It IS Different This Time…

News

|

Posted 20/06/2017

|

7841

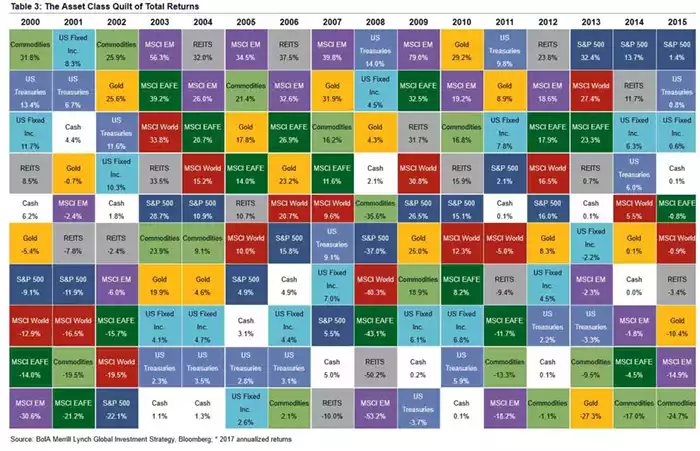

The following graphic is a fascinating insight into the relative performance of financial assets around the world since the turn of the century.

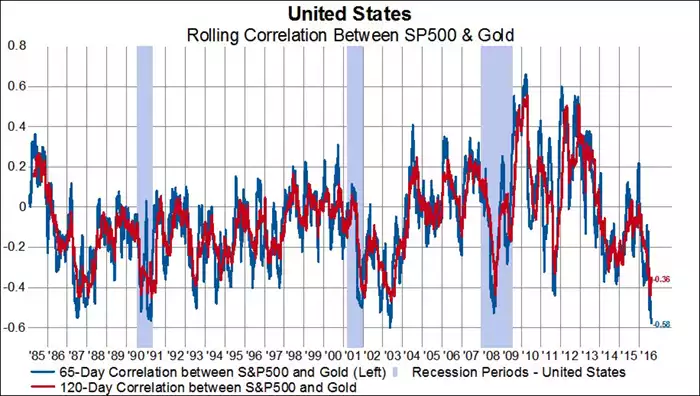

We harp on about gold being historically un-correlated to financial markets. You can see that playing out in the above chart. As a reminder the graph below illustrates that lack (negative) correlation:

The exception you will note is in the period of the few years after the GFC. That is most likely due to the all the US QE printed money piling into shares distorting the natural market. As we wrote yesterday, that, on a global scale, appears to be coming to an end. So what next??

Is it different this time? Jeffrey Snider of Alhambra Investments says it actually might be this time (but not in the traditional sense…)

“The only thing missing from the mean reversion scenario is a catalyst. Unlike 2008 or the dot com era there hasn’t yet been any kind of spark to ignite the fear. In the former it was liquidations and margin calls that created the dramatic crash especially after July 2008; in the latter it was the rude intrusion of common sense brought about after many of the high flying companies of the era were finally seen as worthless, and therefore dangerous.

We don’t know what the spark will be this time around and in fact there may not be one. We feel confident in saying that today’s valuations are not supported by the US economic outlook. Workforce growth – or lack thereof – productivity growth – or lack thereof – and the continued deterioration of the Eurodollar market are not supportive of the growth necessary to justify current valuations. That means that future returns on stocks are likely to disappoint – but we don’t know how they’ll disappoint.

This time around is different in that valuations are more uniformly stretched; there isn’t one overvalued sector like technology in 2000. Any reversion to the mean will certainly not be like the 2000-2003 bear market when there were plenty of places to hide. And it probably won’t be like 2008 because global bank balance sheets have shrunk. But reversion to the mean will happen and all those buy and hold passive investors out there are going to be tested. How many of them will be able to weather multiple years of low or negative returns? Some of the most overvalued stocks in the market – in our opinion – are the Blue Chip dividend payers that everyone has bought as bond proxies. How much will that dividend matter if your principal is down by half?

Every bull market produces excesses that get reversed in the ensuing bear market and for this one the best candidate is the dumbing down of investing, the passive indexing craze. Indexing may not be the road to serfdom but it isn’t the yellow brick road either.”

Maybe, just maybe, the central banks ‘turning off the tap’, will be that catalyst.