New record on COMEX – OI to Registered Gold

News

|

Posted 08/09/2015

|

8631

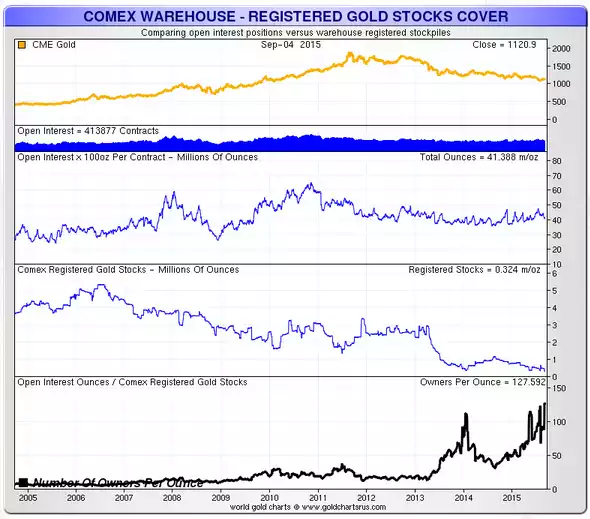

As these markets get more and more strung out we start to see more telling signs of what may be in store. Back in early August we brought to your attention (and explained) a record number of futures contracts per registered ounce of gold. Well that record has now been surpassed. We now have a situation on COMEX, the world’s futures platform for gold, where we have a staggering 1 ounce of registered gold backing127.6 claims on that single registered ounce. The graph below illustrates very clearly this epic set up.

Now some may say ‘but that is just registered stock, there is also eligible stock’. That is true, but consider that even then there is only less than 8m oz of eligible as well so we still have over 40m contracts for a total of little over 8m oz of gold in total when adding the measly 325,000 oz registered, immediately available gold. But there is a big difference between registered and eligible gold stocks. Hebba Investments make these insightful points:

“Of course eligible inventories could be converted into registered gold, but investors should remember that there is nothing that requires eligible gold holders to do this to satisfy delivery requests - after all there is a reason they are keeping their gold in eligible status and not available for delivery. In fact, it would make more sense for eligible gold holders not to transfer gold into registered status to satisfy delivery requests as that would mean more of an opportunity to force contract-holders to accumulate physical gold outside of the COMEX to satisfy delivery requests - an obvious way to boost the gold price and the value of their holdings…….The biggest takeaway here is that gold bulls should look at COMEX inventories as a major positive despite the gold price as gold inventories available for delivery continue to drop. That is why we think that investors should consider keeping a large exposure to gold with positions in physical gold….”