Why Silver is Falling & China’s Credit Crisis

News

|

Posted 05/05/2017

|

9681

Industrial commodities continued their week long rout last night taking silver down with them. Adding to the pressure on silver is that the ‘managed money’ speculators on COMEX have never been so long silver…ever. When silver gets sucked down in a combination of the same ‘everything’s awesome’ dynamic as gold together with the commodities sell off, that puts a lot of pressure on those long positions and we have likely seen a big capitulation by these speculators on COMEX adding to the falls. A gold silver ratio of 75 says everything.

So why the crash in commodities? China.

China’s leadership has made repeated statements they want to reign in their shadow banking system including them constantly bailing it out. If you missed it you should read our recent post on this topic here.

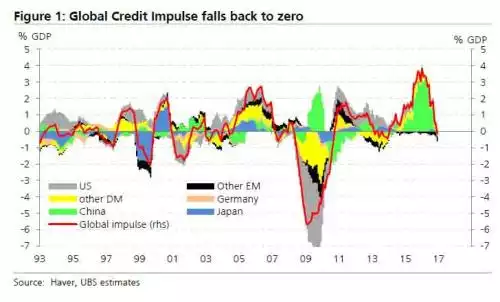

The last couple of days has seen the likes PIMCO, UBS and Hayman Capital’s Kyle Bass warn that the current tightening and liquidity squeeze in China is being dangerously overlooked by financial markets. PIMCO is warning to “brace for lower growth” and UBS warns their “global credit impulse (covering 77% of global GDP) has suddenly collapsed”. The global credit impulse measures the change in the change in credit. Why is it collapsing? China.

You can see last time it dipped into the negative in 2014 China (light green) came along with $trillions in credit creation to save the day. (A note for Aussies - look at the green spike during the GFC too…. That is why we didn’t really have a recession in the GFC… China bailed us out with a debt based commodities boom. Note too that ore is being particularly smashed in this rout and that is not good for us at all, just one week before the budget…).

Kyle Bass, in an interview with Bloomberg this week, is warning of a full blown credit crisis in China as their credit system grew "too recklessly and too quickly," and "it's beginning to unravel,". To put the shadow banking system into context he compares it to the subprime mortgage system that created the GFC. The mismatch of assets to liabilities at the peak of the subprime phenomenon was around 2%. China’s current mismatch with the unregulated shadow banking / wealth management products (WMPs) phenomenon is over 10%.

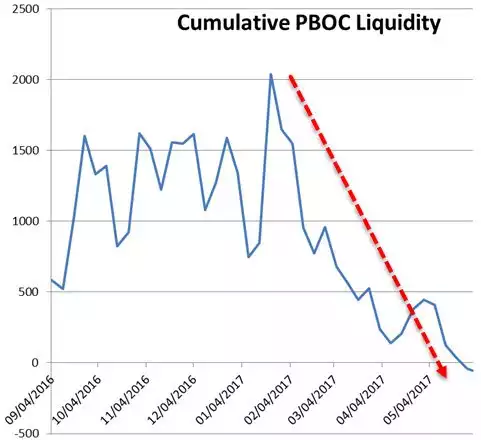

Bass says the warning signs are clearly already there evidenced by the interbank loan rates spiking severely and erratically. This is a clear sign of liquidity getting desperate when interbank lending becomes a source of liquidity but with spiking cost reflecting high risk / distrust.

Less liquidity from PBOC

Desperate spikes in interbank liquidity

From Bass :

"What you see when the liquidity dries up is people start going down... and this is the beginning of the Chinese credit crisis."

Bass is at length to say he has no idea how quickly this will play out. He points out that the first signs of the subprime GFC crisis were in early 2007 and that didn’t really play out until mid 2008.

His live interview on Bloomberg is definitely worth watching. Its only 10 minutes long but he explains it all very well. Click HERE for the link.

Silver has two masters, it is half industrial metal and half monetary precious metal. At the moment it appears it is getting stung by both as we explained above. Should a credit crisis occur the historic rush to safe havens would most likely see gold and silver rise together. The current set up just means it’s on sale beforehand…