Why are both Gold and S&P500 Rising?

News

|

Posted 20/02/2019

|

6866

One of the key attributes of gold is its lack of (inverse) correlation with financial markets and hence its ‘safe haven’ reputation. We often talk about the fact that over the last 50 years, in each of the 5 worst crashes, shares on average went down 24.4% in those years whilst gold went up 38.5% in the same year, meaning you would have been 63% better off in gold.

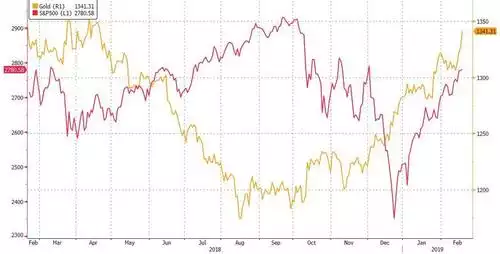

However this year we have seen a distinct POSITIVE correlation between gold and the world’s biggest sharemarket index, the S&P500.

Maybe one need look no further than the reason for the sharemarket rally this year being rather coincidental with the US Fed changing their stance from firmly in tightening mode (both raising rates and unwinding their QE balance sheet) to clearly accommodative. From that last Fed meeting:

“- The Fed will be “patient” with future rate hikes, meaning they are now likely on hold as opposed to their forecasts which still call for two to three more rate hikes this year.

- The pace of QT or balance sheet reduction will not be on “autopilot” but instead driven by the current economic situation and tone of the financial markets.

- QE is a tool that WILL BE employed when rate reductions are not enough to stimulate growth and calm jittery financial markets.”

The market is rallying on the promise of more Fed accommodation. Buying shares is supposed to be investing in the growth of businesses yet at this point, 80% of the way through Q4 earnings reporting, we have seen 76% of companies give negative earnings guidance. Hardly an environment in line with the current market euphoria.

So why is gold rallying alongside it? Maybe, again, the market is seeing this rally for what it is and balancing out their risk. And of course, whilst inflation is still apparently in check, further accommodation from the Fed puts more pressure on inflation, and gold loves inflation.

Lance Armstrong of RealInvestmentAdvice.com addresses this in his usual insightful style. In asking the question “The Fed Conundrum – Data Or Markets?” he points out that the current ‘positives’ of full employment and rising input costs always precede a recession. Those rising producing costs (PPI) are outpacing CPI meaning businesses can’t pass on the higher costs to consumers. That’s either bad for economic growth or a prelude to CPI taking off. Again you can see the win win for gold.

Armstrong’s article is well worth the read (click here to read) as he walks you through this setup for the Fed. He concludes:

“Today the Fed has all but put the kibosh on further rate hikes and, per Mester’s comments, will end balance sheet reduction (QT) in the months ahead.

It is becoming more suspect that the Fed knows something the market does not.”

But, exactly what is it?”

Gold had another strong night last night, hitting a near year-long high of USD1341 and getting close to that $1350-60 resistance line. Break through that and it could be off to the races…