Shanghai Silver v COMEX

News

|

Posted 05/08/2014

|

7015

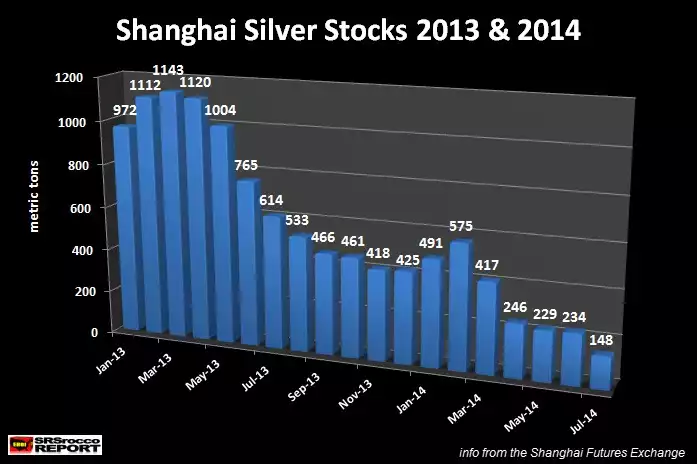

As we’ve seen in gold there is an interesting development in silver trading as well where the largely ‘paper/cash’ traded COMEX futures, which incredibly inform a lot of the pricing we see, is being overtaken by the Shanghai Futures Exchange which sees most trades settled in real metal not cash. So at a time where the big commercial (JP Morgan et al) traders are massively ‘short’ silver on COMEX, the inventories in the Shanghai Futures Exchange are running low…. two very different tales and only one ‘real’. The ‘East’ is taking more and more control of precious metals and that is a good thing for those who hold physical metals. SRSrocco reported recently that trading volume on the Shanghai Futures Exchange and Shanghai Gold Exchange are nearly 3 times higher than the volume at the COMEX. If you were holding a heap of paper short contracts on COMEX, you’d surely be getting pretty nervous looking at the graph below, especially in a world in economic and geopolitical turmoil.