Platinum – Bullish Investment Setup

News

|

Posted 03/12/2020

|

9105

Often the forgotten precious metal, the investment set up for platinum is one that is deserving of more attention. The latest quarterly report from the World Platinum Investment Council outlines this bullish setup. But first let’s step back and look at what has happened in platinum, its PGM brother palladium and gold since 2013.

Gold

Palladium

Platinum

These last 2 charts tell the main story for platinum. Both platinum and palladium are important components in the manufacture of catalytic converters for petrol and diesel vehicles. As you can see palladium used to be a fraction of the price of platinum and so manufacturers figured out how to substitute palladium for platinum and geared up plants accordingly. You can see what that then did to the price of palladium in the chart, to the point where it quadrupled and is now, at US$2412, 34% more expensive than gold whilst platinum nearly halved, at US$1015, and is now nearly half the price of gold. Supply and demand 101.

There were other factors at play too (and the reason for the charts above being from 2013) in terms of platinum’s price from 2013. We wrote a 2 piece in depth look at platinum per se and then the break up of Anglo and Johnson Matthey in 2013 here and here. They are must reads for anyone looking at this precious metal for further diversification.

Turning back to the catalytic converter story, now it seems that manufacturers are gearing back up now toward using platinum again to reduce their cost but importantly are not widely discussing it as they want to load up on platinum before the investment market realises. It is also now becoming more widely accepted that diesel (for which platinum is more effective) is being increasingly recognised as the more green of the 2 fossil fuels.

Before we get into the highlights, below is an excerpt from the report on the exciting development of ‘green hydrogen’ and where platinum fits in:

“Green hydrogen, produced by the electrolysis of water using renewable electricity as the power source, is key to decarbonisation across many industries, and is attracting significant policy interest. During 2020 more than 70 countries, plus the EU, pledged to achieve carbon neutrality by 2050. Importantly, China which previously focussed on environmental policy measures to improve air quality, has now pledged to be carbon neutral by 2060. Hydrogen is highly versatile with applications as a feedstock, a fuel, an energy carrier and for storage of renewable energy. Platinum’s role in the hydrogen economy is crucial. It is used in fuel cells and in electrolysers to produce green hydrogen, where it is used in conjunction with iridium. A recently announced breakthrough by Heraeus cuts iridium requirements by up to 90%, unlocking more widespread adoption and increased demand for platinum.”

The report is long and detailed (30 pages) so here are some key highlights:

- COVID-19 hurt supply more than demand

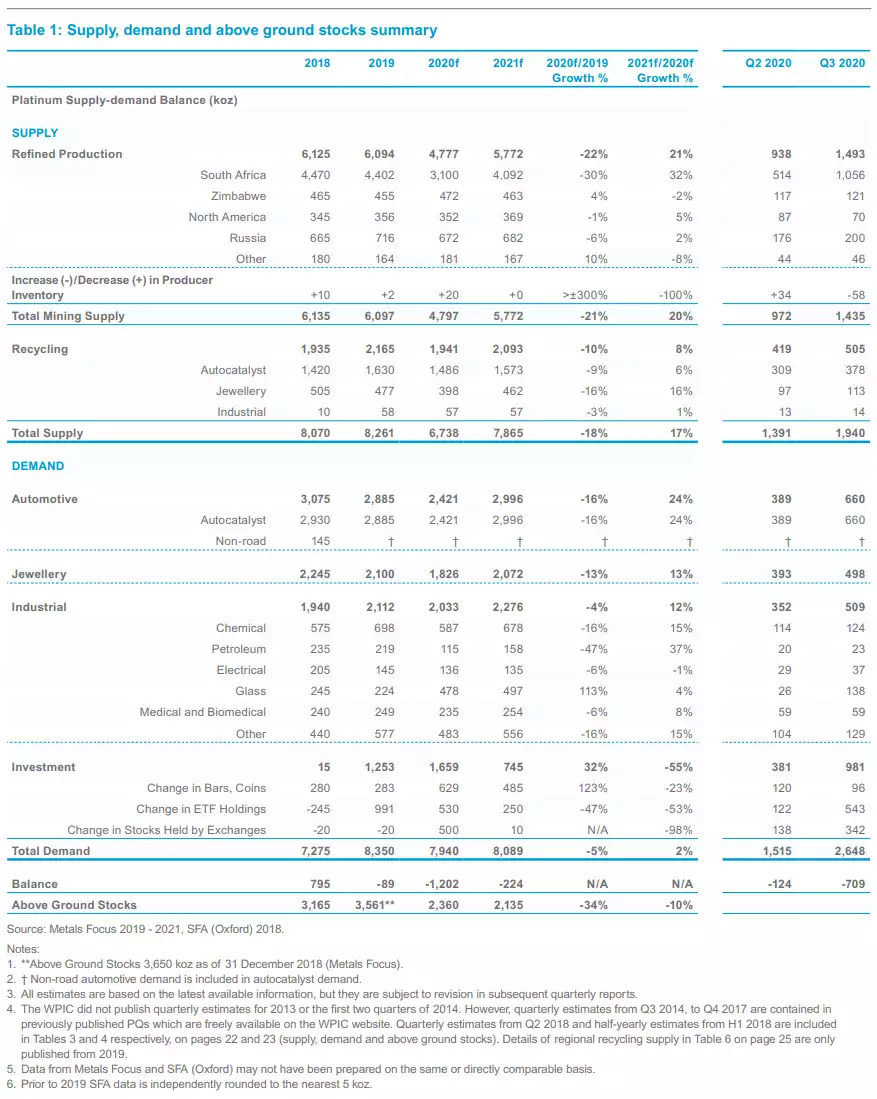

- Poor supply and stronger demand saw a Q3 deficit of 700,000oz and takes full 2020 to 1.2m oz deficit

- Forecast deficit for 2021 is 220,000oz

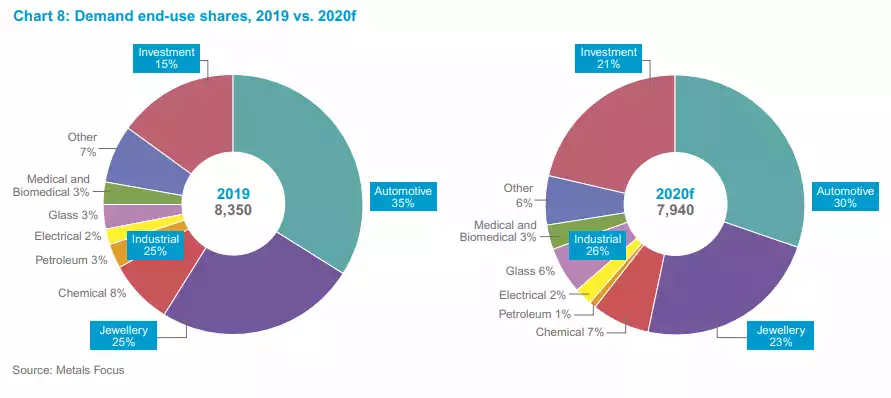

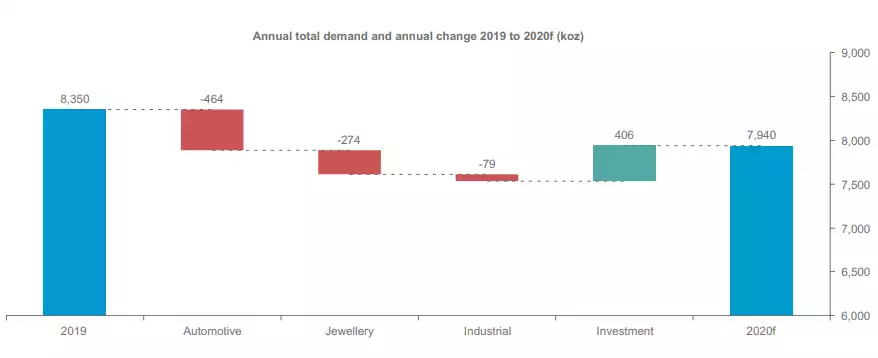

- Total platinum demand in 2020 is forecast to be 7,940 koz, 5% (-410 koz) lower than in 2019 due to reduced demand in the automotive (-464 koz), jewellery (-274 koz), and industrial (-79 koz) segments.

- However, weakness in these demand segments is expected to be partially offset by continued strong investment demand, with investment volumes expected to be up 32% (+406 koz) to a record high of 1,659 koz. Heightened global risk is expected to continue to drive investor demand for hard assets, with 2020 bar and coin demand forecast to grow by 123% to 629 koz.

- Total platinum supply in 2020 is now forecast to fall by 18% (-1,524 koz) to 6,738 koz and reflects a 22% (-1,318 koz) decline in refined production and a 10% (-224 koz) decline in recycling supply.

- The investment case for platinum has become more compelling as 2020 has progressed, supporting strong gains in platinum investment, in particular growth in ETF holdings of over 600 koz since platinum’s March and April price lows and bar and coin demand of 523 koz in the first three quarters. Investor interest and positioning increased further based on the positive developments in 2020. These included the stronger than expected V-shaped recoveries in automotive markets, sustained pandemic-related risk driving precious metal investment demand and severely reduced supply, that all contributed to the record -1,202 koz deficit forecast for 2020.

- automakers and autocatalyst manufacturers have not published details of the extent to which platinum is currently being used to replace palladium – it is proprietary and confidential information and publication would risk increasing the platinum price. We believe that the amount of substitution is far greater than limited public information might suggest, and that substitution volumes are likely to increase rapidly in 2021 and beyond, as the successful replacement of palladium by platinum is applied to a higher portion of new gasoline and diesel models launched

- The table below provides a full breakdown and history on all components of supply and demand. Note too the absolute concentration of production in the unstable South African and Zimbabwean environments discussed in the linked articles above.

You can read the full report here: https://platinuminvestment.com/files/786933/WPIC_Platinum_Quarterly_Q3_2020.pdf