“Unbalanced World” – What we mean

News

|

Posted 05/07/2021

|

7437

We often write at length about all manner of macro and micro influences on the global and local economy and precious metals. Experts, analysts and economists alike debate whether this or that factor will produce this or that outcome. It’s a complicated space and hence why ‘experts’ can have such divergent views. The inflation debate right now highlights exactly that. Accordingly our trademark is ‘Balance your wealth in an unbalanced world’. Don’t make one way bets thinking you somehow know more than the experts or that one of them is definitely right.

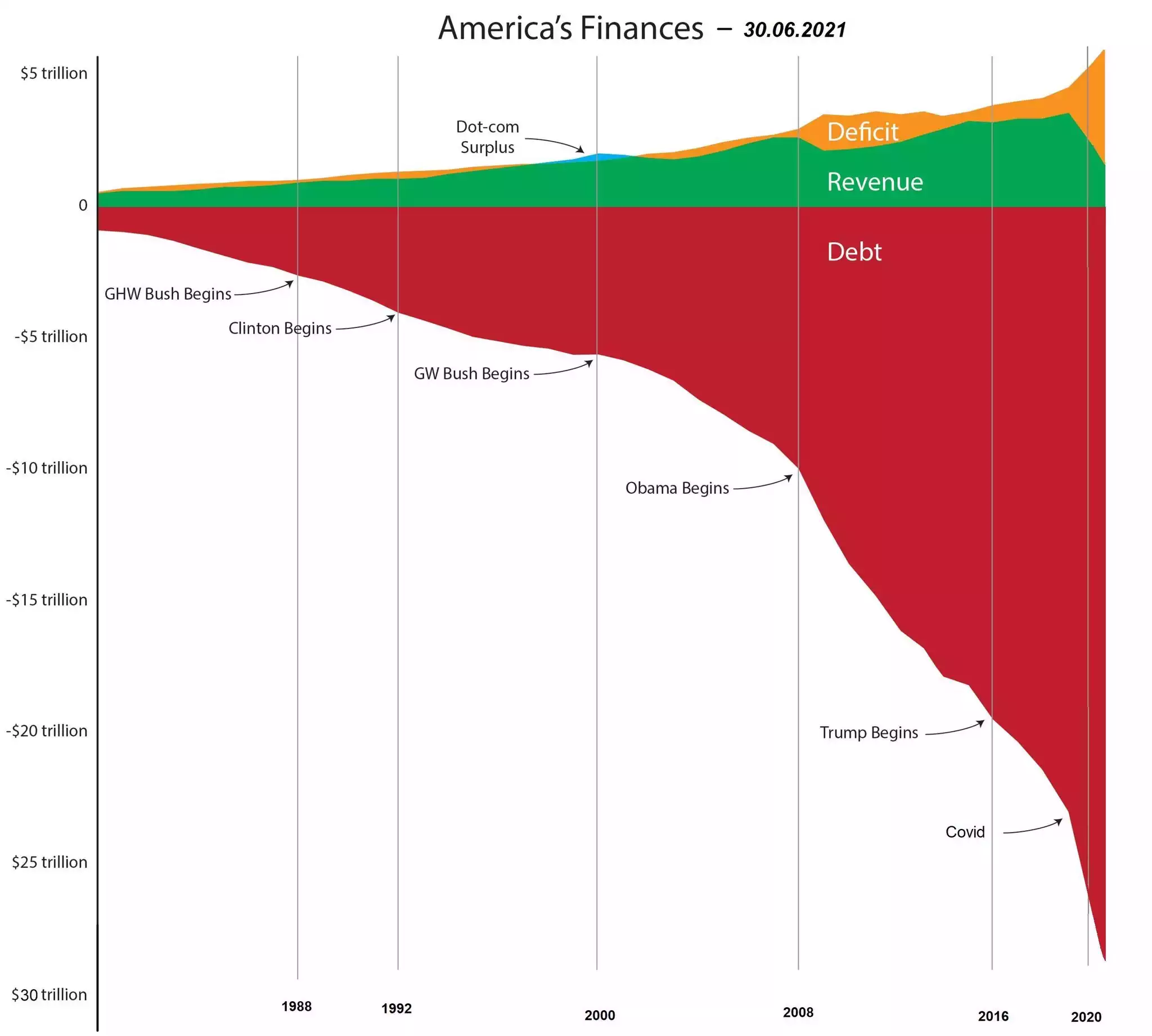

So rather than write again about the aforementioned ‘this or that’. Lets reinforce, simply, what we mean by unbalanced. Consider exhibit A below:

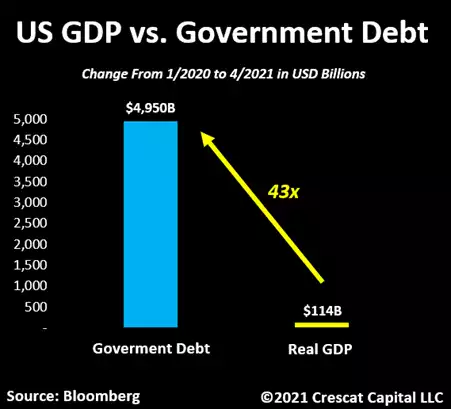

But what if that debt is ‘productive debt’ they say… Consider exhibit B below:

Whilst it doesn’t really need words, here’s what the author said:

“43 Units of Debt for 1 Unit of Real Economic Growth

The recent growth in US government debt relative to economic growth has been astonishing. To put this into perspective, since January 2020, real GDP grew by $114 billion. Meanwhile, during the same time, government debt increased 43x that amount. This was perhaps the most unproductive use of capital that we have seen in history.”

So again, we’re not going to write to this. Right now your ‘gut’ is telling you all you need to know. Sometimes common sense has a way of cutting through the noise.

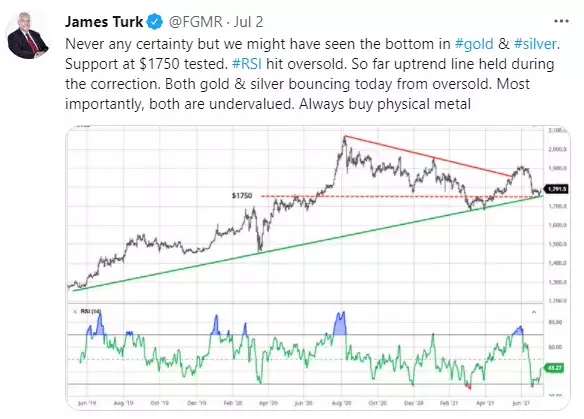

So how, in this set up, is the market for 2 of the best hedges against the inevitable outcome going? Over to none other than James Turk for his take on twitter on Friday:

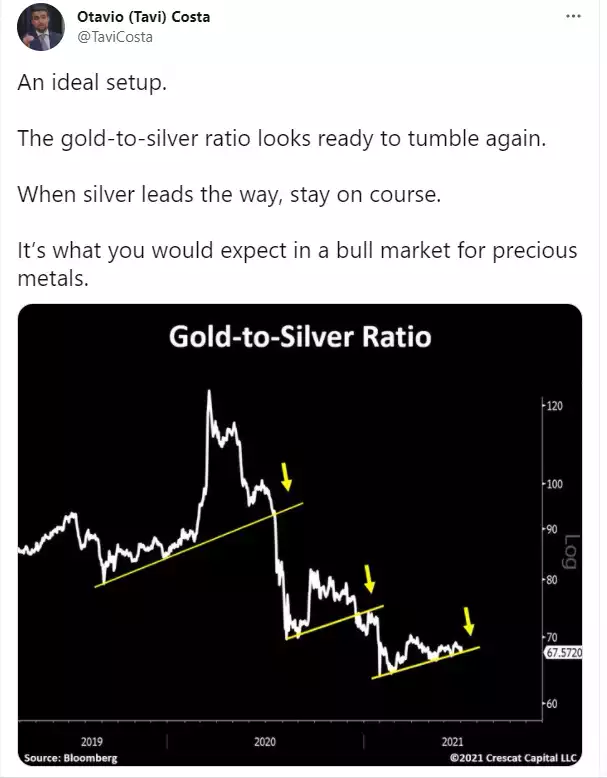

And Otavio Costaon that harbinger of precious metals moves.. the trusty GSR.