Silver Demand Explodes – Industrial AND Investment

News

|

Posted 31/05/2021

|

10099

The web was aflutter over the weekend with news that the US Mint released an “important update” stating “The global silver shortage has driven demand for many of our bullion and numismatic products to record heights” and “In the interest of properly rectifying the situation, the Mint is postponing the pre-order windows” and “As the demand for silver remains greater than the supply, the reality is such that not everyone will be able to purchase a coin.”. Whilst this focusses on investment demand the Silver Institute also released a report outlining the surging industrial demand for silver, specifically in electronics.

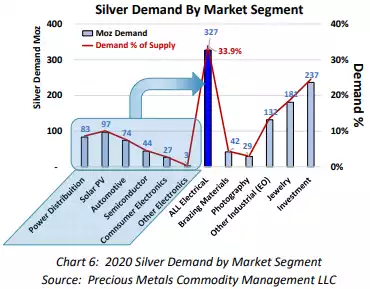

“According to our research, 33.9% of the annual silver global supply in 2020 ended up in electronics. This is a total of 327 million troy ounces (Moz) that finds its way into various electronics markets every year. Given the projected growth of electrification, we are confident that this will continue to grow over time since silver is the world’s most conductive material.

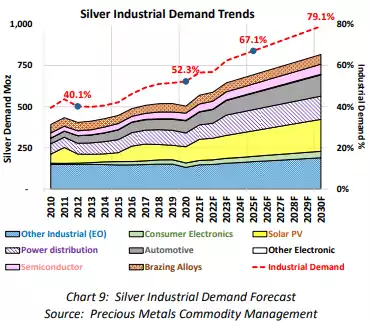

Adding to this growth will be an expansion in the solar photovoltaic segment, which already consumes 10% of the global silver supply. According to our forecasts, the amount of silver consumed in solar photovoltaics (solar PV) will climb to 15% (155 Moz) by 2025, and 19% (197 Moz) by 2030. The International Renewable Energy Agency is now calling for a growth to 14,000 GW of installed solar PV globally, or approximately 2,000 GW/year by 2050.

Growth in 5G wireless, automotive electronics and the Internet-of-Things (IoT) are well documented electronics growth opportunities as well.

Our research reveals that a critical application for silver is its use in printed and flexible electronics. This market segment, although relatively small today, generates approximately US$59 billion USD in total revenue, and is achieving an 11% annual grow rate.”

Silver is the ideal conductive material. It is relatively easy to screen print, inkjet dispense, aerosol dispense, and roll-to-roll print with numerous deposition and coating technologies. Nano-silver inks are one of the easiest to cure at a low temperature making them ideal for many flexible substrate applications as well. In addition, silver offers excellent corrosion resistance, easy bendability, and stretchability characteristics all while still retaining its conductive properties, making it ideal for this market segment.

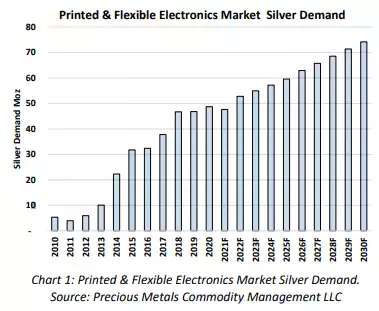

In 2021 we forecast that 48 Moz of silver will be consumed in the printed and flexible electronics market. This is projected to grow to 74 Moz by 2030 and stands a good chance of accelerating its growth rate as more low cost and high-volume IoT connected devices, low-cost display technologies, and large area organic photovoltaic (OPV) technologies are successfully deployed.

The future is bright for silver in this printed and flexible electronics market. This is just one market that is adding to the continued proliferation of electronics and overall silver industrial demand.”

The chart below shows the breakup of silver demand of which you can see electronics already dominates, outpacing even investment.

That industrial demand that sits at 52% now is forecast to consume more and more with the proliferation of solar and automotive uses in particular, but broadly increasing across every segment to total 79%.

This increase in industrial demand against a metal supply that cannot readily be turned on, means less and less available for investment where demand is surging at the same time. We wrote about this last week and as concluded there too, the fundamentals for silver look incredibly constructive for much higher prices right now.