Where’s the silver gone?

News

|

Posted 29/08/2014

|

6497

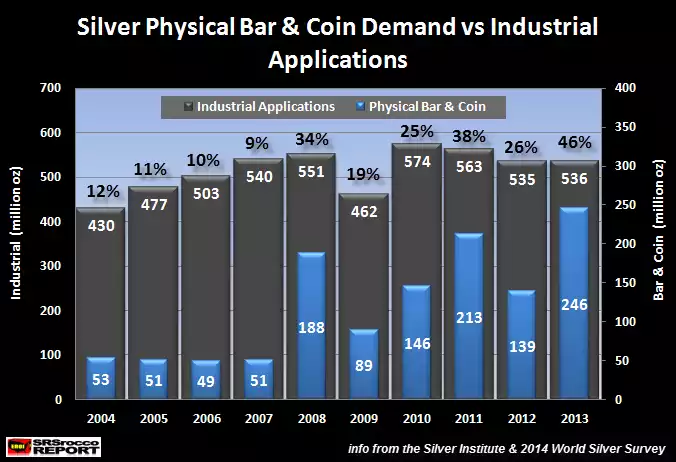

We reported previously on the 90% decline in silver holdings in the worlds largest physical silver exchange, the Shanghai Futures Exchange, on July numbers since the April 2013 price route. Well the first 3 weeks of August have seen another (incredible) 29% reduction taking the total holdings to just 103t! The graph below shows a number of things. Firstly the 2013 numbers explain where a lot of that missing silver has gone… investors snavelling silver up whilst it was “on sale”. Secondly, have a look at what happened in 2008 when the world economic system collapsed and people fled to the safe haven, and again in 2011 when we saw a supply squeeze. When you consider we are getting very close to another GFC (with many saying this one will make 2008 look like a picnic) and the SFE barometer of supply indicating another supply squeeze we may be set up for a new record in investor demand and this time with limited supply, associated price rises.