1.2 billion Reasons Africa May Drive Bitcoin Upwards

News

|

Posted 03/12/2019

|

10857

Jack Dorsey, the chief executive of both payments company Square and Twitter, has set his sights for the "future" of bitcoin and technology in Africa and its more than 1.2 billion people.

The potential and possibility of cryptocurrency and blockchain advancement in Africa appear to be maturing and evolving. The likes of the UN has even published pieces on how the continent is ripe to be the next frontier for digital currencies, but with individual interest now also piquing, things could be ready to advance.

2.5 billion around the world lack access to financial services, which deepens their poverty and prevents them from pursuing opportunities and growing their potential.

Greater access to financial services would allow people to build up credit, accumulate savings, access loans to expand business operations, purchase insurance to protect against crop loss, and more. Research has shown that access to a bank account improves a family’s ability to pay for education, health care, food, and more.

Further, inclusion in formal financial systems can allow people to receive better government services, and obtain payments for work more reliably.

The likes of Venezuela and Zimbabwe have demonstrated directly the huge uptake and protection Bitcoin can provide amongst a crashing local currency with its wealth protection role. Africa more broadly, along with India and China, potentially adds to this the medium of exchange benefits as well.

If interest and education around Bitcoin and Blockchain can continue to grow at a similar rate to the advancements of the space in Africa, there is significant potential that several vital issues dogging these lower GDP countries can be addressed.

Earlier this year, Dorsey started a crypto division of Square to fast track bringing simple cryptocurrency payments to the broad public and particularly break into the undeveloped world – where payments are not easy, corruption is high and there is little to no banking infrastructure in place.

Over the last two years, three of the top five countries searching Google for bitcoin have been in Africa. Developing regions and countries have long been expected to benefit the most from bitcoin, cryptocurrency and the underlying blockchain technology. In a corresponding way, many developing countries have leapfrogged developed ones when it comes to mobile payments, Dorsey thinks the same will occur with bitcoin and blockchain.

Major Bitcoin and cryptocurrency companies, from global exchanges Binance, Belfrics and Paxful, to crypto group Bancor, are also expanding into Africa.

And while interest in Bitcoin across China may be picking up again, as we discussed a few weeks ago, the last 12 months have been dominated by Africa when it comes to Bitcoin fever. According to Google Trends, Nigeria and South Africa take the number one, and two, spot for searching the term Bitcoin in the last year.

“Africa is not “getting big into” bitcoin—they have been using bitcoin for years and taught us everything we know about what bitcoin’s true use cases are,” Ray Youssef, CEO of peer-to-peer bitcoin marketplace Paxful.

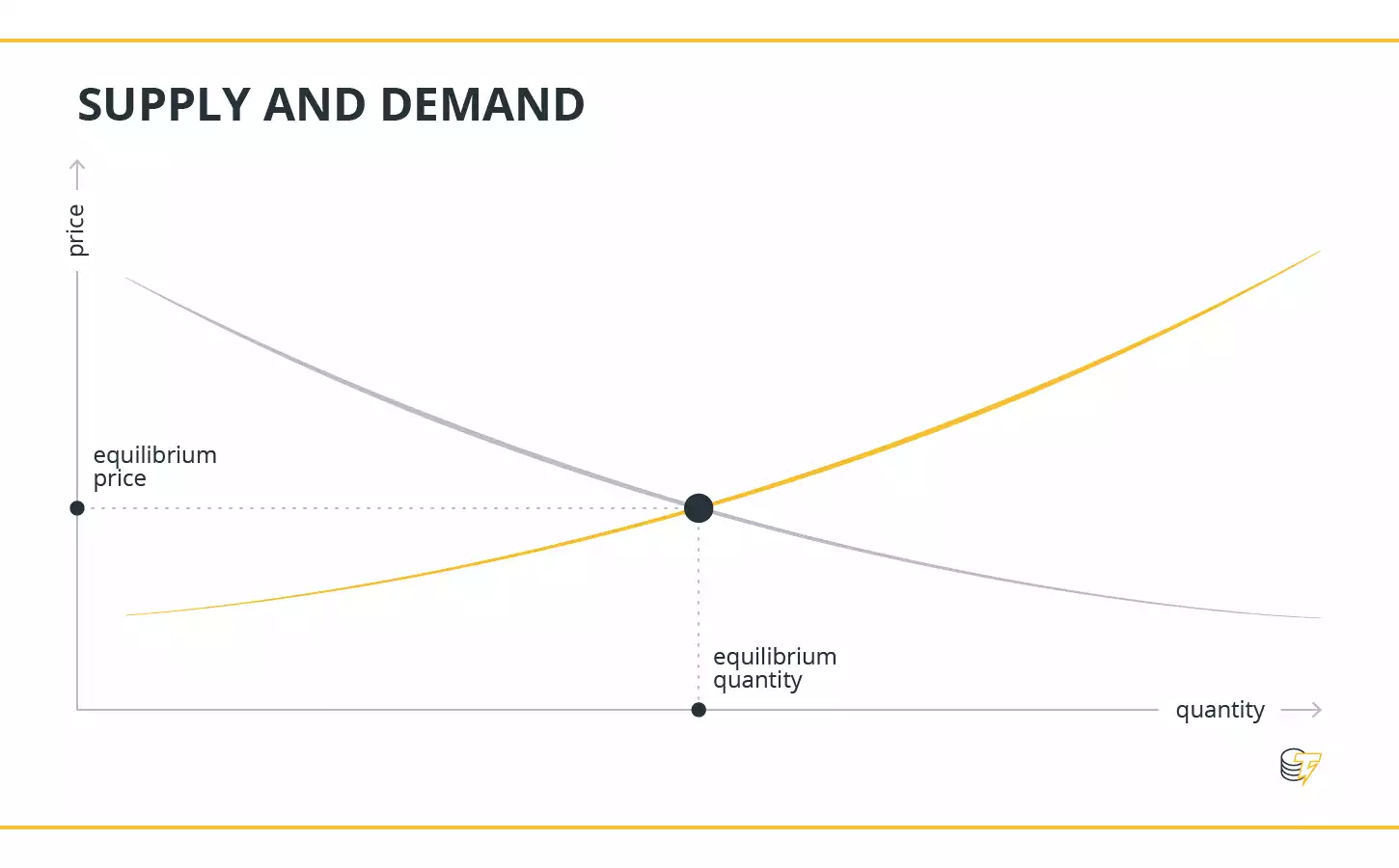

As we have discussed before, Bitcoin’s price heavily relies on sentiment and supply and demand. Not only is Bitcoin deflationary, a subject we have discussed previously here but on-ramps are always being combined to help increase demand. So, not only will there be a shift in the supply curve, but also a notable shift in the demand curve when projects like Jack Dorsey's crypto expansion in Africa come to fruition.