVID. Irrespective they remained net buyers for the year, maintaining the uninterupted record since the GFC.

This comes off the back of the news this last week that Thailand bought a whopping 90 tonne in just the 2 months of April and May this year and is not disclosing whether it has finished buying. Not long before this, Hungary also announced it bought 63 tonne in March which in one move nearly triples its holdings to 94.5 tonne. Looking forward, Poland, who currently have over 140 tonne, has flagged it may buy at least 100 tonne more in the coming years and Serbia has been a quiet accumulator and the President recently announced they will be looking to add substantially more. Their National Serbian Bank summed it up nicely:

“Long term, gold is the most significant guardian and guarantor of protection against inflationary and other forms of financial risks”

Indeed the recovery from COVID with its effects still fresh in their minds is seeing renewed interest from central banks across the board. From Bloomberg:

“The recovery in global trade is bolstering the current accounts of emerging market nations, giving their central banks the option of buying more gold. Higher crude prices are also boosting bullion purchases by oil exporters, including Kazakhstan, according to James Steel, chief precious metals analyst at HSBC Holdings Plc. That’s likely to continue, he said.

“If a central bank is looking at diversifying, gold is a marvelous way of moving out of the dollar without selecting another currency,” he added.”

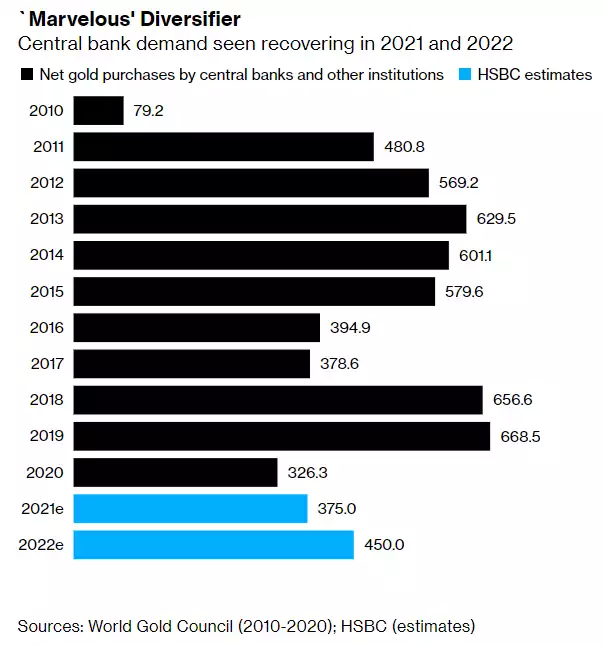

The above forecast from World Gold Council may well be conservative too:

“In a bullish scenario, as the global economy rebounds, central bank buying could reach about 1,000 tons, Aakash Doshi and other Citigroup Inc. analysts wrote in a report. The bank’s forecast is for purchases to climb to 500 tons in 2021 and 540 tons next year. That’s below the twin peaks above 600 tons in 2018 and 2019, but a significant advance on the 326.3 tons purchased last year, according to World Gold Council data.

About one in five central banks intend to increase their gold reserves over the next year, according to a survey by the WGC published last month.”

Notably absent from all of the above is the world’s biggest buyer of gold, China. However Lawrence Williams explains:

“there has always been doubt about China‘s gold purchasing activity and the true size of its total gold holding, which some suggest may be several times the amount it reports to the IMF. China has justified some lack of transparency in its gold holdings in the past by saying that some of its gold is held in accounts that do not have to be reported to the IMF - for example the Chinese military is believed to have substantial gold holdings as do the country’s state-owned banks.”

It is not a huge surprise that China would want to play its cards close to its chest as it starts to shirtfront the world across multiple fronts.

Standard Chartered Plc’s precious metals analyst Suki Cooper summarised the broader central bank situation exactly in line with our article earlier this week about the need for balance in an unbalanced world:

“Geopolitical tensions, the need for diversification and heightened uncertainty have continued to buoy interest in gold reserves”