More Gold Leaves the US Fed

News

|

Posted 21/05/2018

|

9523

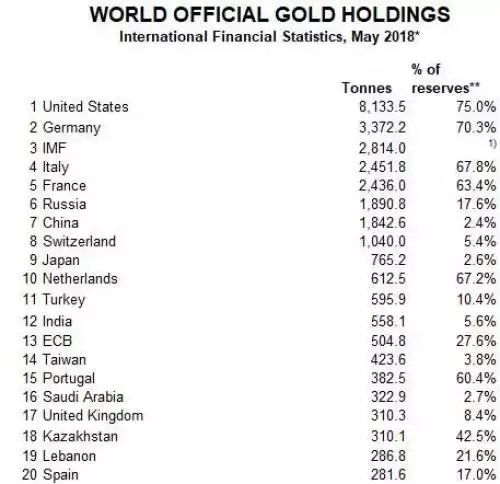

As we reported recently the Q1 2018 World Gold Council Gold Demand report saw central banks continue their unabated net gold purchases since the GFC. One of the most aggressive purchasers has been Turkey. The table below shows Turkey now sits above even gold loving India at 11th in terms of official gold reserves. This comes after they increased their holdings by 40% in just the last year, up to 596 tonne worth around $23b.

But Turkey is not just notable for its purchases, but also for its repatriation program. Turkey has decided to take greater control and repatriate 220 tonne of gold held in vaults around the world. Most notably, and publicly, has been the removal of all its gold from the NY Fed citing the "tense political situation" as the reason. Indeed Turkey’s President Erdogan has been outspoken on his views of the use of US dollars as the reserve currency, particularly as his own Turkish Lira has plummeted to all-time lows amid double digit inflation. Last month he publicly pronounced:

“I made a suggestion at a G20 meeting. I asked: Why do we make all loans in [US] dollars? Let’s use another currency. I suggest that the loans should be made based on gold…… with the [US] dollar the world is always under exchange rate pressure. We should save states and nations from this exchange rate pressure. Gold has never been a tool of oppression throughout history."

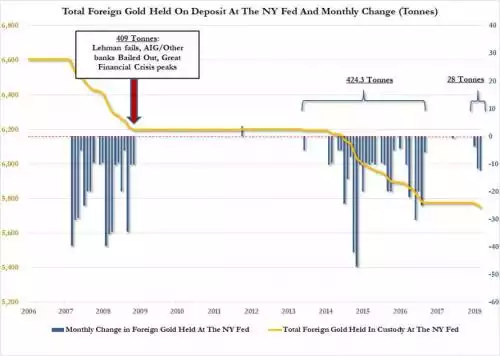

Turkey’s certainly not alone. As we’ve reported previously, Germany famously withdrew over 300 tonne 4 years ago, Venezuela just before that and again together with Austria and the Netherlands more recently. The graph below shows the custodial holdings of foreign owned gold has dropped to an all-time low of 5,750 tonne.

Sadly Australia bucked the net buying trend and our gold reserves dropped in the first quarter of 2018 to just 72.8 tonne (from 79.85 tonne in Q4 2017). All of that is held at the Bank of England in London….But hey, we’re “the lucky country” yeah?