When halving means more

News

|

Posted 12/11/2019

|

19930

Unlike fiat currencies, which can be printed by central banks at will, the supply of bitcoin is limited algorithmically. There are only 21 million bitcoins which will ever be in existence. This, by definition, makes it a deflationary asset, as opposed to an inflationary one.

Every 10 minutes, a “block” of bitcoin transactions is solved by miners and added to the bitcoin blockchain. This is complicated and expensive work, demanding a lot of electricity and specialized hardware. So why would anyone do it in the first place? Because the algorithm rewards miners with new bitcoins, which are generated and added to the circulating supply every 10-20 minutes. This distribution of new BTC is known as the “block reward.”

When bitcoin first appeared in 2009, the block reward was 50 BTC. This means that every 10 minutes, somebody, somewhere, was getting 50 bitcoins delivered to their wallet. This was back in the days when BTC was worth pennies and you earn a block reward using only a laptop.

Currently, the block reward is only 12.5 BTC.

What happened? The block reward was cut in half — twice. This is a feature programmed into bitcoin and occurs every four years (210,000 blocks). Once that number is crossed, the block reward is cut in half. This process is predetermined and will continue until the last bitcoin is mined – expected sometime in the year 2140.

This process is referred to as a "halving," and it can have long-term effects on the price of BTC. It's expected to occur again in mid-May 2020, bring the block reward down to 6.25 bitcoin. You count down the days using this website https://www.bitcoinblockhalf.com/

The event is important for miners worldwide. With the reward being reduced, profitability will also be cut, at least in the short term, so old versions of specialized mining machines, known as ASICs, will stop bringing their owners any profit.

Streng, of Genesis Mining, says less hardware in circulation will serve the industry well in the long run. “We are going towards a really heavy industry with much longer life-cycles of the machines.”

“It’s a very brutal event. Most inefficient miners will be wiped out. But it’s driving the innovation,”

“It’s a psychological event, and there is a tendency for the price to increase. From my experience, a lot of miners are expecting the price to go up, so they reduce selling and weaken the selling pressure of the market.”

“The market is moving towards the industrial mining, and there won’t be hype like it used to be anymore. There are significantly less crypto enthusiasts on the market now.”

After the next halving, only half as many BTC will be generated per day by miners. (roughly 4,380 US x 6.25 x 5,000 = $136,875,000 US per month). When this occurs, one of two things will happen: Miners will simply give up, or they will refuse to sell bitcoins generated at a price below $10,000 US, giving the market a solid price floor.

What do the inflation rate and circulation supply have to do with Bitcoin's performance?

The block reward halving tends to have long-term positive effects on the price of bitcoin. Why does this happen? There are a lot of theories, the most common one comes down to simple supply and demand: If fewer bitcoins are being generated, the newly increased scarcity automatically makes them more valuable.

Economics 101 – When the supply curve is shifted left, equilibrium price will increase…

Let’s see this occurring in the past…

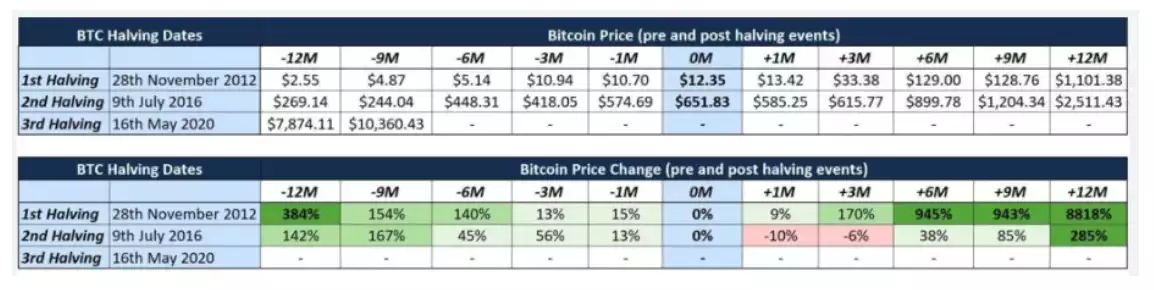

The first halving occurred in November 2012, when 1 BTC went for around USD 11. The following year, the price began to climb dramatically, reaching a new all-time high of over USD 1,100 in 2013. The price then crashed down to the $220-$240 range, where it would remain for the next few years.

The next halving occurred on July 9, 2016. BTC stayed in the $580-700 range for several months before slowly rising toward the end of the year.

The pre-and-post price performance of Bitcoin has been the most bullish during the 6-12-month period preceding the halving dates and the 6-12-month period after the halving dates. If we assume that history will repeat itself again, the price of Bitcoin over the next year and a half is very likely to be much higher than it is today – and that may at the very least help to dispel some of the bearish bias surrounding Bitcoin at the moment.

The rates of increase of the price from one halving to the next along with the dates of the halving are given below:

The biggest changes in the crypto ecosystem this time around will be the higher public awareness around bitcoin and the interest of institutional investors. If financial institutions begin taking big positions, it could affect bitcoin in ways investors have never seen before.

Regardless, the main takeaway from today's history lesson is this: There is a clear correlation between bitcoin reward halving and price volatility afterwards.