“Dangerously Dumb” – Deloitte Warns

News

|

Posted 13/04/2017

|

11409

Last night saw gold and silver surge yet again and shares continue to fall. But of particular note for Australia is the precipitous drop of iron ore, down 8.5% last night, extending the 28% drop since it peaked on 21 Feb and ahead of predictions of another 20% drop to come. Why? More concern about China’s growth.

In one of the harshest warnings from a top tier accounting firm in some time yesterday the Australian Financial Review reported on Deloitte Access Economics’ Chris Richardson:

“Recession will be unavoidable if China stumbles because Australian households are being crushed by the world's second-largest debt burden and "dangerously dumb" property prices that are more overvalued than at any time since at least the early 1980s”

“Reasons for the near inevitability of recession if there were to be a crisis in Australia's largest trading partner includes already ultra-low official interest rates, an already low dollar, a wide budget deficit and large debt load, and rampant household growth that has left households vulnerable to any jump in unemployment, he suggests. [throw in sliding ore prices…]

"Australian families have borrowed up a storm since the GFC, while housing prices in this nation are now dangerously dumb," Mr Richardson will say in his address [to the National Press Club yesterday].

Deloitte estimates that house prices are now about 30 per cent overvalued when compared to national income - the widest gap in its data since the early 1980s.”

The AFR article doesn’t really go into what that China ‘stumble’ or ‘crisis’ looks like so let’s look at one aspect of that…

Bloomberg reported yet another warning earlier this week about the gargantuan shadow banking system. That non regulated banking system is now $9 trillion in size and “fast approaching” 100% of GDP. Much of that shadow banking system is through so called WMP’s or Wealth Management Products. At the moment, despite the numbers, there is investor comfort being taken that China’s central bank (PBOC) will always step in, bailing out these entities. This PBOC liquidity support for their banking system has seen an exponential increase over the last 18 months and investors think they will never let something ‘too big to fail’ do exactly that. But PBOC are grappling with the so called ‘moral hazard’ where such unfettered belief leads to a system taking on too much risk with reckless abandon. PBOC know this and according to Bloomberg:

“Intervention is becoming less likely, if the new draft rules are anything to go by. Regulators are working on language that would make clear there are no state guarantees on asset-management products -- which include WMPs, trusts, mutual funds and other products -- people familiar with the matter said in February.”

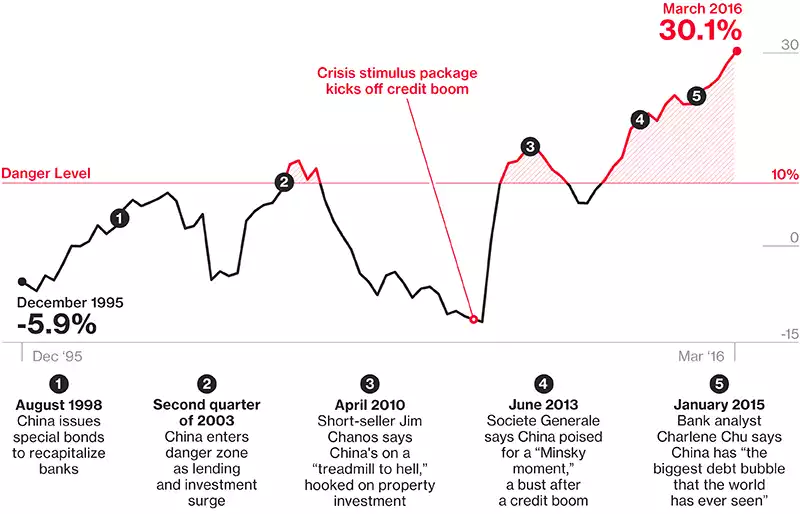

In a separate article late last year Bloomberg produced the following chart that in the context of the above should make people sit up and listen to Mr Richardson and rather than continue to be ‘dangerously dumb’ start be prudently balanced….

If you missed it, our article “Is China About to Crash Financial Markets Again?” is worth revisiting.