SMSF – The Twofold Balance Question

News

|

Posted 17/05/2018

|

8655

Balance has essentially 2 meanings – an even distribution of weight enabling someone or something to remain upright and steady – and – the amount of money held in an account. When it comes to Self Managed Super Funds the two meanings rightly get a lot of attention.

Too often we hear people wanting to obtain the first definition in their super told they can’t because of the second. i.e. “you don’t have enough in your super to have an SMSF”.

Let’s discuss that second point first. Through an historic and now outdated study from 2013, many advisors quote $200,000 as the minimum balance needed to have an SMSF. The genesis of this often harks back to ASIC commissioning Rice Warner to determine if there was a minimum cost-effective fund balance for an SMSF. Whilst this was never meant nor published as a mandated minimum, too often it is taken as such. Much has changed since its release in September 2013, particularly the economic environment and the cost of setting up and maintaining an SMSF.

The report was based on the then average annual cost of around $2,800. There are many alternatives nowadays at over half that cost. Be warned though, some do that via very efficient but very ‘cookie cutter’ means forcing you into providers and asset classes that fit into that cost effective machine. We work with many SMSF experts and as one example, mysmsf allows you to invest in both precious metals and crypto as well as the usual array of other financial assets starting at around $1100 per annum. At well less than half that $2800 and remembering fees are 90% tax deductable, you then have a very different cost / return equation. Now let’s talk about the ‘return’ side of things…

Late last year we wrote the piece Financial Maths 101. If you missed it, it’s a must read. In looking at the aforementioned first definition of balance, we have the segue to talking about true diversification in your super fund. At the risk of repetition let us say again… There is no more important wealth vehicle to have truly diversified than your super – You don’t get to choose what the markets are doing on the day you retire – So you’d better have something doing well whilst others may not be.

True diversification can only be achieved by having uncorrelated assets. Our trademarked tag line is ‘Balance your wealth in an unbalanced world’. We wrote just recently here about what that looks like right now but regular readers know of the precarious state the world finds itself in right now. Don’t get us wrong, precarious can last for a while longer and there will be gains on financial markets to be had…. this is only the second longest US bull market in all of history…. That’s the beauty of balance.

The fact is however, that most institutionally managed and industry super funds are very very heavily weighted into shares. There is no direct play precious metals, no direct play property and certainly no direct play in crypto. Whilst using names like “Balanced”, they are anything but.

So when considering a couple of percentage points in cost it may be prudent to consider our ‘maths 101’ article reminding you that when your financial asset drops 50% in value, you need to make 100% on what’s left to get back to square. 50% is what happened in the GFC, gold doubled in value over that time, and Bitcoin was born as another uncorrelated asset class.

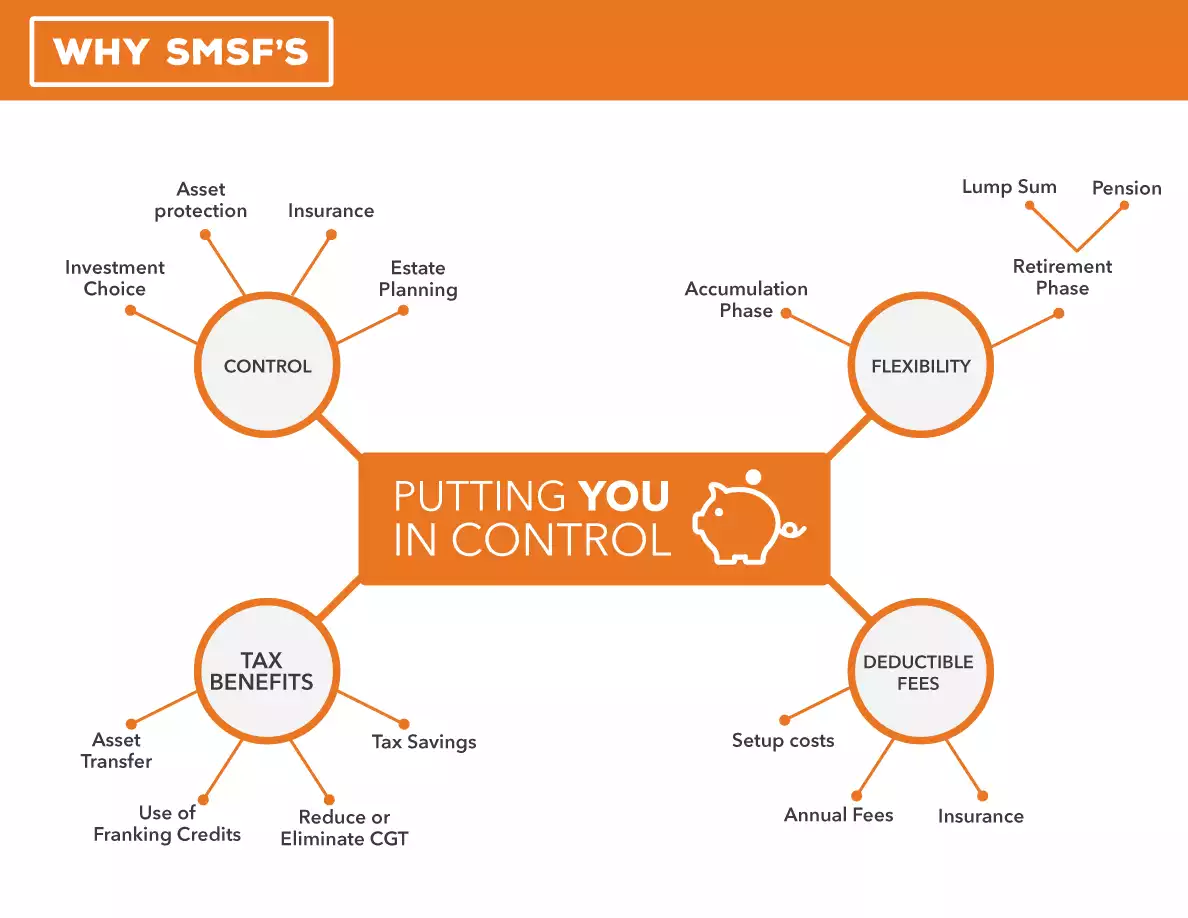

$200,000 super balance is NOT a rule. The choice is entirely yours. Visit here for more info and consider the graphic below: