When Central Banks Turn Off the Tap

News

|

Posted 19/06/2017

|

8766

It is widely acknowledged that today’s “everything bubble” is largely courtesy of the unprecedented amount of central bank stimulus deployed since the GFC. We are just 2 months away from the 10 year anniversary of the onset of the GFC. 10 years of printed money buying up financial assets around the world and near (or below) zero interest rates forcing people into yielding shares and property.

Just last week we wrote of the turn, or reduction, in corporate loans whilst central banks had printed more money than ever. That turn normally precedes a recession, but what if the central banks’ monetisation programs outweighed it? Well too bad… they (ECB and BoJ) are now announcing a reduction of their QE programs (including large amounts of shares) and the Fed last week stated it will start to reduce its holdings of bonds that it bought with its QE programs. So to be clear, we now have both corporate credit rolling over and the world’s central banks about to do the equivalent.

Citibank’s market strategist Matt King had this to say:

“As we’ve noted in the past, in recent years asset price moves have displayed a high degree of correlation with central bank liquidity additions. Central bank buying has reduced the net amount of securities (in DM) the market needs to absorb, both this year and last, to near zero; we think this has played a critical role in propping up valuations at elevated levels.

Next year looks very different. We project that the private sector will have to absorb c.$1tn of securities – the highest number since 2012. The main driver for this is our anticipated reduction in ECB purchases from €780bn this year to €150bn in 2018. The faster pace of Fed balance sheet reduction we can now expect cements our impression that next year will see a big shift away from the current status quo. Assuming that Fed balance sheet reduction begins in September, the US market will have to absorb a further $450bn of supply in addition to the gap left by the ECB.”

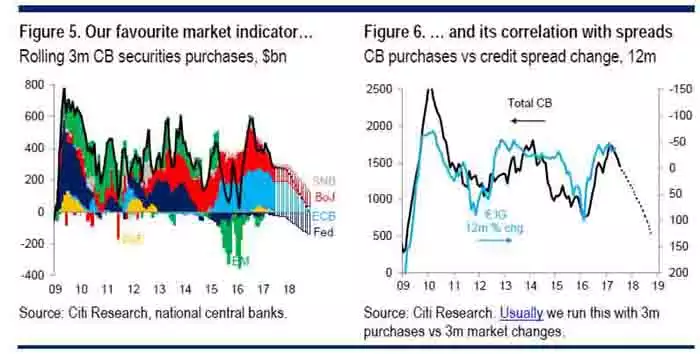

Citi then produces the following charts illustrating the trajectory:

We explained yield spreads on bonds last week. The above is similar in that it is the spread between government bonds and higher risk non government bonds. Just check out the correlation!

This is a GLOBAL market built on credit, either corporate or central bank. That it looks now like this may be coming to an end is the ultimate test for the financial market bulls. After the Fed’s rate hike and announcement of starting to unwind its QE purchases last week Citi’s Mr King had this to say:

“…the Fed’s hawkishness this week to our minds adds to the likelihood that in markets a significant un-balancing (or perhaps that should be re-balancing?) is coming.”

The first half of this year saw the greatest amount of money injected into the global system by central banks ever. The second half is to see this reversed.

Mr King talks of balance above. Is your portfolio sufficiently balanced to weather the storm?