Brexit, EU Collapse and Gold

News

|

Posted 13/06/2016

|

6971

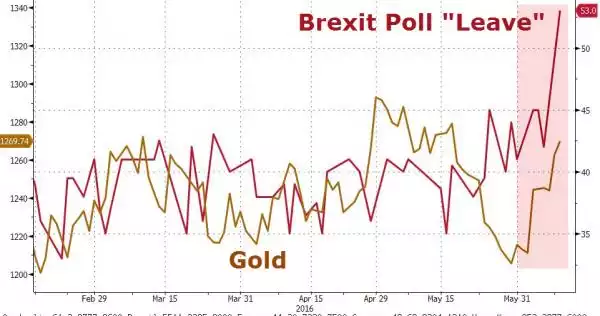

In 10 days the UK votes on staying in or leaving the EU. We reported on this earlier this month but things have escalated since. Polls appear to show a clear lead for the leave case (“Brexit”) and, given a lot of the sentiment driving it is immigration based, last night’s massacre in the US may well see a groundswell in that regard. However, it is not simply control on immigration that is driving the Brexit movement, but an exit from the very clear signs of financial and political distress in the EU experiment.

Staying in the EU sees the UK tied to a system where there are countries and major banks on the edge of financial collapse. This goes way beyond the basket case, but relatively small, and yet to be ‘fixed’ Greek problem. Italy, the 3rd biggest economy, has a major systemic financial problem being kept at bay by EU intervention; the European Central Bank (ECB), having bought huge swathes of sovereign debt to print money is now buying corporate debt at a staggering rate in their $1.2 trillion QE program; and European banks, across the board, are crashing, with the last 2 weeks seeing the biggest drop in European bank shares since the Euro crisis of 2012. There is also clear infighting with both the German Finance Minister and Europe’s biggest bank Deutsche Bank objecting to the extent of monetary stimulus from the ECB as it desperately tries to breathe life into a dying economy. This from Deutsche Bank late last week:

“ECB policy is threatening the European project as a whole for the sake of short-term financial stability,”

George Soros, who last week dramatically increased exposure of his $30 billion fund into gold had this to say:

“If Britain leaves, it could unleash a general exodus, and the disintegration of the European Union will become practically unavoidable,”

And it’s not just financial elites such as Soros. Retail demand for gold in London too has surged. According to the CEO of leading bullion dealer Sharps Pixley:

“It seems to have sunk into people’s consciousness that Brexit is a real possibility now. All stocks are being bought out in advance of even being shipped,”

As we discussed in Friday’s Weekly Wrap Podcast, it should be no surprise that some of the biggest backers of the “Bremain” camp are the big banks. They have a lot at stake. We often talk about a global financial system artificially inflated beyond fundamentals with debt accumulating monetary stimulus. It is a global financial house of cards. The EU, collectively, is the world’s 2rd biggest economy putting it at the bottom of that house of cards. You know what happens to the rest then….