Central Banks v 4 Week Timeclock

News

|

Posted 12/06/2017

|

8247

Friday saw another US hard data miss with Wholesale Inventories falling the most since March 2013 and so ensued the usual GDP estimate downgrades from various economists. Yet another hit to the ‘everything’s awesome’ narrative before this week’s Fed meeting. However the markets are convinced we will see another 0.25% hike this Wednesday. Again we remind you of the history of recessions triggered by the Fed raising rates into weakness.

We also recently reported (here and here) on the recession predicting track record of declining commercial and industrial lending. This shouldn’t be a surprise to anyone, but of course it is every time for the sheeple, because if growth is based purely on more debt and that debt turns down… guess what happens?

Zooming in on the present set up and you can see the precipitous nature of the current decline:

The authors of this chart, ZeroHedge, calculate that at the current rate of decline “the US will post its first negative loan growth, or rather loan contraction since the financial crisis, in roughly 4 to 6 weeks.”

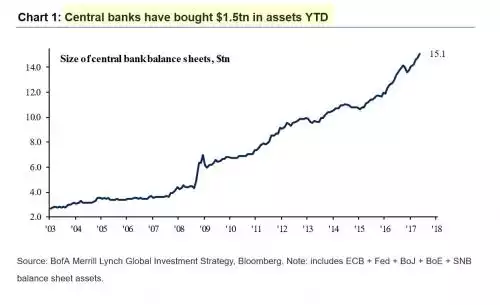

Whilst US corporates are deleveraging the increasingly desperate central banks are printing more money than ever. We mentioned last week central banks had bought $1 trillion of financial assets using freshly ‘printed’ money in just the first 4 months of this year. Bank of America Merrill Lynch just updated that to a record breaking $1.5 trillion year to date! Whilst everyone was fixated on the (at the time) incredible $4.5 trillion QE program by the US Fed, since then Japan and Europe have dwarfed it. And that, importantly, is not counting the opaque but clearly evident and massive efforts of the Chinese. When the US finished QE3 in 2014 the total stood at close to $10 trillion. It’s now at $15.1 trillion just 2.5 years later (and again we stress, excluding PBoC).

To put this into historic context for you: In the US, it took 90 years from 1918 to 2007 to reach $800b ($0.8t). The US Fed then printed about the same in each and every year after the GFC to take it to $4.5 trillion.

This is desperation of an epic scale to fight off the bursting of the very bubble they created. Refer back to the first graph above….