New Gold Records “Very Bullish”

News

|

Posted 16/11/2015

|

6356

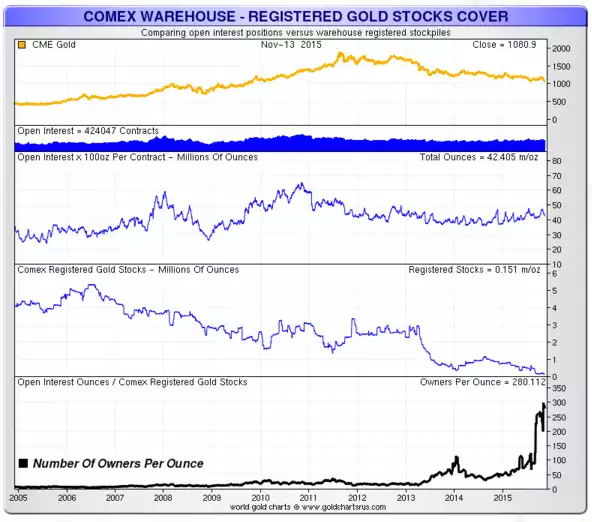

Those paying attention are witnessing an historically bullish set up playing out in gold right now. We wrote recently of the continuing epic shift of gold from west to east and record number of futures contracts per ounce of registered gold. We’ve now also seen a couple more very telling signals that can’t be ignored. Firstly the registered gold inventory on COMEX has declined even further – check out the graph below:”

Part of the significance of registered v eligible gold inventories is the real availability each presents (as we’ve explained previously). Case in point, last Thursday the Chinese gold kilo inventory stocks saw an all-time record daily withdrawal of nearly 713,000 oz.

We also learned late last week that September gold exports from London to China saw an all-time record high of 37.6 tonne (25% up month on month, 280% year on year!!). Note that London of course produces no gold, rather it is often the main holder of gold backing up the likes of ETF’s etc. This is yet another clear illustration of the shift of west to east, speculator to long term holder, at a time of record gold demand. Total Chinese consumption also just surpassed the previous all-time record of 2013 at over 2200 tonne and at just week 43. This has all prompted Hebba Investments to last week issue this to investors:

“The Comex inventories have been falling for a while, but the fact that we just saw a huge gold withdrawal from China coupled with rising gold premiums is making us very bullish. Maybe this Chinese withdrawal was simply jewellers replenishing gold stock (bullish) or maybe this was a larger fund or entity recognizing low inventory levels on all gold exchanges and taking advantage of it (very bullish), either way despite the negative sentiment we are now really bullish on gold at these prices.

That is why we think that investors should consider keeping a large exposure to gold with positions in physical gold…”

And that, Aussie investors, is in USD. The AUD set up is even better again.