Wall Street Hammered – Gold Strong

News

|

Posted 11/10/2018

|

7647

On its 5th consecutive day of losses, Wall Street upped the ante last night with an 832 drop in the Dow (3.2%), 95 drop in the S&P500 (3.3%), and the NASDAQ had its worst day since Brexit, down 316 (4.1%). The volatility index (VIX) not surprisingly spiked up to 22. Technical levels were broken everywhere with the Dow below its 50 DMA, S&P500 below its 100 DMA, and NASDAQ plummeting below its 200 DMA. In just last night’s session alone, more than half of the entire year’s gains were wiped out.

You may have seen all this on the news. What you probably haven’t is what has happened since… At the time of writing the losses have extended in the futures markets with the Dow now down over 1000 points and NASDAQ extending out to 5% down.

Much of the commentary is blaming escalating trade war tensions which we discussed yesterday. But rest assured everyone, Trump assures us it is just a correction we’ve been waiting for for a long time. He upped his misgivings on what the Fed is doing tightening saying he really disagrees and that they have “gone crazy”. That kind of makes sense if you are the President adding another $1 trillion of debt in one year to make everything ‘great again’. No one with $21.5 trillion in debt wants higher rates now do they?…. Markets are markets and Donald may well be correct and it’s just a correction. It certainly looks like the market agrees with him on the Fed though. It’s been down since the Fed Chair talked up hiking above neutral last week… It seems no one wants the cheap money game to end.

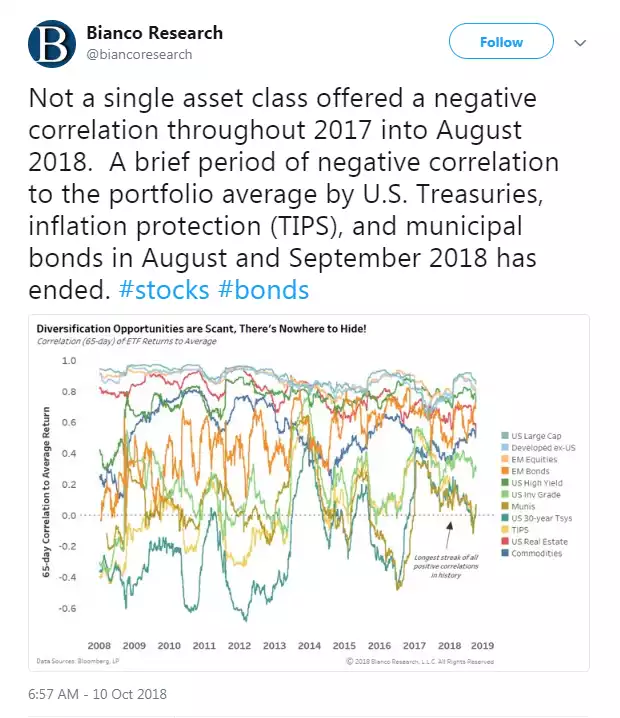

So what’s gold done? It’s actually up $5. Why? Because historically that’s what gold has done. It’s your uncorrelated asset. So whilst Trump may be right and it’s just a correction, it is a salient reminder of how quick things can play out. Talking of correlation, we often use the analogy of the perception of not having all your eggs in the one basket but all those baskets are in the one truck. A truck that can crash breaking all those ‘diversified’ eggs. The tweet below from Bianco Research illustrates this so very clearly albeit with one glaring error or omission.

If you thought you had a really ‘diversified’ portfolio of shares, bonds, property and commodities geographically dispersed you’d find that since early last year they have all been positively correlated. That means one down, all down. But can you spot that glaring omission? Yep, gold.

As we’ve shared before gold and silver have proven to be negatively correlated to most other assets over a long history.

Whether last night’s falls continue into an outright crash or Donald is right and it bounces, we are reminded of the saying about having your substantial gold hedge in place…

“Better a year too early than a day too late”.