Brexit Has Citi Say “Buy Gold”

News

|

Posted 01/06/2016

|

8099

Last night saw both the end of May and also market fears escalate over a “Brexit” with the latest polls showing more in favour of Britain leaving the EU than staying.

Brexit Has Citi Say “Buy Gold”

The news weighed down on shares and saw big falls last night before a late mini rally got the Dow just over April’s close to be just up for the month (but still down 0.5% on the night). Gold went up on the news. It was a month that saw sizeable corrections in both gold and silver, and more particularly the latter with silver seeing its worst month since September 2014, down 10.4%. As we reported yesterday a correction after such a rally was overdue and gold and silver are still up 15.7% and 16.5% respectively for the year, easily outperforming nearly any other asset class. Indeed Citi bank came out yesterday with a report predicting USD1,400 gold by year’s end. On the current exchange with AUD that is $1936 in Aussie dollars and if the AUD is down around 60c by year’s end as many predict, it would be $2,333. This is what Citi had to say:

“While prices have fallen 3% (month to date) in May, we believe this may in fact prove to be an opportune moment to ‘buy the dip,’”… “The risk of ‘Brexit’ is likely to complicate matters for U.S. policymakers, and we do not expect the Fed to move until after the June referendum,”

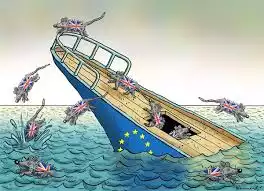

This makes a lot of sense as the Brexit is probably one of the bigger Black Swans circling our financial skies at the moment (add in Trump victory, post rate hike crash, Chinese Yuan devaluation or major shadow banking default, Euro banks, etc). That the major polls (2 overnight) have “Brexit” clearly in front of “Bremain” makes this look more and more likely. Importantly these are polls taken after the WTO said there would be no easy path for British trade with Europe should they exit. It would seem the British see the EU as the ticking time bomb it is and want out. As Citi suggest, now might be the opportune time to increase your weight in gold amongst all this uncertainty.