Why Gold Rises with Tightening

News

|

Posted 21/01/2022

|

10863

Few investors realise that central banks are nearly always too late to raise rates and tighten financial conditions. For that reason, gold has a history of rising on increased rates not the seemingly intuitive reverse of that. Yesterday we saw spectacular jobs figures for Australia which, when combined with high inflation, effectively force the RBA’s hand to raise rates. However, those reading this as the signal to buy equities and property because ‘everything is awesome’ may be sorely disappointed. Such record low unemployment figures (albeit measured before the impacts of Omicron), normally come at the end of economic cycles not the start.

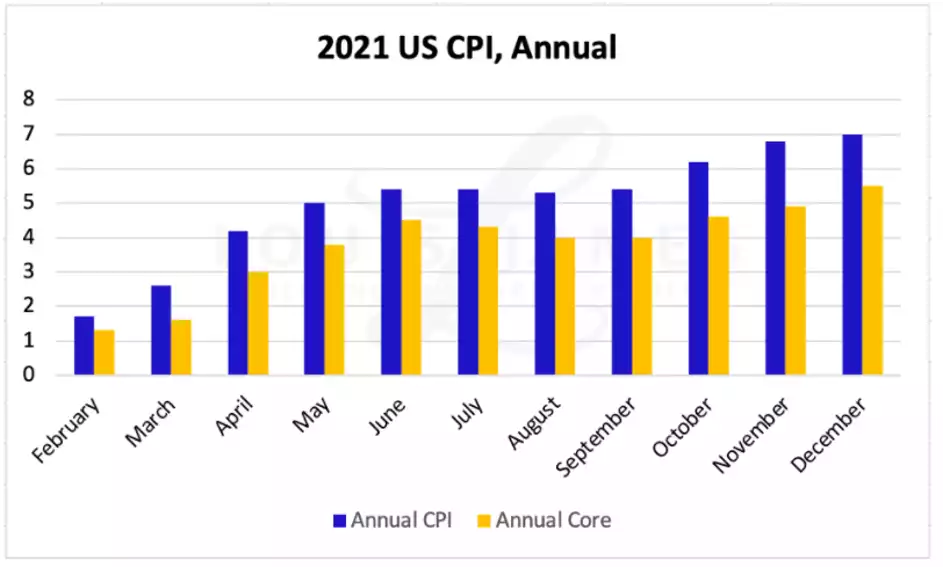

The same is the case in the US where a chorus of Wall Street Banks are ringing the top of the market by calling rate hikes and balance sheet reduction in 2022. Late last week, JP Morgan’s Jamie Dimon called for 6-7 rate hikes (1.5%-1.75%) by the end of the year, as he expects the 7% inflation of 2021 to carry into 2022. With retail sales down on higher inflation and cost of living pressures, this year is shaping up as the first year of stagflation since the early 80s.

The JP Morgan CEO is tipping persistently high inflation to force the Fed’s hand in raising its benchmark interest rate. With a 0.5% increase in the CPI in December, 2021 saw the highest annual inflation in four decades at 7%.

Going back to the last time we were above 7%, we find ourselves in 1981, when the Federal Funds Rate averaged 12%. Jamie Dimon is far from the world's best market predictor after famously tipping Bitcoin as a fraud and going to zero in 2018. However, as a consummate Wall Street insider, his voice echoes a number of Fed governors signalling higher borrowing costs are in the works. He tempered market reactions however by arguing that it would be a mistake to assume that indices and the broader economy couldn’t grow through a period of higher rates. Even if there were seven rate hikes the effective rate would still only sit at 2% for borrowers.

Deutsche Bank see four rate hikes in the tea-leaves, but also predicted a $3tn reduction in the Fed’s Balance Sheet from $9tn of treasuries and Mortgage Backed Securities down to 6tn. The Fed themselves have subsequently confirmed as much without quantifying it. As covered in last week’s news, if the Central Bank is the only major purchaser willing to lock in negative real returns, then what’s going to happen when they start selling? Quantitative Easing is earmarked to run its course in March ‘22, at which point the Fed’s balance will start falling from 35% of GDP where it currently sits, down to 20%. Goldman Sachs has also called for four rate rises.

Chief Investment Strategist at Bank of America, Michael Harnett, has warned that global markets are on edge, with a ‘rate shock’ in 2022 bringing on a very ugly turn of events for equity markets. Hartnett argues that global investors’ faith in the US Dollar denominated bonds is fading fast and the next decade is likely to see commodities and ironically cash outperform stocks and bonds. To restore faith in bonds in the midst of rising inflation, rates would have to lift significantly, but that would cause stocks to pop. 2022 may well be the year when the Fed can nurse the bubbles no more.

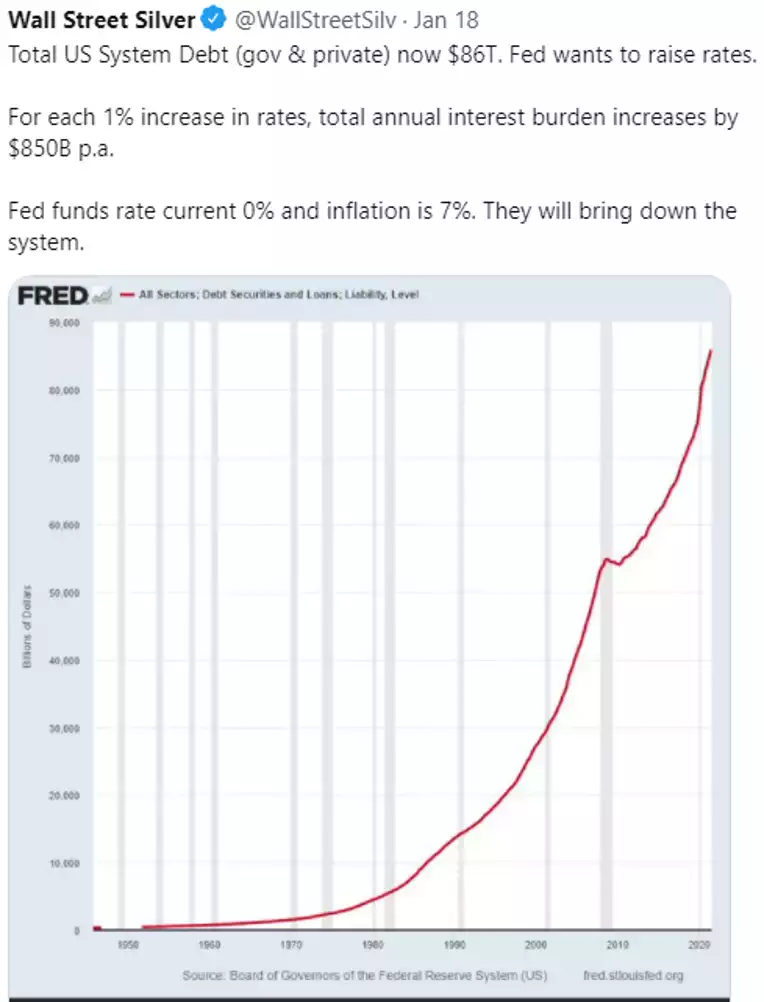

Hayman Capital Management fund manager Kyle Bass has argued that “The Fed can’t raise rates more than a 100-125bps before they have to stop.” It’s well known that the Fed are only willing to reduce their balance sheet, raise rates, or even taper purchases so long as the major names on Wall Street maintain their valuations. At first sign of danger, they reverse course and juice the markets again with loose policy.

Topically, this is a good observation on what that 100bps (1%) looks like in effect:

This may well be the year that the gold fear trade heats up and Main Street investors start to recognise the real deterioration. The majority of investors still perceive inflation to be transitory while enjoying the wealth effects of higher share portfolio valuations and real estate values. Others still see supply chain shortages purely as a covid phenomenon, which will pass with Omicron.

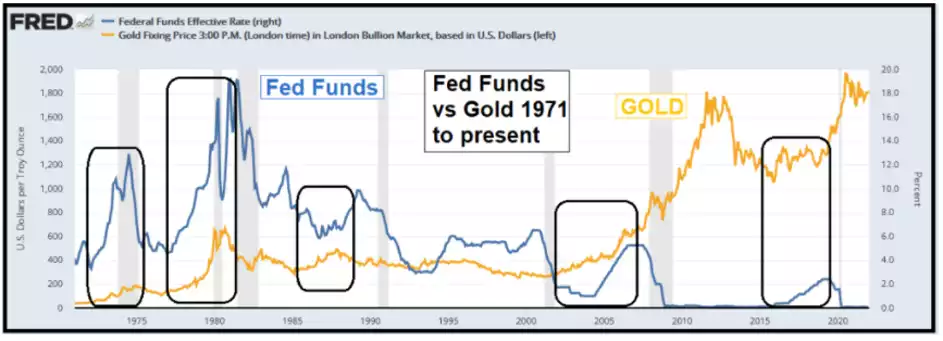

Ultimately, when the dollar drops, precious metals on the other side of the trading pair, Gold/USD, go up almost by definition. By the same logic, everything else should go up too, and it has been. The issue is that the fundamentals of most asset classes have been hollowed out and are only propped up by cheap liquidity, whereas precious metals haven’t had their inflation run yet. Investors expecting gold to sell off when interest rates go up would be surprised by the following chart from Dave Kranzler that shows how gold typically takes off when rates ratchet up and then continue to follow through even after they are brought back down again.

Another way of interpreting the cycles is that the Fed only raises rates when the economy is already faltering. Through these periods, generalists moving into gold are expecting the Fed to need to curtail hikes and loosen even more to restimulate an economy/stock market on life support.

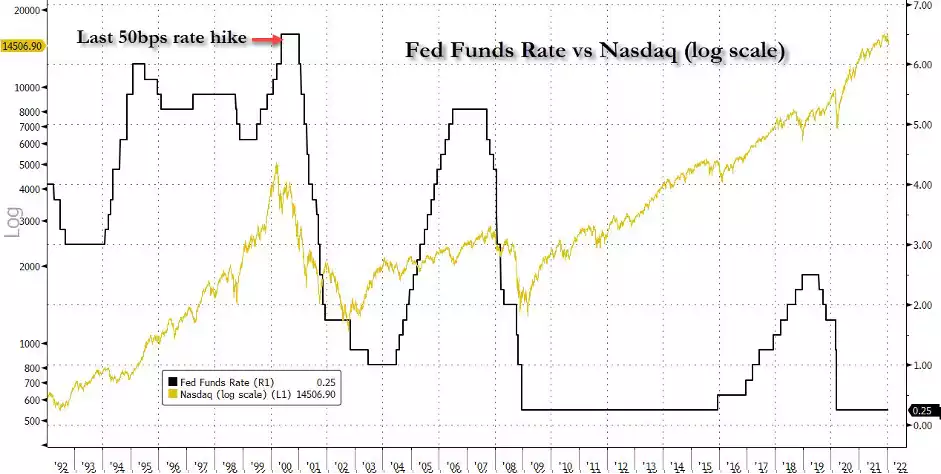

This week has seen the escalation of expectations that the Fed may even start with a 50bps (0.5%) hike not 25bps. The last time they did that was May 2000 and it burst the dot.com bubble. As you can see below it took the NASDAQ 14 years to recover…

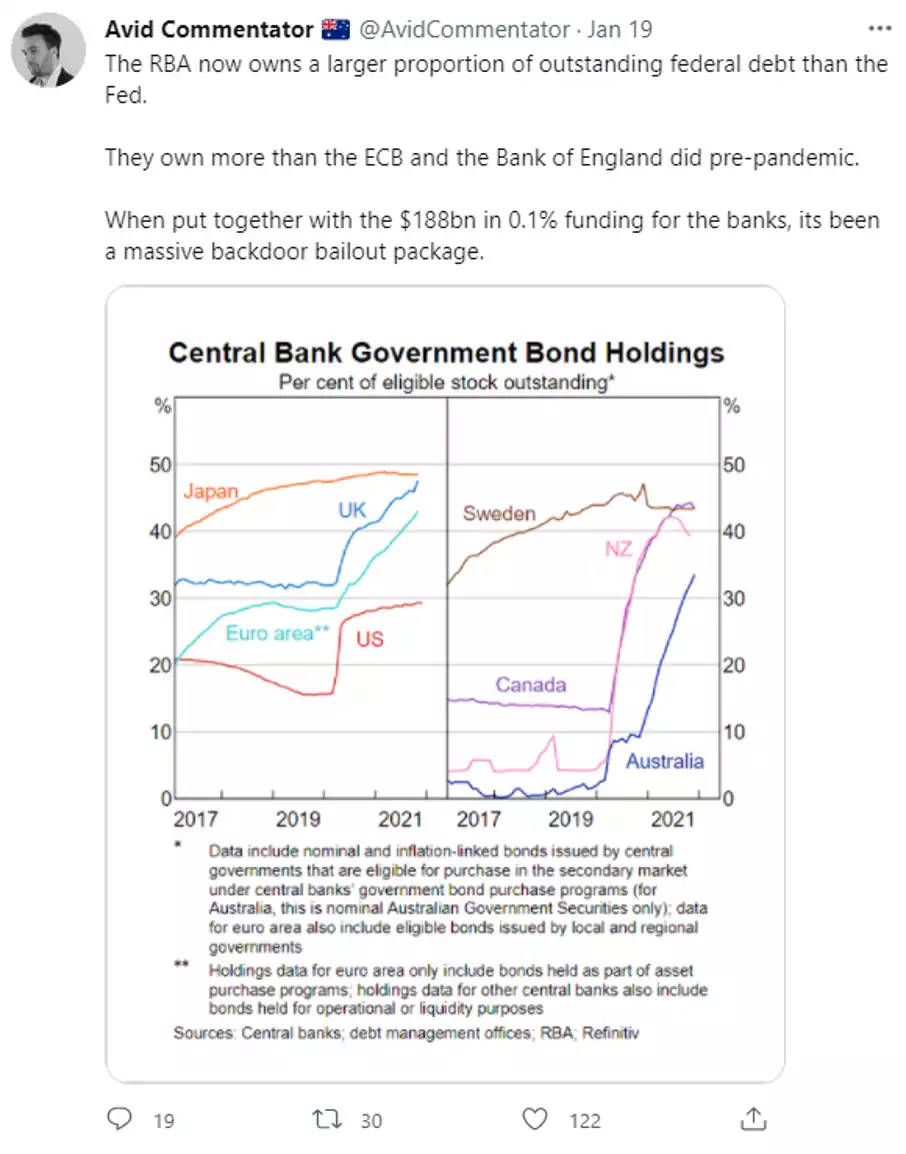

And again, this is NOT just a US-only problem. Regardless of the ‘US sneezes we catch the cold’ truism, we are in the same boat and few realise the extent to which the government has been bailing out our economy. This poses the same question of what happens when the juice is removed?

When the penny drops that negative real rates are here to stay and that fiat currencies will continue to expand full steam ahead, a precious metals revaluation is the logical trade. The recent rally by both gold and silver over the last few days may just be the beginning of a long overdue breakout. If you missed this technical chart for gold it is worth revisiting…