IMF Warning for Australia Amid Trade War

News

|

Posted 10/10/2018

|

8829

IMF Warning for Australia Amid Trade War

The front page of the Australian today warns of economic pain ahead for Australia amongst the trade war building between the US and China. Australia however is not alone and the two main participants in this trade war, the US and China, have also seen their economic growth outlook slashed by the IMF in their latest World Economic Outlook forecast.

The IMF slashed 12.5% off the 2018 forecast for Australia to 2.8% for 2019 to “partially reflect the negative effect” of that trade war.

KPMG too have modelled the impacts of the trade war on Australia predicting job losses of 60,000 and real average wages dropping by $16/week. That comes at the same time as IMF predicting inflation increasing to 2.3% in unison and our trade deficit increasing as well. From the IMF:

““An intensification of trade tensions, and the associated rise in policy uncertainty, could dent business and financial market sentiment, trigger financial market volatility, and slow investment and trade.

Higher trade barriers would disrupt global supply chains and slow the spread of new technologies, ultimately lowering global productivity and welfare. More import restrictions would also make trade-able consumer goods less affordable, harming low-income households disproportionately.”

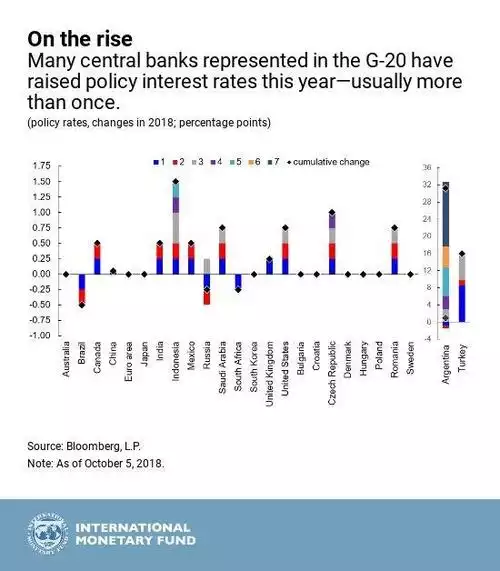

Such pressures have more and more economists predicting further falls ahead for the Aussie dollar. In addition to the aforementioned economic pressures, the rising rates elsewhere in the world are adding more downward pressure on the Aussie dollar as well. The Aussie was buoyed by years of comparative returns where our 1.5% cash rate was relatively high in a world of zero and even negative rates. But that has now changed with the US now at 2.25%, well above our 1.5%, and others on the rise.

This presents a constant dilemma for the RBA. Raise rates to combat inflation rising faster than wage growth and to stabilise the Aussie dollar and they add further debt servicing costs to a property market already teetering and make us less competitive in the already difficult export market. Amongst talk of a strong economy, the ASX200 has given up all and more of its 2018 gains over the last month and the IMF and KPMG, amongst others are warning of tougher times ahead.

We are seeing firsthand the impacts of rising rates on the property market right now in the US as mortgage rates hit the psychological ‘line in the sand’ of 5% and housing metrics tumbling with that:

Regular readers need no reminding (read here) that Australia is far far more exposed to property debt than the US.

Finally, referring to that G20 chart above, check out Argentina and Turkey as examples of what happens when you lose control. Argentina has a cash rate of 60% to try and prevent their peso crashing further. The IMF have just revised their inflation forecast for Venezuela to be 1.37 million percent by the end of this year and 10 million percent in 2019. Whilst we are not suggesting Australia is in such territory these examples further reinforce the beauty of gold. As their currencies devalue Argentinians and Venezuelans holding physical gold before this all occurred would have preserved all their wealth, and indeed enjoy buying products on the peso or boliva with their US spot price denominated gold.

As the Aussie dollar falls so too the value of your gold in Aussie dollars rises. The world’s safe haven against economic and geopolitical uncertainty is also the world’s safe haven against your local currency falling.