RBA’s own ‘policy error’ comes home to roost

News

|

Posted 17/11/2021

|

10923

It is becoming increasingly hard for ‘believests’ to ignore what is so clearly coming in The Lucky Country and that directly correlates with Ainslie being increasingly busy with people buying up bullion and crypto to protect themselves.

Westpac just raised its rates on fixed rate mortgages for the 3rd time this month (!) whilst 16 lenders have hiked fixed rates twice, including CBA, NAB and ANZ. But the RBA is still saying no rate rise until 2024 is still their “central scenario”…

Julian Brigden of Real Vision’s Macro Insiders had a bit to say about our RBA from London in his latest In Focus report:

“Let’s start with Australia, where more pain has been caused than is commensurate with its relatively insignificant size in the macro investment world.

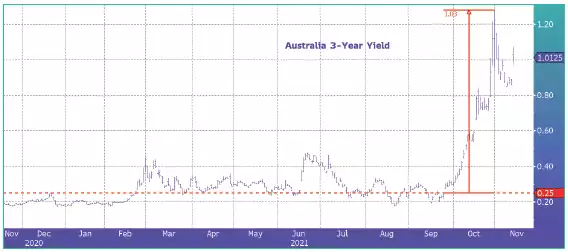

You will recall that Australia followed Japan into an experiment with Yield Curve Control. Announcing on 19th March 2020, in the teeth of the first wave of Covid, that the RBA would peg 3-Yr Government Bond Yields at 25 basis points for the foreseeable future, Australia was seen as a harbinger of things to come in the rest of the developed world.

How did that pan out for our friends Down Under? Not so well.

Australia was dismally slow to start its vaccination programme (barely 10% had been vaccinated by mid-May at the beginning of the southern hemisphere winter). The government administered one of the harshest lockdown regimes in the world, including an almost total ban on incoming flights, hotel quarantine for those who couldn’t avoid needing to enter the country and other equally draconian measures.

Perhaps as a reaction to the depressing lockdown landscape, once vaccinations started, they took off in earnest and by October had rocketed to 70%, upon which most measures of freedom returned.

Cue the RBA

Despite vociferous contestations to the contrary and some very poor analysis by investment analysts (RBA to maintain YCC peg till AT LEAST 2023 etc), the policy came under strain from mid-September as the prospects for re-opening combined with better economic outcomes. It then broke at the end of October and rates moved sharply higher without really touching the sides. By the time the RBA officially abandoned its ill-conceived YCC experiment at their meeting on 2nd November, yields had already traded a full 100 basis points over the original 25bp target. The chart below shows generic Australian 3-Yr Government Bond Yields.

So What?

Well, where else have we had “un-administered” tightening of interest rate expectations?

Almost everywhere. Led by the Bank of England, who seemed to get hawkish over-egging market expectations going into the MPC meeting on 4th November only to then get cold feet, Lagarde at the ECB got in a tangle about what she should or shouldn’t be saying about financial conditions.

The Fed wriggled uncomfortably on the hook about what is or isn’t transitory before announcing the pace of tapering which the market had already assumed ($15 billion less per month, split ten less for Treasuries and five less for mortgages).”

In other words, the RBA can say all they like, they have lost control of the real market that sets rates for the instruments the banks actually use to lend you money.

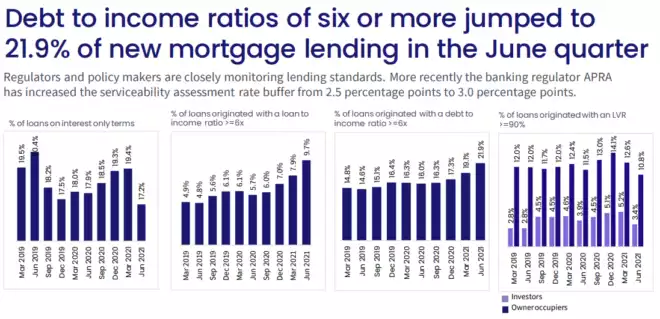

We wrote in more detail about this recently here with one analyst predicting up to a 25% drop in property prices on just 1% rise in rates. The charts below paint a concerning picture with the number of loans issued with a debt to income ratio higher than 6x (600%+!!) continually rising and now at a staggering 22%

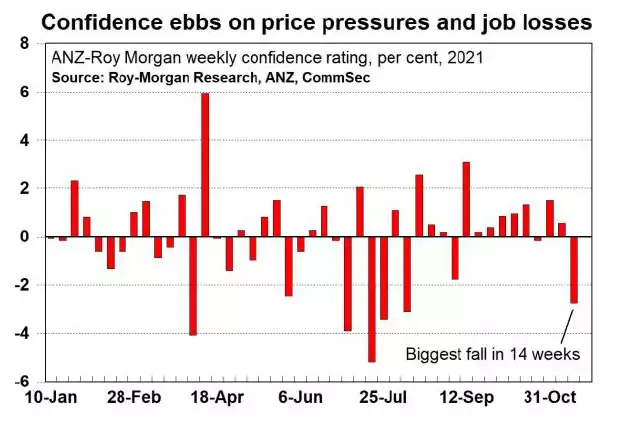

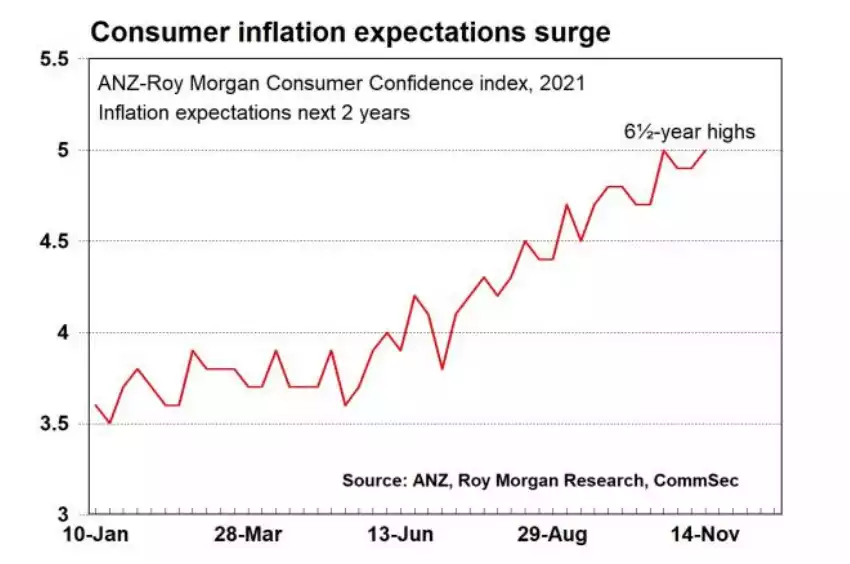

That this coincides with rate increase risk, surging consumer inflation expectations and declining confidence, per the following charts, must be more than a little concerning for the trapped RBA.

As @AvidCommentator tweeted yesterday:

And so as we see bubble like markets in shares and property, gold is now started to move demonstrably again as the logical safe haven.