RBA turns hawk – what next for AUD?

News

|

Posted 06/04/2022

|

13473

Yesterday’s Reserve Bank of Australia meeting marked a clear turning point for the Aussie central bank. The same bank that not long ago promised we wouldn’t see rising rates for ‘years’ has been doggedly playing its “patience” card of maintaining an all time low cash rate of 0.1% amid the inflationary onslaught and bubble like housing market. Yesterday “patience” was very clearly removed from the narrative.

Big bother, the US’s Federal Reserve, has long since abandoned it’s patient “transitory inflation” position and flipped aggressively to tightening mode. The RBA yesterday flagged that whilst it will no longer be patient, it is waiting for (even) more confirmation from key inflation and jobs data:

“Over coming months, important additional evidence will be available to the board on both inflation and the evolution of labour costs,”

With an election in May, the flack they copped for raising rates during the 2007 election and the above “evidence” being inflation data on 27 April, wages data on 18 May, and National Accounts data on 1 June, the stage appears set for an overdue, coiled spring, June hike.

Despite the ‘not yet’ message, the clear inference that “patience” has become ‘soon’ saw the market react strongly with the AUD surging above 76c. AUD priced gold of course came off $20 in that same move before reclaiming some of that lost overnight as a stronger USD saw the AUD back under 76c.

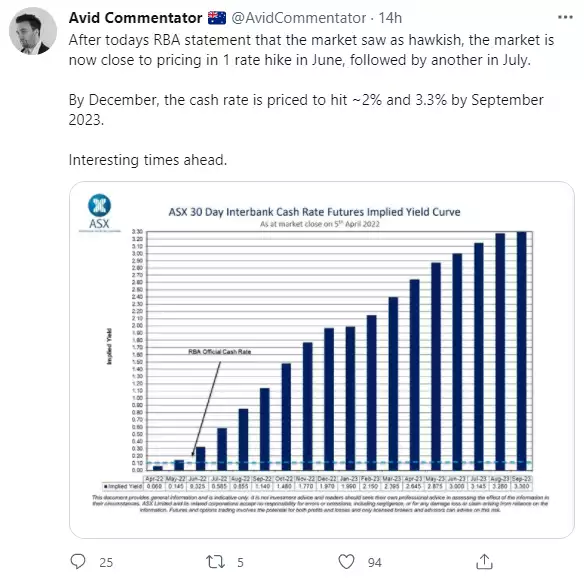

The market is also pricing in a much more aggressive move than the RBA as well. From the AFR:

“Traders are tipping an 84 per cent chance of a 0.25 percentage point hike in the cash rate in June, and nearly even odds for a 0.5 percentage point move followed by nearly eight increases to 1.9 per cent by year’s end.

The Australian government three-year bond yield jumped 16 basis points to 2.48 per cent and the Australian 10-year yield added 6 basis points to 2.86 per cent amounting to a curve flattening.”

And so whilst the Aussie yield curve has not inverted like that of the US, this severe flattening is the same journey the US had to get there.

And so to be clear, the country with the world’s highest personal debt underpinning a property market that has seen 20%+ growth in a year, is staring down the barrel of a 30 fold increase in rates… One of Australia’s most prominent economists sums it up nicely…

Regular readers will remember Chris Joye’s prediction here that just a 1% rise could trigger a 25% correction in the property market. The market is predicting 3 times that!

The path ahead for the AUD is very unclear with many opposing forces. Whilst commodities boom amid the Ukraine conflict it is certainly bullish for the AUD but there are growing fears the recession flagged by the US yield curve inversion will wipe that out. In the meantime, in a world where everything has a denominator pair, the USD as the dominant AUD denominator, is looking at a Fed now becoming even more aggressive in their monetary tightening. Overnight one of the most dovish and most senior Fed members, Lael Brainard shocked the market by stating the Fed:

“will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting,” adding that she "[expects] the balance sheet to shrink considerably more rapidly than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017–19."

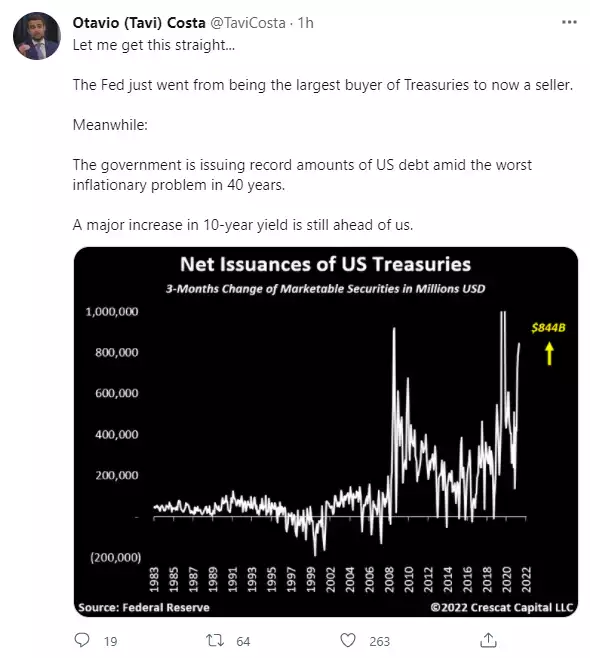

So QT (quantitative tightening) sees the actual reverse of QE and the Fed is a net seller of US treasuries. However, the US government is issuing new Treasuries hand over fist to fund all its deficit spending (ironically to keep the ‘strong’ market afloat). So who buys all these bonds at sufficient pace to not see yields (and hence real market based rates) surge higher???

Higher rates generally equals higher USD which puts downward pressure on the AUD.

David Llewellyn-Smith, Chief Strategist at the MB Fund, encapsulates the uncertainty ahead:

“My own view is that global recession is coming much faster than most think, which will add double the downside to AUD as commodities crash and DXY rockets.

That said, until that panic emerges in full, AUD is clearly biased upwards on Ukraine war commodity price impacts.

These extreme opposing forces risk above all greater volatility and the AUD outlook takes on the dimensions of a boom and bust.

My base case is that this will fully play out in 2022.”

Balance your wealth in an unbalanced world….