USD to Rise or Fall? The Debate Rages, Gold Wins

News

|

Posted 04/09/2020

|

10058

Last night saw the US share market fall sharply with the NASDAQ down 6% at one stage before finishing down nearly 5%. The S&P500 was down 3.5% and Dow down 2.8%. In USD gold was down 0.6% and silver 3.5%, only the falling AUD saw that change to +0.3% and -2.2% respectively. Cryptos were clubbed across the board including BTC below $US10,500 and ETH back below US$400 at one stage. And against the whole ‘USD is dead’ crowded trade, it maintained its upward trajectory from its low on Monday.

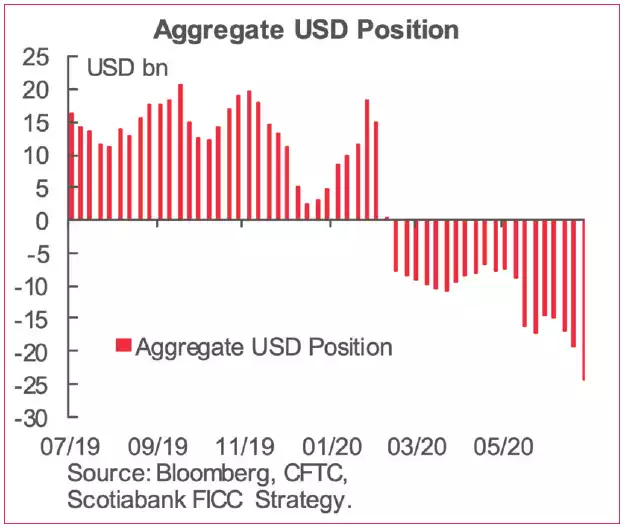

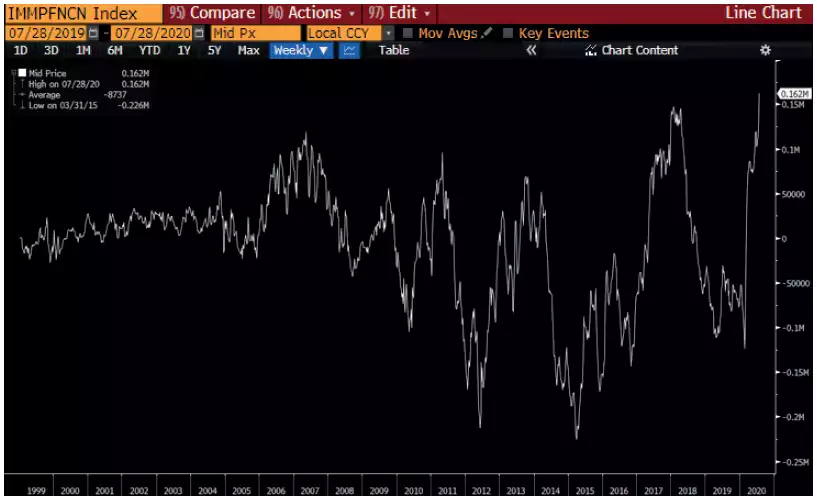

That short the USD trade has been one of the most epically crowded trades you’d see in a while. The charts below courtesy of Macro Insider’s latest Raoul Pal Deep Dive show the extent of this:

First DXY (USD index) on the futures market was fully 2 standard deviations over sold:

‘Every’ hedge fund short the USD:

The scale and spread of different managers of which is quite amazing, with non commercial, asset managers both deeply short and leveraged funds heading to zero:

The DXY is dominated by the Euro on the other side, so it should not be a surprise that Euro futures are now in their longest position ever. Why? Because if you lose faith in the numerator, you need to be confident in the denominator and that’s largely the EUR. The narrative for this new found faith in the Euro is off just one (hard fought) agreement to mutualise debt and bail out the PIIGS as we reported here at the time beforehand and on the event.

A lot of the reasoning for the rotation was that the Eurozone was ‘over’ COVID and the US was one of the worst places in the world. Whilst the latter is still true, Europe is seeing a strong surge in the 2nd wave and far from out of the woods. People have quickly forgotten how long it took to get agreement on that bailout package and ‘MOAR’ is not guaranteed when it is needed. The Euro economy is still very very sick and does not support a high Euro if confidence restores to the USD.

There was another interesting interview recently on Real Vision around the perception that all this QE is going to weaken the dollar because it is inflationary, pumping new money into the system. However the interview between “Dollar Milkshake” theorist and Santiago Capital CEO Brent Johnson and Steven van Metre has them positing that because QE doesn’t actually create new ‘normal’ money, rather reserves in the respective commercial banks’ Fed accounts, that it is, as intended, suppressing rates and yet the consequential intent of people borrowing more off the banks (who have these new reserves) is not happening as everyone is too scared and is instead saving. The money required to buy this $80b/month of bonds is of course coming out of the economy and yet ultimately ending up in those reserve accounts, and so in effective is removing liquidity, not adding it. That of course is deflationary, not the widely adopted view of imminent inflation. That, you will recall falls neatly into Raoul Pal’s “The Unwinding” thesis as well that we have laid out previously. First deflation and THEN inflation.

The debate between the 2 theses will no doubt continue to rage but as all participants appear to agree there is one winner either way, gold.

The weak USD and inflation case is pretty straight forward as that has always been bullish for gold. The strong USD and deflation takes further insight more into the REACTION rather than the EVENT. Their thesis is that the reaction of the Fed and Government fiscal spending will be massive as they will have the double whammy of negative inflation and zero rates. i.e. positive real rates at a time when negative is desperately needed amid a recession and massive debt pile. It will also be accompanied by a huge crash in shares. That reaction would see a huge rotation into gold.

Pal’s updated outcome is as follows:

That some of the greatest minds are debating which way this goes highlights the extent of uncertainty in this world today and the massive imbalances or asymmetric nature of markets. That most are confident in gold highlights that when things aren’t ‘normal’, when so unbalanced, gold can protect at each end of the risk equation because one thing is predictable, and that is human behaviour at each of those ends. That is especially the case when said humans have amassed an unprecedented amount of debt and some of them want to get re-elected…

Our trademark is “Balance your wealth in an unbalanced world”. Just sayin’….