The Problem with US’s Corporate Debt

News

|

Posted 21/02/2019

|

9363

Last night was a rollercoaster on sharemarkets as they digested the minutes to the last Fed meeting. Simplistically you could observe those market gyrations as cognitive dissonance. The market knows a Fed turned dovish is because the market is weak, and yet they also know the market will probably rally off this ‘bad news’, but they don’t know for how long…. Yesterday we discussed the anomaly of both shares and gold rising in unison for that very reason.

Casey Research released an article a couple of days ago as a timely reminder of one of the reasons this market is fixated on the Fed. In short, the US has never seen such high corporate debt before, nor so poorly rated. If the Fed pushes up rates, the cost of servicing that debt goes up. If the Fed pushes rates just a little too far and causes a recession (as they have in each of nearly all preceding recessions), the companies carrying this debt may be unlikely to service or have sufficient equity to support it. The ramifications are massive and as we’ve reported before, corporate debt is usually on analyst’s top picks for the cause of the next crash.

The article presents just how much BBB rated debt there is now and how much more leveraged it is then even the junk below it. At this stage it is worth pointing out to you the credit rating of gold and silver. It’s effectively infinite as gold and silver held by you have no counterparty risk. AAA in comparison is junk….

It’s an excellent article so we will present it verbatim for you, acknowledging the author Justin Spittler of Casey Daily Dispatch.

“• But let’s first take a closer look at the corporate debt market...

Starting with the basics, corporate bonds are debt issued by companies to raise money.

Practically every major company borrows this way. But corporate borrowing has skyrocketed over the last decade.

This is, of course, thanks to the Federal Reserve’s easy money policies. Remember, the Fed dropped its key interest rate to effectively zero in December 2008, and held it near record lows for almost seven years.

This made it incredibly cheap for corporations to borrow money. You can imagine how corporate America responded…

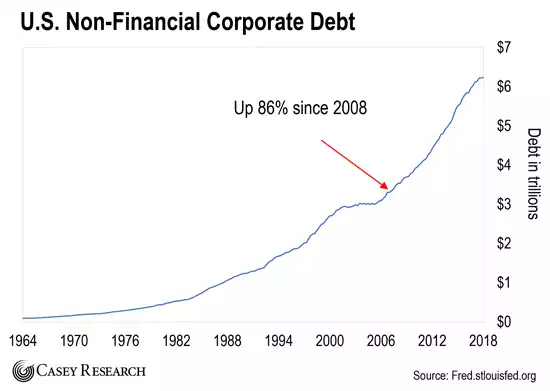

Just look at the chart below. You can see that there’s been an explosion in corporate debt since 2008.

The amount of outstanding corporate debt is up 86% since 2008. For comparison, the U.S. economy grew just 18% over the same period.

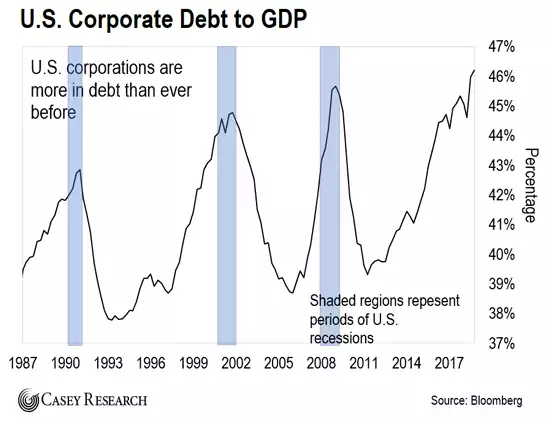

• To understand why that’s a problem, take a look at this next chart…

It shows corporate debt as a percentage of U.S. gross domestic product (GDP), the most popular measure of economic growth.

You can see that corporate debt as a percentage of GDP is now higher than it’s ever been… higher than it was during the recession of the early ’90s… and at the peak of the dot-com bubble in the early 2000s… and the 2008-2009 financial crisis.

That alone is a major red flag. But it gets worse…

• We’ve seen an explosion in BBB-rated corporate debt since 2007...

Let me show you what I mean by that…

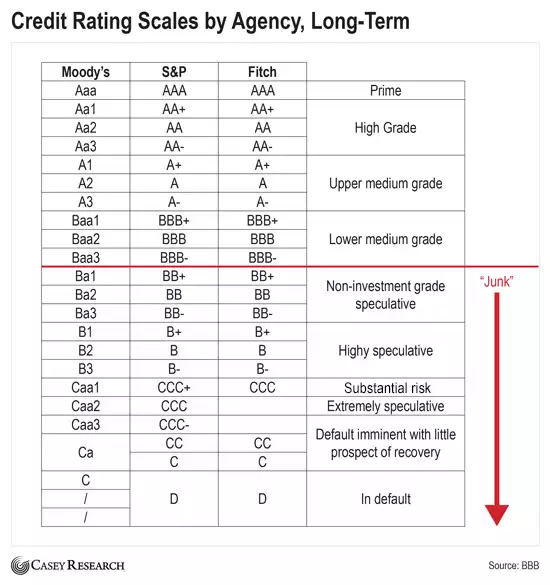

When a company issues debt, a ratings agency such as Moody’s, Standard & Poor’s, or Fitch will assign the debt a credit rating. This rating tells investors the risk level of a bond.

The table below breaks down the different credit ratings. The red line separates “investment grade” bonds (which are considered the safest) from “junk” bonds (the riskiest).

You can see that BBB-rated bonds are the riskiest within the investment-grade community.

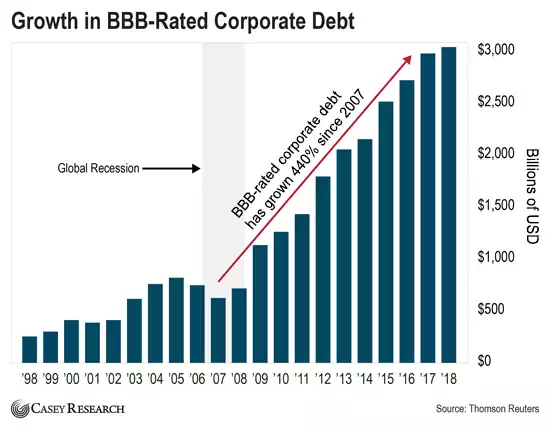

Now, look at the chart below. It shows how much the BBB-rated corporate debt market has grown over the last two decades.

BBB-rated corporate debt is up more than 400% in just the last 12 years.

It’s now a nearly $3 trillion market. That makes it twice as big as the subprime mortgage market at the height of the last housing boom.

And we all know how that ended…

The collapse of the subprime mortgage market triggered a major stock market crash. And it tipped the U.S. economy into its worst economic downturn since the Great Depression.

• I’m not the only Casey analyst deeply worried by this, either...

Nick Giambruno had this to say in last month’s issue of The Casey Report:

Today, BBB makes up about 50% of the overall so-called “investment grade” market, an all-time historical high. It’s also now larger than the entire corporate bond market was in 2008.

Further, over half of BBB-rated companies have a higher net debt-to-EBITDA ratio than the average for the BB segment. (Net debt-to-EBITDA ratio is a key metric for determining a company’s debt burden. The higher the ratio, the more debt per dollar earnings a company makes.)

This means over half of so-called “investment grade” BBB companies are more leveraged than their junk counterparts.

In short: there’s a lot more corporate debt than there was a decade ago. The quality of corporate debt is also significantly worse, on average. Not only that… many of the so-called “safe” bonds are actually much riskier than people realize.

This is bad news for investors with heavy exposure to BBB-rated bonds.

Think about it. When the U.S. economy falls into recession (which it is long overdue for), many companies will struggle to pay off their debts. And that will lead to huge losses for investors who own risky corporate bonds.”